March started with a series of US bank collapses, which brought uncertainty to the financial markets, including cryptocurrencies. Some digital assets have been under high selling pressure, marking notable drops.

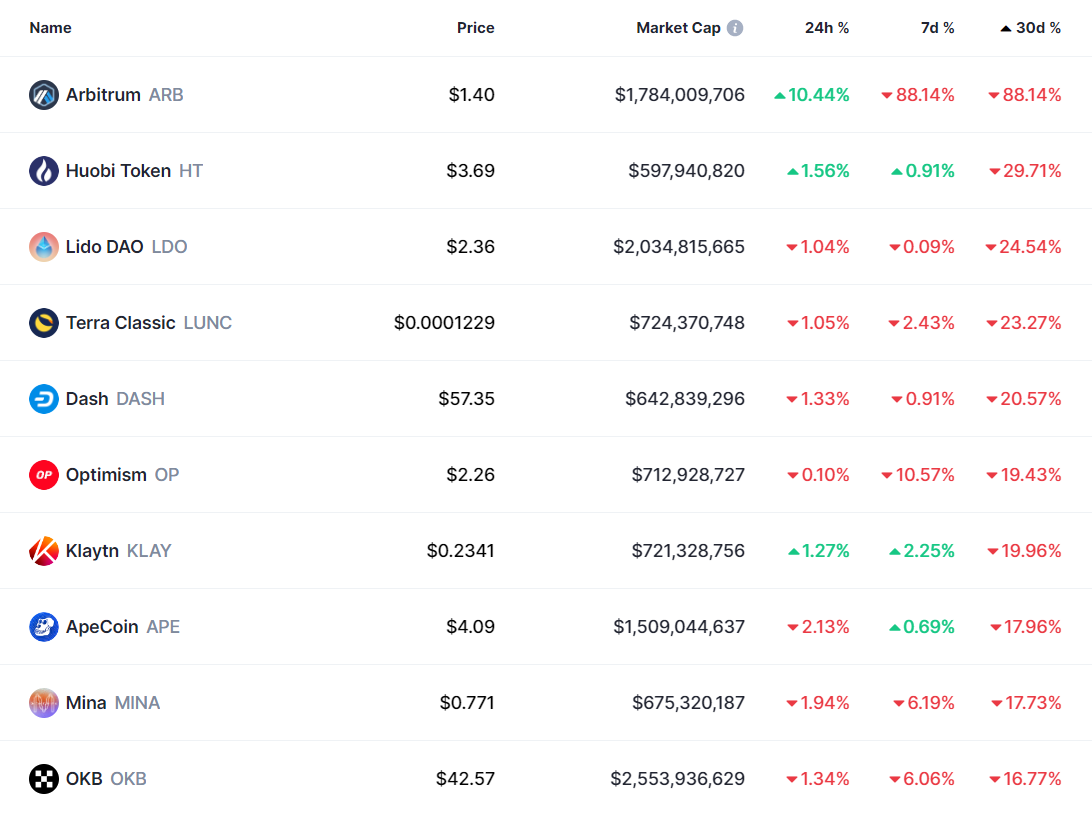

The top loser of the list, arbitrum (ARB), is also the youngest asset among the top 100 cryptocurrencies listed on CoinMarketCap (CMC). After its debut on March 23, ARB saw a nearly 90% drop in just four days.

While the asset could still gain around 10.4% in the past 24 hours, ARB is still down by over 88% from its all-time high (ATH) of $11.8, recorded on March 23. Arbitrum made headlines with its airdrop and debut. It is trading at $1.4 at the time of writing.

According to CMC data, the rest of the losers on the list had a very close gap in terms of price drops. Huobi token (HT), lido DAO (LDO) and terra classic (LUNC) prices dropped by 29.7%, 24.5% and 23.2% over the past 30 days. HT could still recover by 1.5% in the past 24 hours.

Moreover, the last three assets on the list are apecoin (APE), mina (MINA) and OKB. The digital currencies tumbled by 17.9%, 17.7% and 16.7% in March.

The losses come as the whole crypto market witnessed a significant crisis following the collapse of some high-profile banks and the latest regulatory effort against the largest exchange, Binance.

Furthermore, the total crypto market capitalization dropped to $912 billion on March 10, a sudden $88 billion drop in less than 24 hours. However, the industry saw a quick recovery that started on March 12.

At the time of writing, the total crypto market cap is at the $1.19 trillion mark, last noticed in June 2022, per CMC data.