March is behind us and moving into April, cryptocurrencies are looking to be on a strong uptrend following the chaotic year of 2022. Today in this March roundup by investfox, we will be taking a look at top 30 cryptocurrencies by market capitalization and see which five cryptos had the best and worst month.

In general overview, March was a pretty good month for cryptocurrencies, with most major tokens having positive months, while the biggest losers were tokens at the bottom half of top 30. When it comes to reasons for this uptrend market, there are numerous different things that took place in March, but most obvious and influential event has to be the collapse of the SVB, which tainted the traditional financial system and made a lot of people move to crypto as a way to save their money. Now, let’s take a look at which cryptocurrencies have performed best and worst this past month.

Top 5 gainers

When it comes to cryptocurrencies that have gained the most in the month of March, 4 out of 5 were cryptocurrencies inside the top 10 by market capitalization. This is a bright sign for the crypto market and blockchain in general as big players are back to business and are showing positive signs for the future. Now let’s take a look at these cryptocurrencies and determine why they succeeded last month.

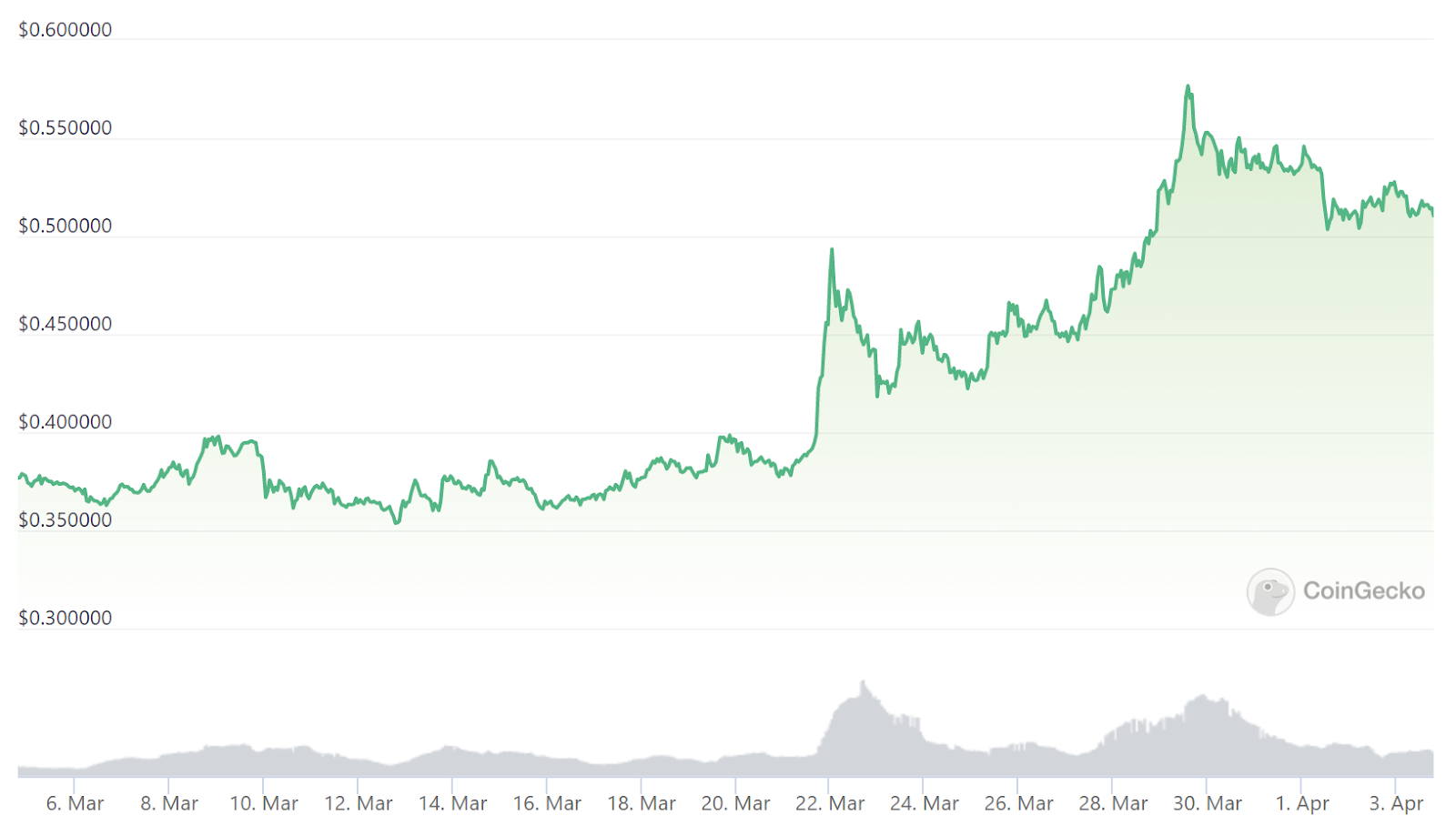

XRP +36.4%

For those that don’t know, XRP is a crypto payment platform that was launched all the way back in 2012. March was a fantastic month for this token as its price rose by 36.4%, making it the highest gainer inside the top 30 cryptocurrencies by market capitalization, which now trades at $0.51. The reasons for this success are multiple, but what played the biggest role in XRP rise is its ongoing lawsuit with the Security Exchange Commission. On March 20, 2023, XRP defendants made an announcement that their ongoing lawsuit with SEC had a positive outlook and they were close to winning the case. Everything started back in 2020, when the SEC sued XRP for allegedly selling unregistered securities, which XRP denied. As things stand the lawsuit is still ongoing and there have been no final verdict, and if we believe rumors that XRP is going to win the case, we can expect this token to rise even higher.

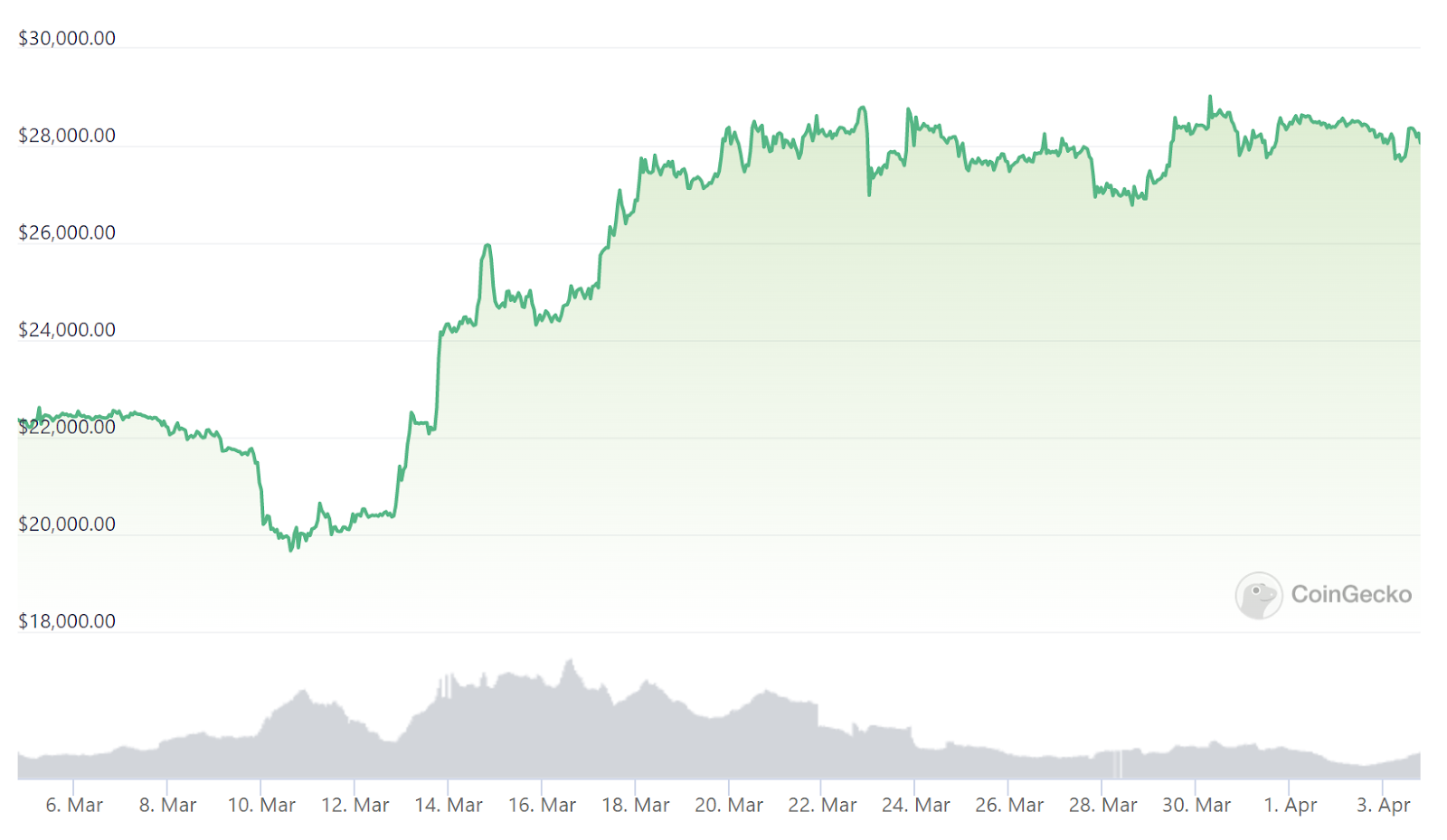

Bitcoin +26.9%

Bitcoin is back and it has started to show very positive signs for the first time after its price crashed last year. March did not start perfectly for Bitcoin as the price went from $22,000 to $20,000, even falling as low as $19,700 at one point. But everything changed around March 12, when Silicon Valley Bank announced bankruptcy and the narrative towards traditional financial institutions changed. Fiat currencies were already under fire, as the US Dollar is losing value each day, this skepticism towards fiat was fueled even further with the collapse of SVB. This left many people worried that their USD will lose more value and storing them in banks was now seen as risky, as rumors started to float around that other banks were in a similar situation as SVB. Because of this, many people started to invest their money into cryptocurrencies, and one of the first cryptos that people go to during this time is of course Bitcoin. This helped Bitcoin to regain the pace and currently it trades just over $28,000 with many expecting that it will break the $30,000 mark sometime in April.

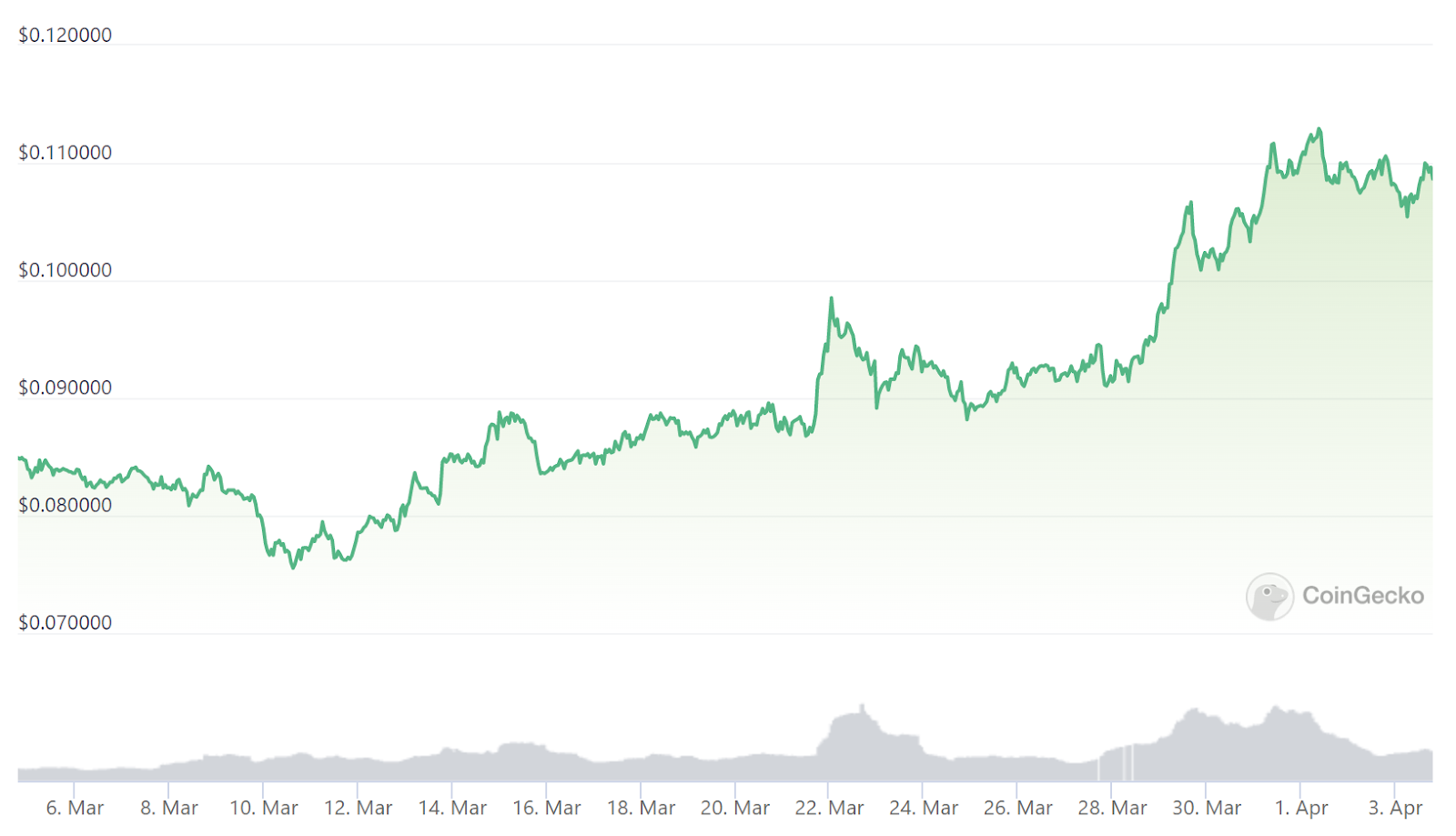

Stellar +26.4%

The only gainer in our list that is outside of top 30 cryptocurrencies, Stellar had a fantastic month despite hitting one of the lowest valuations it had for the past year at one point. Looking at how poorly Stellar finished in 2022, this token has been on a rise ever since and this March it saw value which it last held in November of last year. Everything started really bad for Stellar as during the first week it managed to hit one of the lowest valuations it had in the past one year as prices fell to $0.075, but soon after SVB collapsed, which had a positive impact on the whole crypto market. During this time Stellar started to pick up the pace as more people started to actively trade and invest into cryptocurrencies. This has resulted in Stellar rising consistently throughout the rest of March, even hitting the price mark it last held in November 2022. Currently Stellar trades for $0.1 and is still on an upward trend.

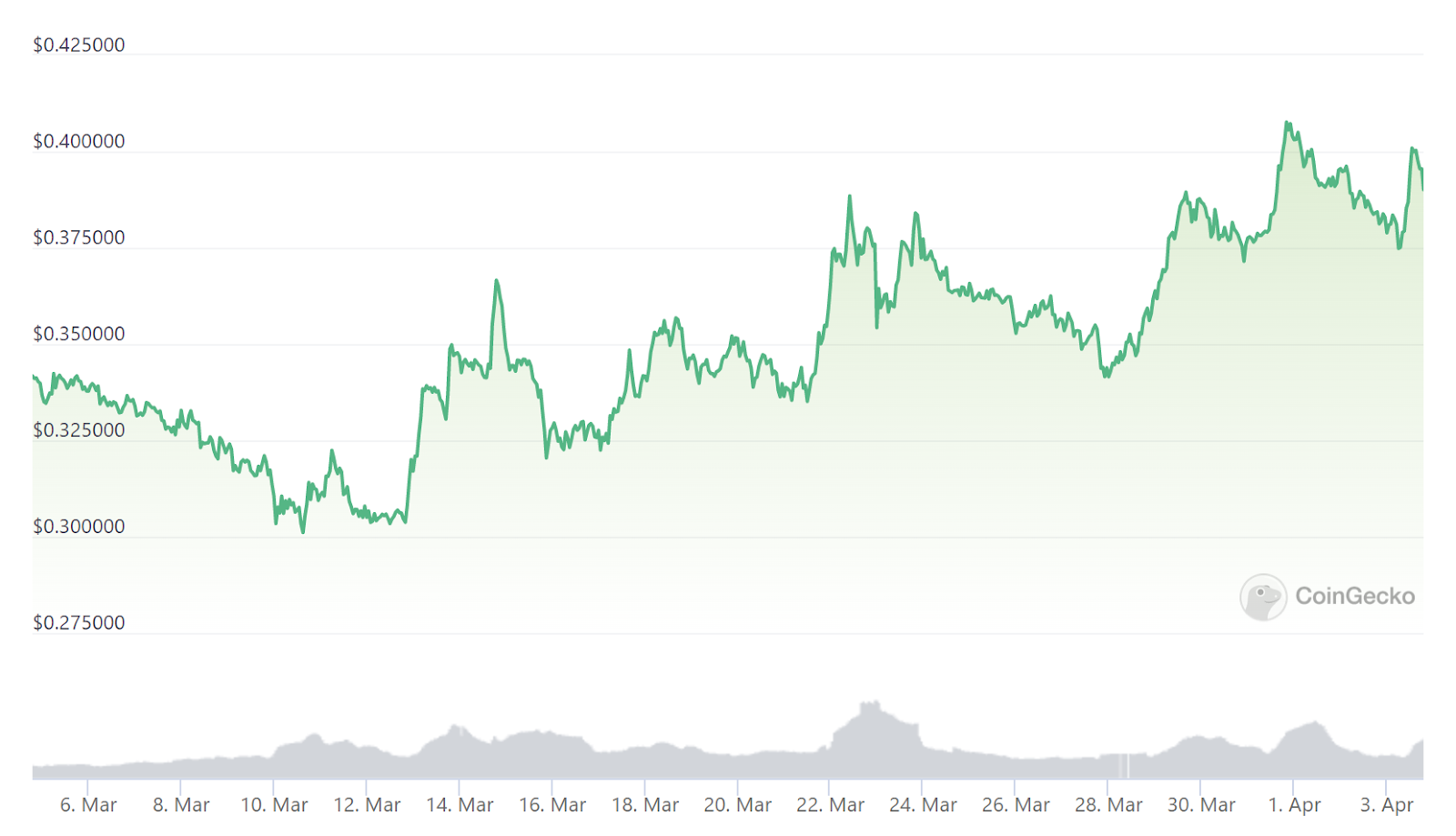

Cardano +16.6%

The fourth best winner of the month is Cardano and its cryptocurrency ADA. Just like any other cryptocurrency, 2022 was not the year of Cardano but starting 2023, Cardano has started to pick up the pace. But everything started to fall apart as prices started to fall again at the end of February and this downtrend continued into the first few days of March as well. But once SVB announced bankruptcy ADA started to pick up the pace once again and an uptrend began. From this point onwards ADA started to be volatile as after hitting certain peaks, prices fell to then rebound once again. But in general this volatility had an upward trajectory and prices were constantly hitting new peaks. ADA closed the month with the valuation of $0.4 which was a 16.6% increase compared to the start of the month and is very close to the peak it had during this year with $0.42 valuation.

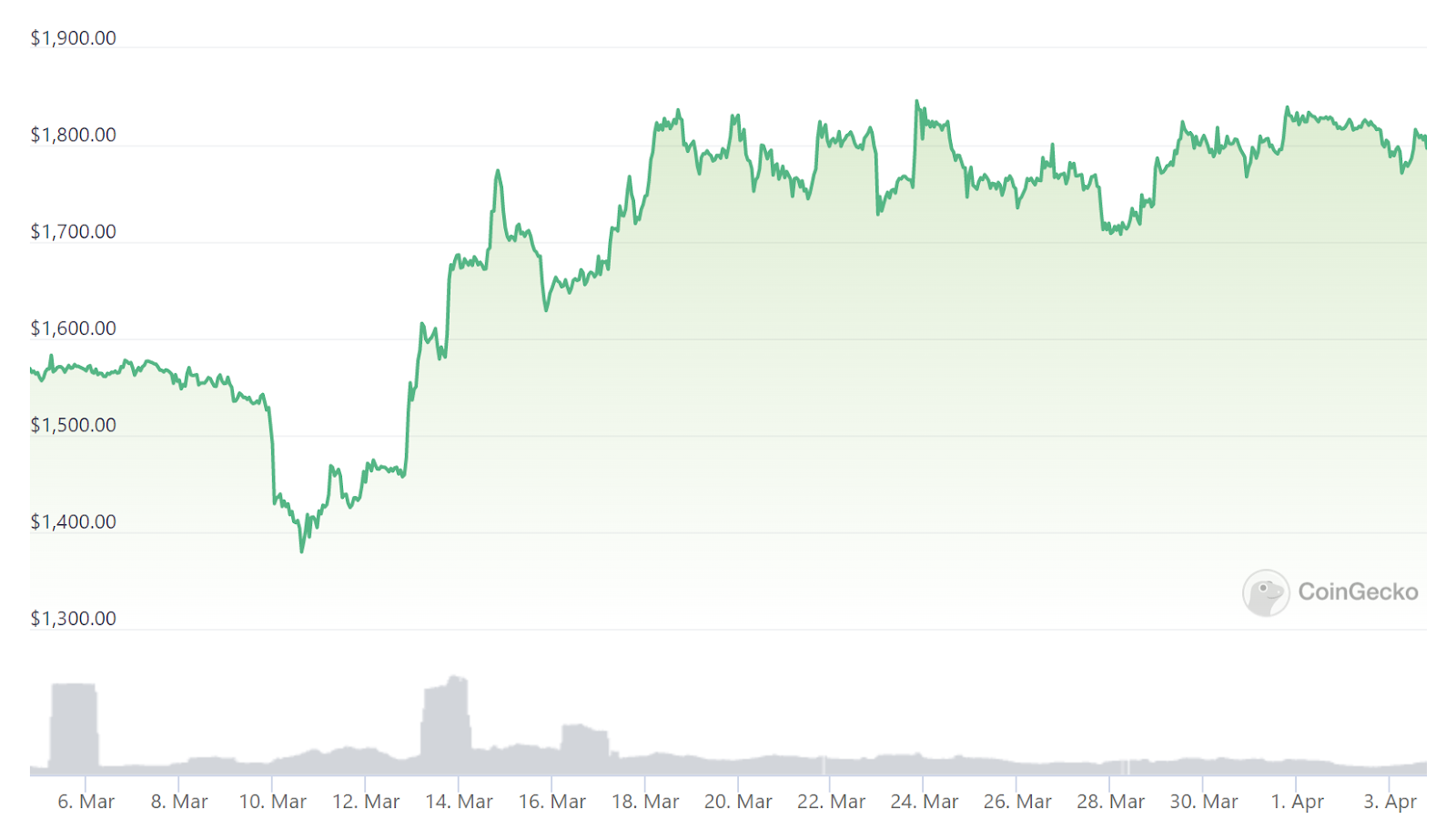

Ethereum +15.6

The last cryptocurrency on our list of top gainers is none other than Ethereum. Just like some other gainers on our list, Ethereum did not start the month strong as it managed to lose almost $100 of its value in the first 3 days of March. From here price remained stable for the following week, before crashing even further losing almost additional $200 and was trading for $1,380. But just like other cryptocurrencies, the bankruptcy of SVB pushed Ethereum prices up once again, as more people started to invest in this token with the fear of other banks collapsing and the US Dollar losing value each day. In just one week, Ethereum was trading for $1,822 and from here on the price of Ether started to go up and down but still remained relatively stable. Currently the price of Ethereum is down compared to the high of March and it trades for $1,800, but it is still 15.6% increase compared to the price it started the month with.

Top 5 losers

When it comes to cryptocurrencies that managed to lose value during the month of March, compared to gainers, there were less tokens that lost the value, but there were still some notable names that had a losing month. But in general these were cryptocurrencies that were on a downward trend already. Let’s take a look at these cryptocurrencies and see what were the factors that made them lose value in March.

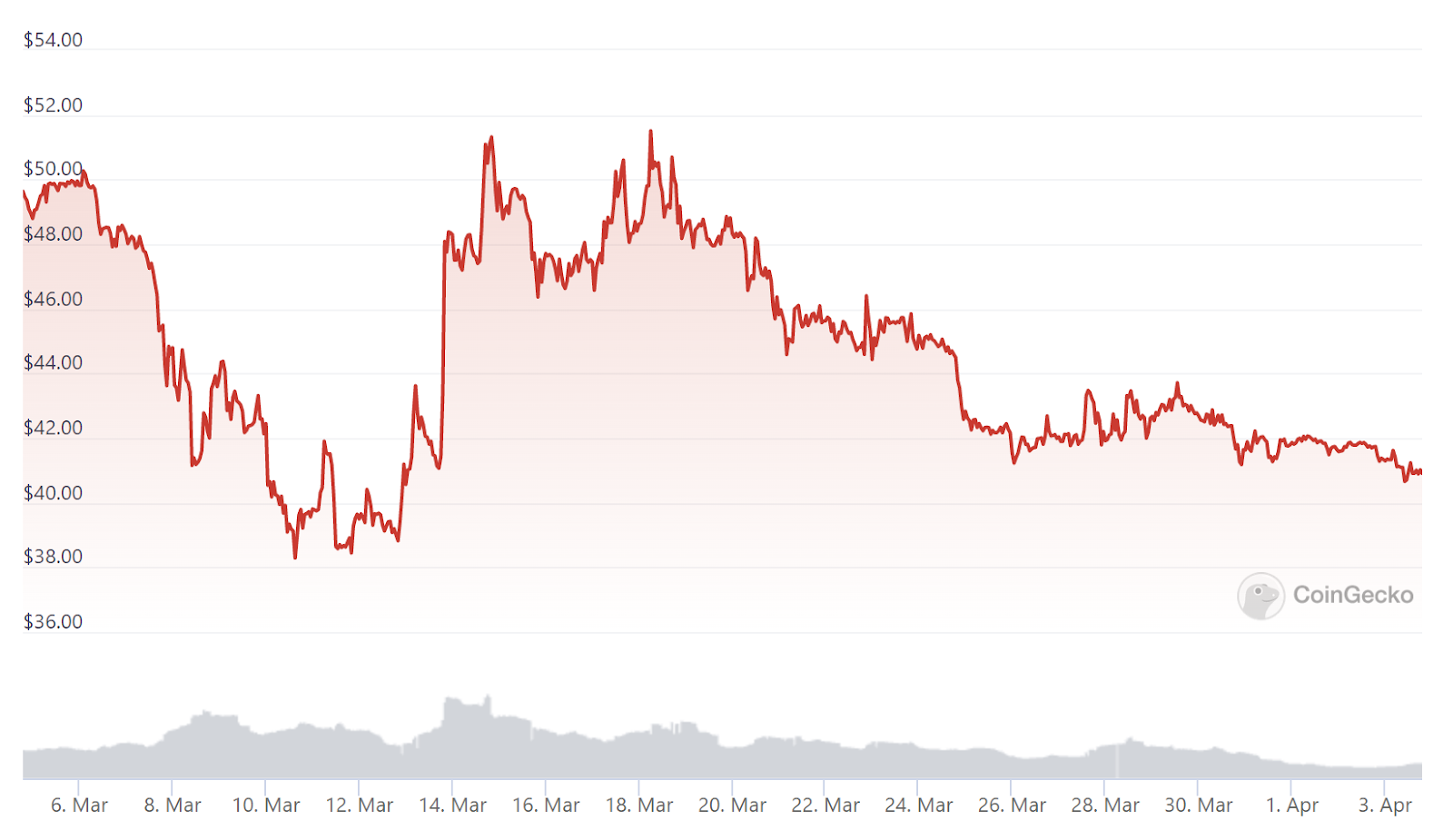

OKB -16.8%

This was something that many people expected to happen, as OKB has been on a very high uptrend for the past few months and it was a matter of time when this token would have had a losing month. OKB was one of the few select cryptocurrencies which actually had a good 2022 with prices rising each month on a consistent basis. But during the first week of March prices fell from $50 to $38, but it soon started to rebound thanks to the SVB collapse and by the end of the second week it was once again back to $50 valuation. But this drop was enough to spook a large number of investors who have been holding OKB for quite some time and in order to not lose their profits investors started to sell their OKB tokens. This created a very big downward trend and prices started to fall very sharply and once the end of the month rolled around OKB was trading for around $40 and charts were showing -16.8% loss in value compared to the start of the month.

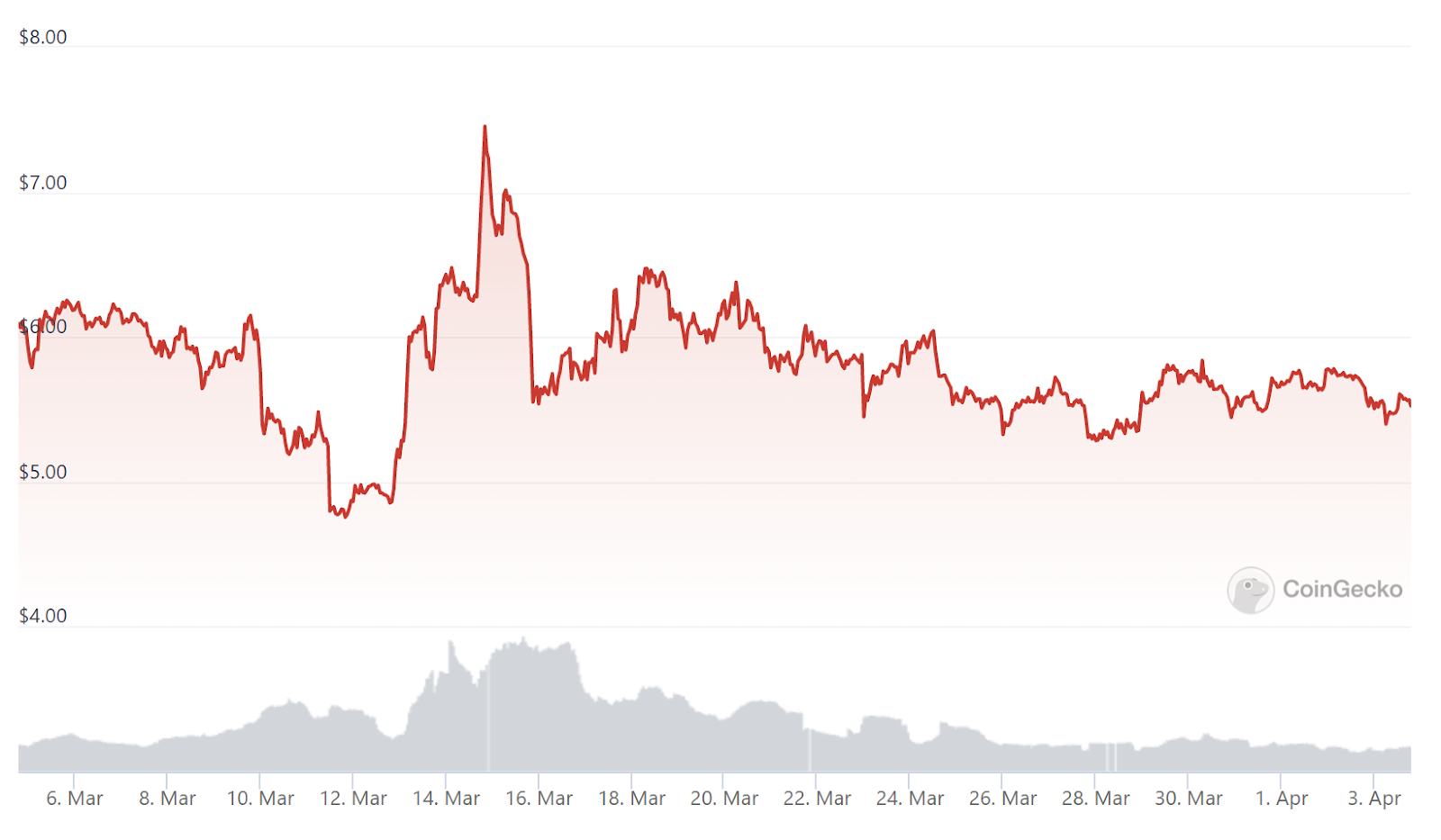

Filecoin -10.1%

Barely making our list, Filecoin is the 30th cryptocurrency by market capitalization and it is also the second largest loser in this list. Filecoin entered March on a pretty mixed tone, with token having gained value in the past month, but still being down compared to the peak it hit during that month. Entering the March on a downward trend Filecoin, just like most other cryptocurrencies, lost a big chunk of its value during the first week. But, also similar to other cryptos, it rebounded thanks to the SVB bankruptcy and USD usability. But as fast as prices rose they fell with the same speed. Filecoin hit its peak value of March on 14th when it was trading for $7.50, and by March 16th prices were already down to $5.50. This downward trend slowed down and prices started to rise once again, but this was short lived and it once again entered a bear market. Once the end of March rolled around Filecoin was trading for $5.50 and had lost 10.1% its value compared to where it started the month.

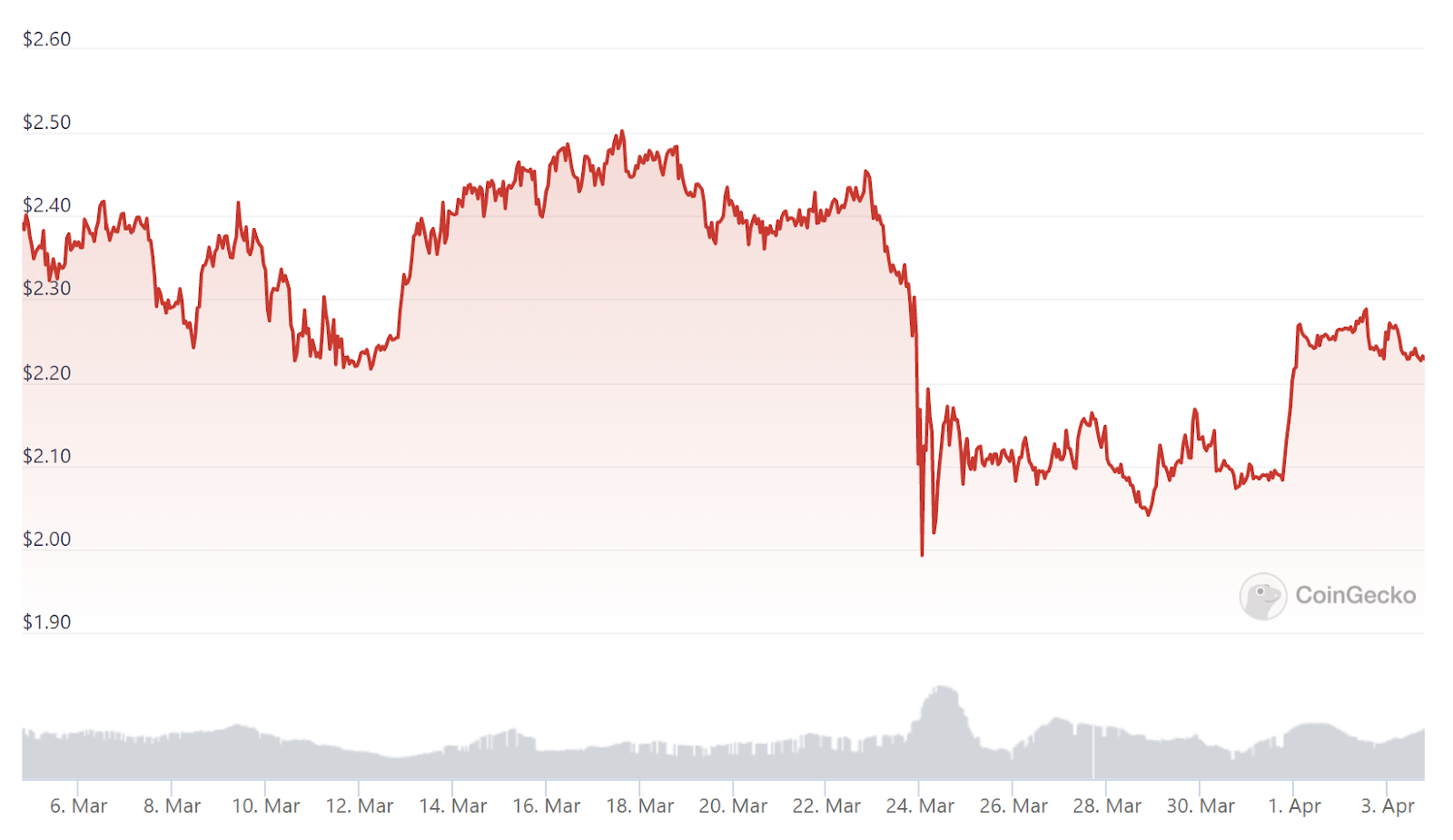

Toncoin -6.7%

The third biggest loser of March is Toncoin which currently is the 22nd largest cryptocurrency by market capitalization. Coming into March Toncoin was on somewhat of a rise following volatile February and this shakiness continued into March as well. Toncoin managed to lose 6.7% of its value in March, which is not a very big drop for cryptocurrencies and this was caused by simple market movements. Similar to other cryptocurrencies, Toncoin lost value during the first week of March and then quickly regained its momentum and prices started to rise again. It should be noted that looking at charts we can see that Toncoin did not lose as much value during the first week as most other cryptocurrencies. But this was not a sign that prices were going to rise as the token entered a volatile market and on 23rd March price crashed very significantly as a large number of whales exited the market. Toncoin failed to recover from this crash during March and ended the first month of spring with -6.7% loss in value.

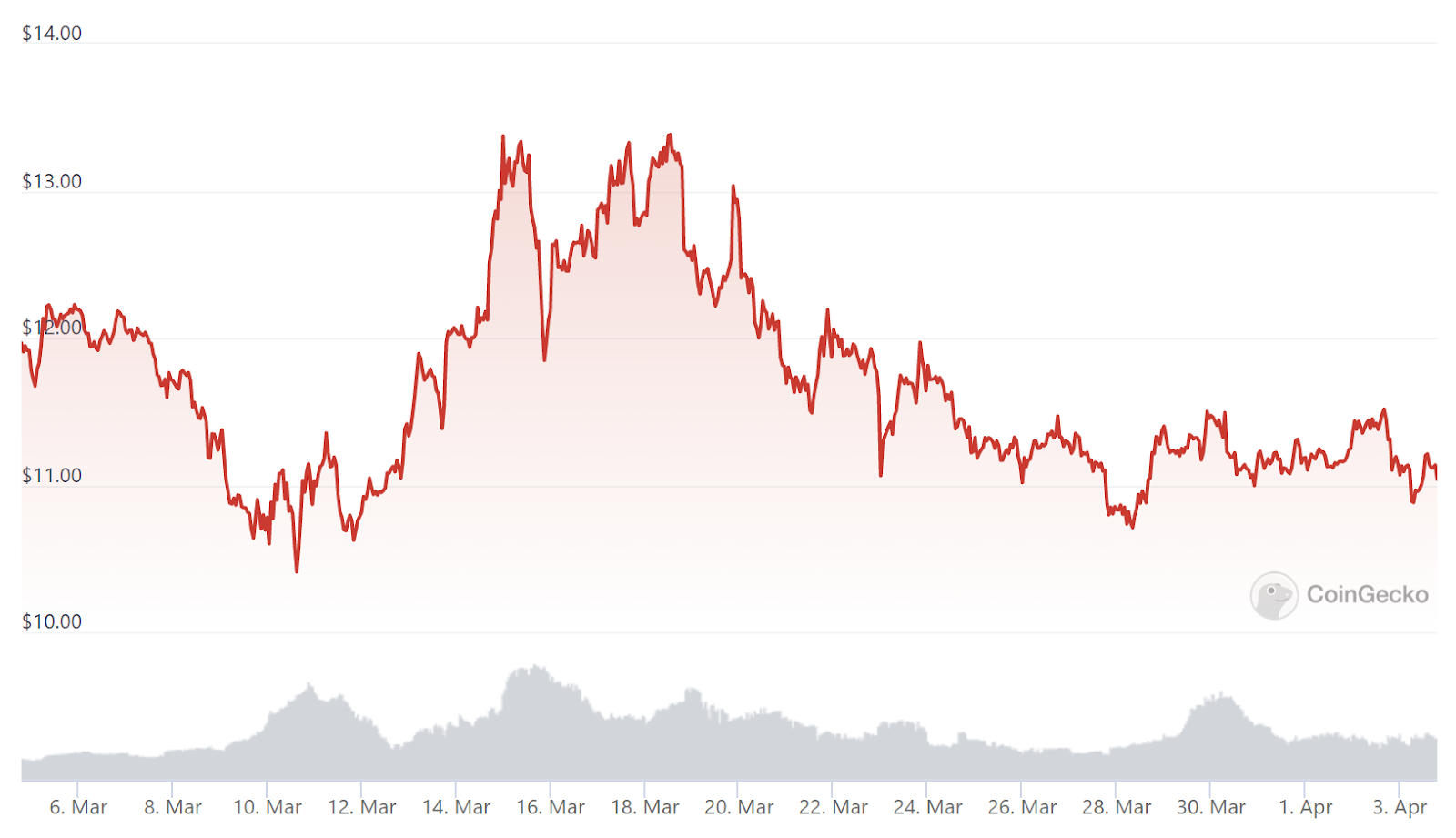

Cosmos -6.4%

Cosmos is the fourth cryptocurrency that lost most of the value during the March, Just like Toncoin this was a very small loss for crypto standards and it was caused by simple market trends. Cosmos entered March on an ongoing downtrend which continued for the first week of March as well and at one point it was trading for $10.50. But soon after Cosmos started to pick up the momentum and prices started to rise, reaching $13.40 value by March 15. But from this point Cosmos suffered huge volatility with prices jumping up and down to then eventually move into a downward trend which continued until the end of March. Cosmos closed the March with a valuation of $11.30 and a loss of 6.4% of its value compared to where it started the month.

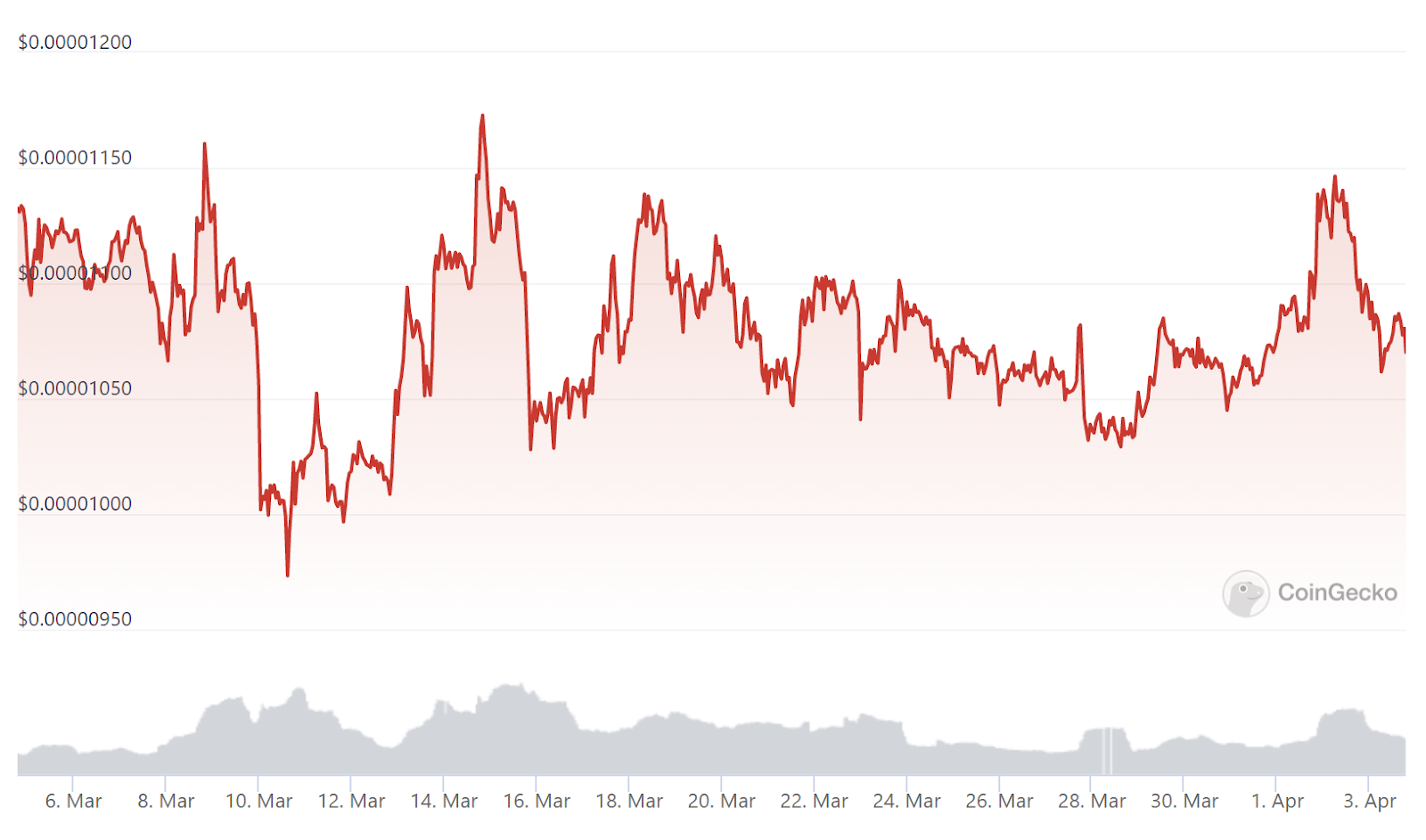

Shiba Inu -5.7%

We are finishing our list of top 5 losers of March 2023 with everyone's beloved meme coin Shiba Inu. Saying that Shiba Inu had a volatile March would be an understatement as prices were jumping up and down every day and looking at the chart someone might confuse it to a heart beat monitor. This high volatility, low drop is value, and no apparent reason for this drop all show us that this loss in value was caused by simple market movement and if March had one more day it could have even ended the month on positive gain rather than loss. When it comes to the most noticeable price movement throughout the month, it came during the first 10 days of March when the price of Shiba fell sharply and then soon rebounded to hit the peak value of the month. But this peak value dropped once again and volatility continued as people are still unsure if there is any future with these meme tokens.

Final Thoughts

In general March was a pretty good month for cryptocurrencies. Not just looking at top 5 gainers but all cryptocurrencies that have gained the value, majority of them were cryptocurrencies that occupied top spots. This is a good sign for the future of these digital assets and considering the current economic state it is expected that prices are going to go up even further. The collapse of SVB has created skepticism towards the traditional banking system with reports coming out that some other major banks are in a similar situation as SVB. This negative attribute towards traditional financial systems is fueled ever further with devaluation of USD, which is losing value each day. Because of this many people started to look at alternative options and cryptocurrencies are one of the best options out there which resulted in huge inflow of cash into the market and rise of almost every major cryptocurrency. But this rise is not 100% guaranteed to continue as cryptocurrencies still remain volatile and speculative assets and views towards them can change very quickly.

cryptonews.net

cryptonews.net