A popular crypto strategist believes that Ethereum (ETH) will catch up with Bitcoin’s (BTC) performance and ultimately begin outpacing the top crypto asset by market cap.

Pseudonymous analyst Altcoin Sherpa tells his 193,300 Twitter followers that he’s keeping an eye on the chart of Ethereum against Bitcoin (ETH/BTC).

According to the crypto trader, he believes Bitcoin will continue to lead the market in the short term with Ethereum erupting later on.

“ETHBTC: I wouldn’t be surprised to see this bounce around this level, but I ultimately think it goes to 0.055 (BTC) in the coming months. I think BTC outperforms Ethereum for a bit and then ETH explodes later. It had a multi year accumulation. This is probably the same case.”

At time of writing, ETH/BTC is trading for 0.065 BTC, or $1,824. Based on the trader’s chart, a move toward his target of 0.055 BTC ($1,543) suggests a bullish higher low setup for ETH/BTC on the weekly timeframe.

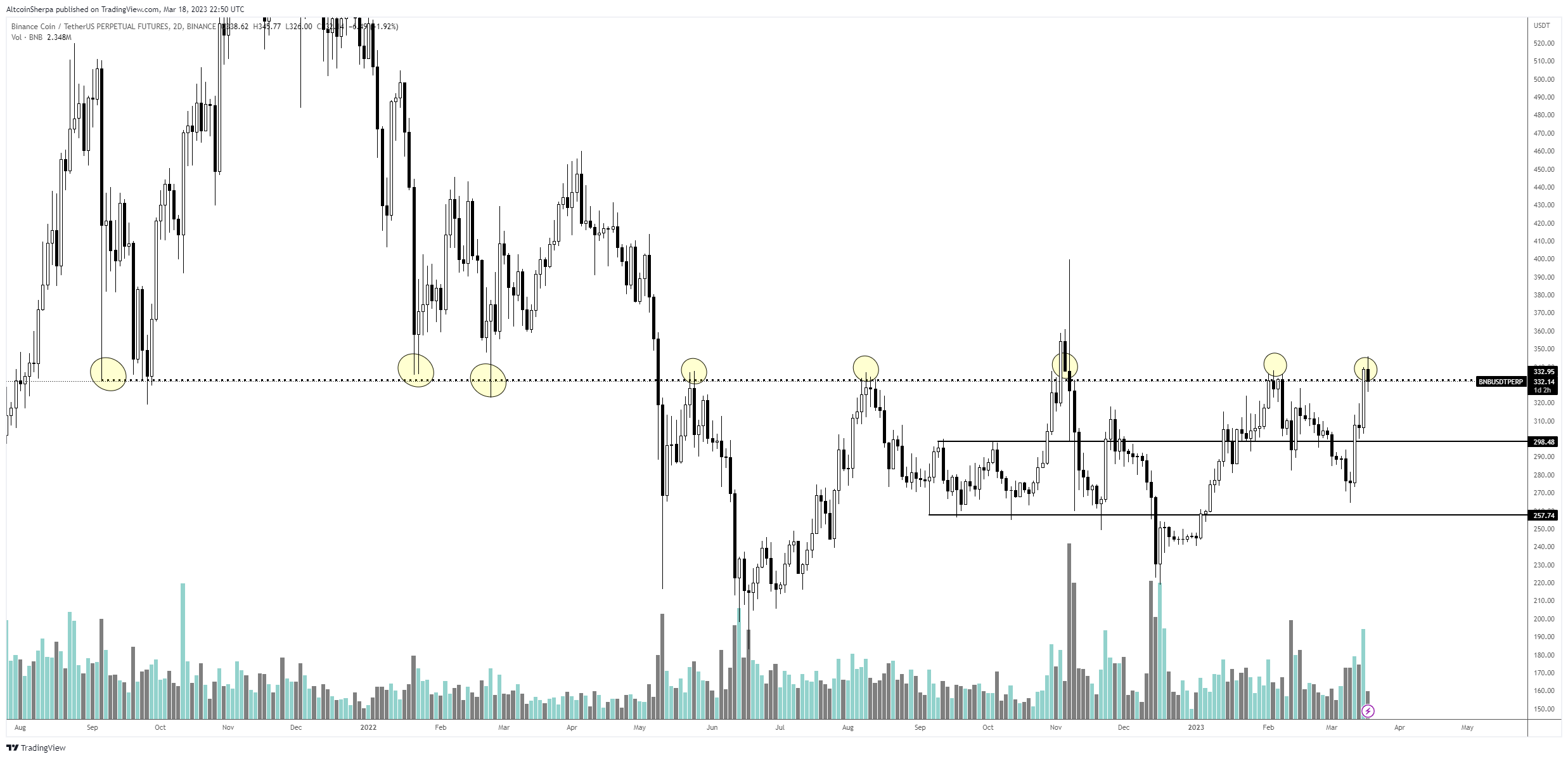

Looking at BNB, the utility token of crypto exchange Binance, Altcoin Sherpa thinks that the fourth-largest crypto by market cap is threatening to take out a key resistance level that has kept it bearish since May 2022.

“BNB: When is this area going to break? First two-day close since the last deviation in November 2022 – watching this $330 level closely.”

At time of writing, BNB is trading for $337, slightly above the trader’s resistance level.

Next up is MASK, the governance token of privacy-centric crypto project Mask Network. According to Altcoin Sherpa, MASK looks bullish but is likely to witness a retracement before the next leg up.

“MASK: Looking very strong but at a resistance area; would look for $5 for a dip buying opportunity. $5-$4.50 seems like a solid entry area.”

At time of writing, MASK is worth $5.88.

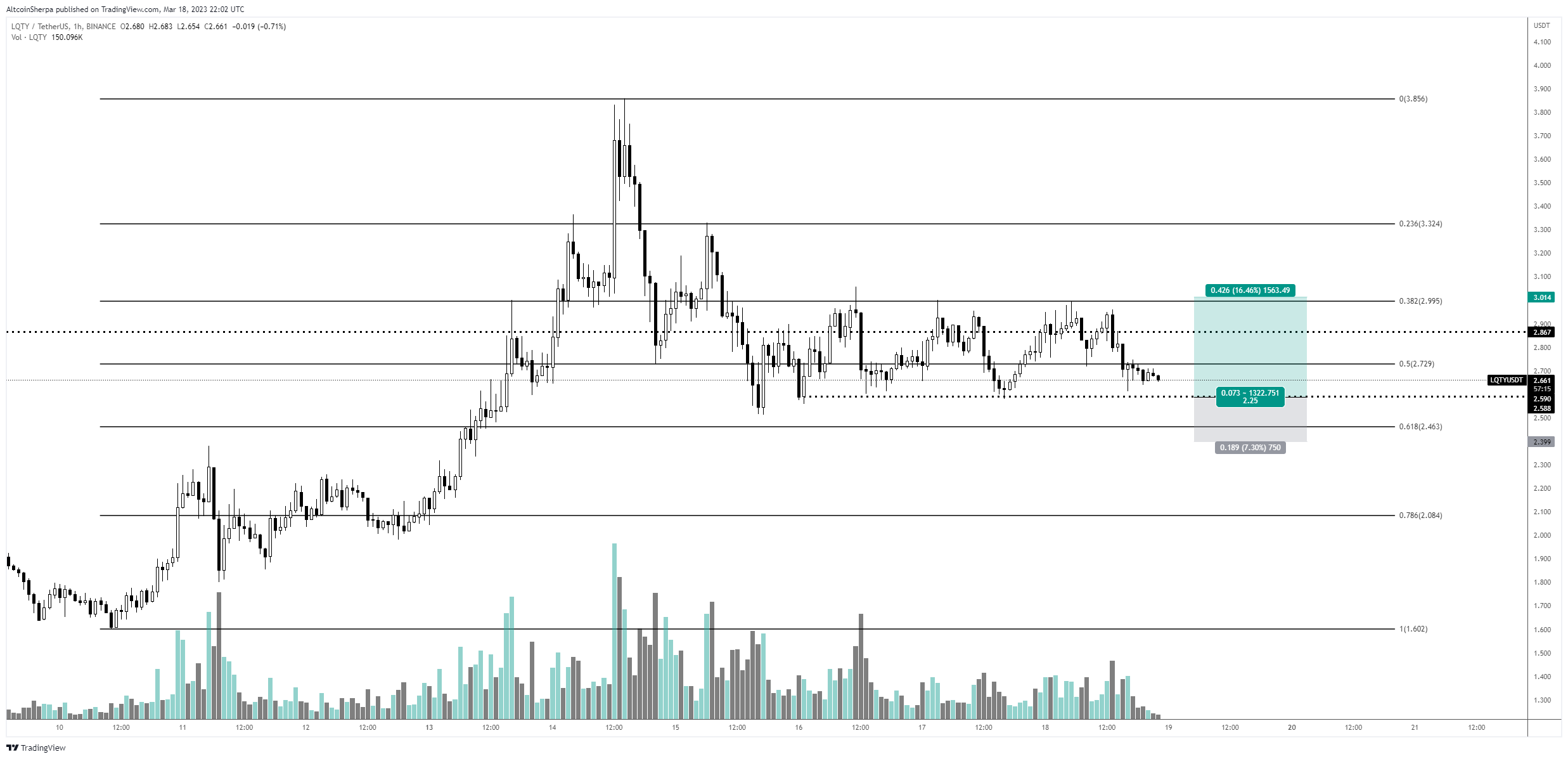

The last altcoin on the trader’s radar is decentralized borrowing protocol Liquity (LQTY). Altcoin Sherpa believes that LQTY may be currently consolidating in preparation for the next rally.

“LQTY: Eyeing this.”

Looking at the trader’s chart, it appears that he’s looking to accumulate LQTY at current prices with invalidation of his bullish view below $2.39. At time of writing, LQTY is worth $2.41.

dailyhodl.com

dailyhodl.com