An overview of current and future prices and a look at the latest news involving the Casper (CSPR), Fantom (FTM) and Chainlink (LINK) crypto assets. What’s happening in the cryptocurrency market?

Focus on the Casper (CSPR), Fantom (FTM) and Chainlink (LINK) crypto assets

It is worth mentioning that Casper is an open source blockchain optimized for enterprises and developers. Specifically, it is the first proof-of-stake blockchain, built from the original Casper Correct-by-Construction (CBC) specifications, designed to accelerate the adoption of blockchain technology.

Fantom (FTM), on the other hand, is an open-source directed acyclic graph network, compatible with the Ethereum Virtual Machine to be able to run existing smart contracts and create new ones that interact with contracts on Ethereum.

Finally, Chainlink is a decentralized blockchain network built on Ethereum. The network is used to facilitate tamper-proof data transfer from off-chain sources to on-chain smart contracts.

Will the crypto Casper (CSPR) reach $0.1 in 2023? The relationship with Fantom and Chainlink trends.

Casper has a market capitalization of $383,471,862 and is ranked 99th in the cryptoverse. However, the volume of CSPR dropped by 25% in the session a few days ago.

As such, the ratio of volume to market capitalization of the asset price is close to 0.0155, suggesting a consolidated price trend. A fact that is also confirmed by the weekly technical chart of CSPR, which suggests a consolidated price trend.

CSPR is currently trading near $0.035 with a 2% decline in the intraday session. Meanwhile, the price resistance of the asset can be seen near the value of $0.075.

In addition, we see that the CSPR support can be observed near the value of $0.02. It is currently trading below the daily moving average of 50 and above 100. There could be a negative crossover in the future that could push the asset price to a new low in the future.

The RSI of the asset price is close to 44, suggesting its presence in the neutral zone, even though there is a small positive slope suggesting an upward trend in the price.

In any case, of notable importance is the fact that Casper recently entered into a partnership with Google Cloud, a factor that could push the asset’s price in the future. In fact, several analysts expect a strong upward trend in CSPR in the future.

Specifically, with this partnership, Google hopes to offer its customers a reliable and secure blockchain platform capable of handling large-scale enterprise-level applications.

Casper Labs has earned a reputation as a leading developer of enterprise-grade blockchain solutions. The company’s blockchain platform is based on the Casper Consensus Protocol, which is designed to offer high scalability, low latency and high security.

This makes it an ideal platform for large enterprises and government institutions that need a secure and scalable blockchain solution.

Downward trend for the crypto Fantom (FTM)

Fantom (FTM) is a popular crypto that has recently attracted a lot of attention from investors and traders. In fact, the coin posted impressive gains in 2022, reaching an all-time high of $3.4 in January.

However, crypto has recently faced challenges and setbacks that have eroded its momentum and market share. This is because major investors in Fantom (FTM) are now flocking to the presale of TMS Network (TMSN), the so-called new DeFi star that aims to revolutionize trading.

Specifically, Fantom (FTM) suffered a blow when Andre Cronje, a prominent developer and advisor to the Fantom (FTM) Foundation, announced his departure from the decentralized finance (DeFi) space.

Cronje was behind several successful projects on the Fantom (FTM) platform, such as Solidly, Keep3r, and Iron Bank. As a result, his announcement triggered a sell-off of FTM and other tokens associated with his work, dropping the total value locked (TVL) of Fantom (FTM) from about $12 billion to $6.7 billion in recent weeks.

The crypto has thus lost its place as the most traded token among Ethereum’s whales to ENS Domain Name Service.

DeFi boom: could Chainlink’s price rebound?

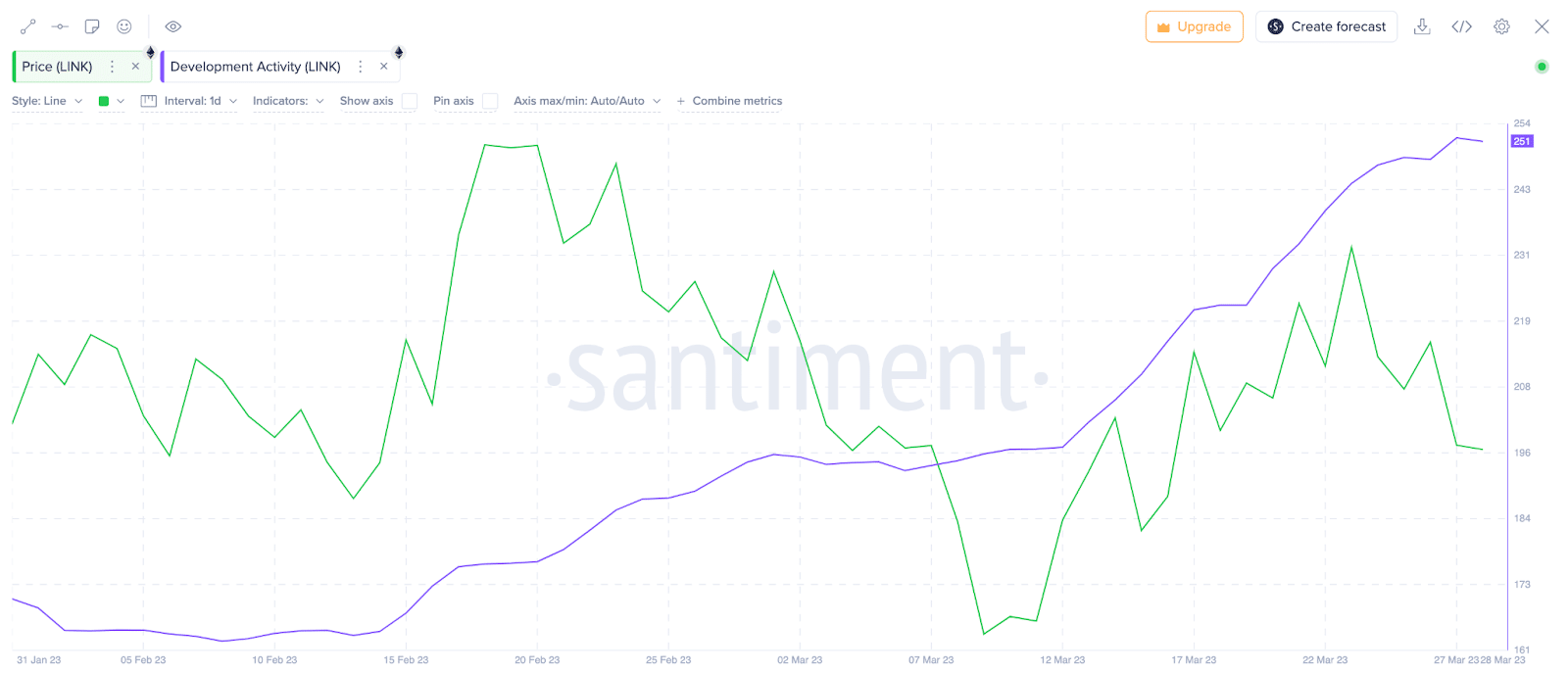

Over the past week, LINK‘s price has undergone a 10% correction. A thorough analysis of historical on-chain data shows that LINK’s price movements are closely related to development activity.

In addition, DeFi’s recent boom could trigger a price rebound for LINK in the coming weeks. We see that LINK has gained some traction as investors turn to decentralized finance protocols amid the turmoil in the US banking sector.

Among other factors, LINK’s recent rally has been fueled by the spike in demand for DeFi products after major collapses in TradFi banking. Indeed, as more and more investors turn to decentralized financial products and services, the hosting DeFi protocols demand the ancillary services provided by Chainlink.

Not surprisingly, the recent increase in Chainlink’s development activity to meet the growing demand for various DeFi smart contract platforms has highlighted this. According to Santiment’s on-chain data, developer activity on the Chainlink blockchain network has increased by more than 50% since the beginning of February.

As shown below, Chainlink’s developer activity score increased from 164.90 to 251.80 between 2 February and 28 March. Development activity indicates how many resources are being devoted to improving the network.

This could mean adding new features, expanding network capabilities, or implementing bug fixes. A persistent increase, as noted above, represents a bullish signal.

Investors may accumulate LINK, expecting that the value added by increased development activity will have a positive impact on its long-term price performance.

Notably, LINK’s previous price increases have often been preceded by a spike in development activity. If this condition holds, LINK holders can expect another price spike in the coming weeks.

en.cryptonomist.ch

en.cryptonomist.ch