Over the week, US banks have already borrowed a record $148 billion from the Federal Reserve’s discount window. Ahead of banking uncertainty, investors now wonder if there were red flags before Silicon Valley Bank fell.

No Buyers for Silicon Valley Bank

Following the FDIC taking over Silicon Valley Bank (SIVB) on Sunday, alongside Signature Bank (SBNY), $263.6 billion of customer deposits were secured. This marks the most significant banking failure in US history since the 1970s, even topping the Great Financial Crisis of 2008-2011.

Over the week, Silicon Valley Bank could not find buyers, leading to Chapter 11 bankruptcy filing this Friday. SVB Financial Group is now divested from its bank, noting $2.2 billion in liquidity while having $3.3 billion worth of funded debt and $3.7 billion of preferred equity standing.

“The Chapter 11 process will allow SVB Financial Group to preserve value as it evaluates strategic alternatives for its prized businesses and assets, especially SVB Capital and SVB Securities,”

William Kosturos, Chief Restructuring Officer for SVB Financial Group

First Republic Bank Still on the Ropes

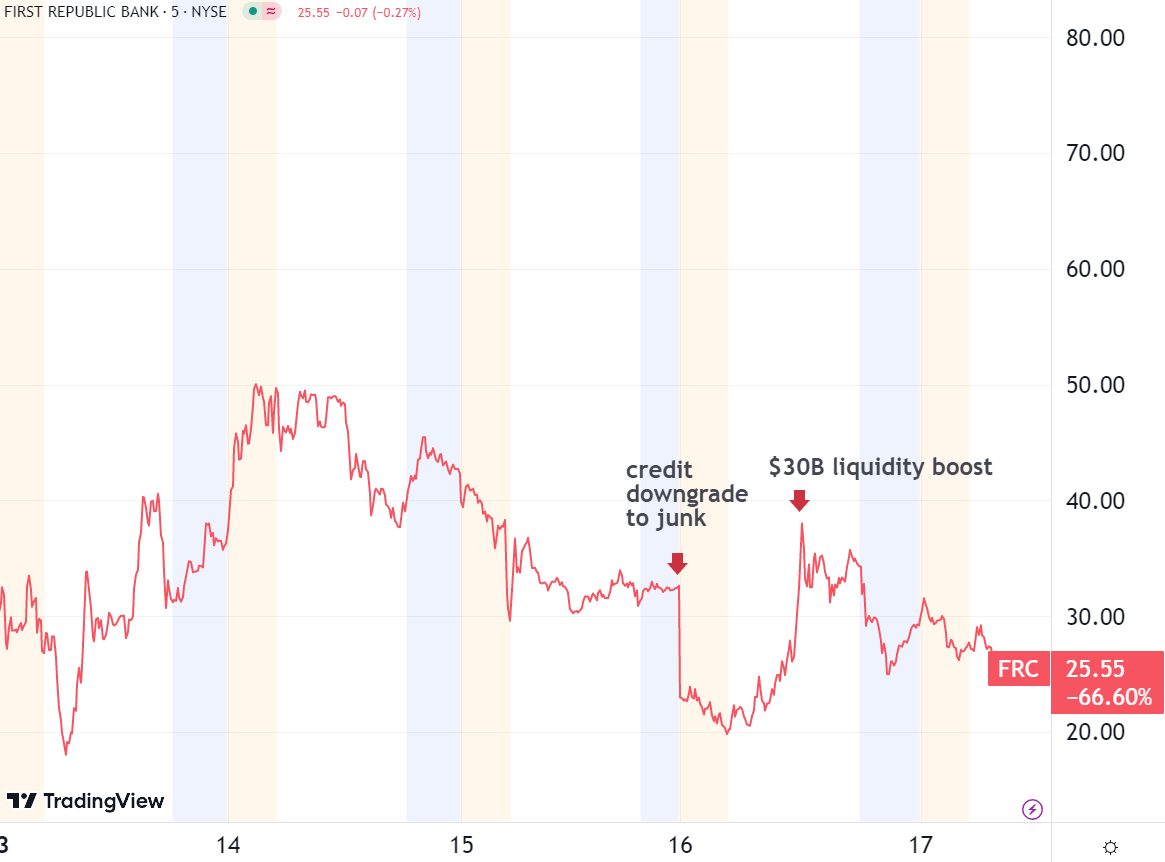

As bank-run contagion victims outside of Global Systemically Important Banks (GSIBs), US regional banks’ stocks were hit hard. First Republic Bank (FRC) is down -80% over the month, prompting multiple trading halts due to volatility.

Eventually, this prompted the combined effort of the Fed, FDIC, and GSIBs to inject $30 billion into the San Francisco-based First Republic. However, as S&P Global Ratings downgraded FRC’s credit rating on Wednesday, the stock boost from $22.6 to $37.8 was short-lived, as FRC is down 66.6% over the week.

Now that it has become clear that Silicon Valley Bank prompted the bank run due to overexposure to long-term US Treasuries in the middle of the fastest hiking cycle in 40 years, which other red flags were present?

Q4 2022 Earnings Paint a Clear Picture

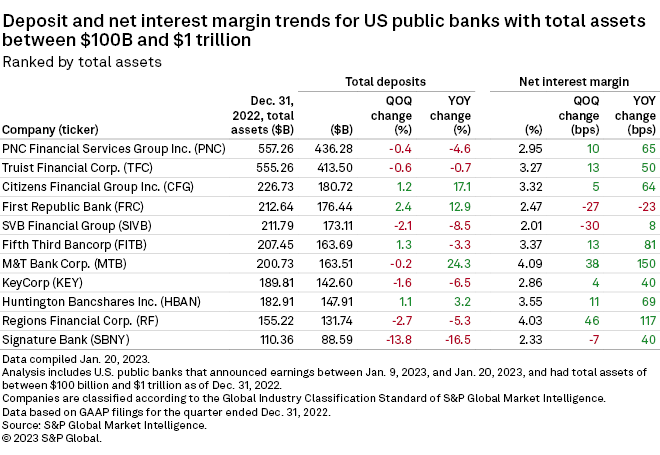

At the end of January, S&P Global compared the Q4 ‘22 earning reports of 11 banks, holding between $100 billion and $ trillion in total assets. Of the 11, seven banks reported damaging quarterly deposits (outflows), with Signature Bank leading by far at 16% year-over-year outflows.

However, the picture becomes even more evident when it comes to net interest margins. Net interest margin measures a bank’s profitability, calculated from the difference between the interest earned on loans and the interest paid to depositors and other creditors as a percentage of total assets.

Quarter-over-quarter (QoQ), all three suspects were in the negative, with Silicon Valley Bank (SIVB) in the lead at -30 bps, followed by the First Republic Bank (SIVB), and Signature Bank (SBNY) at -7.

Year-over-year, the First Republic Bank was the worst performer, the only negative one at -23 bps, while Signature Bank had a solid 40 bps. As a Signature board member, this lends credence to Barney Frank’s statement that he speculates that “using us as a poster child to say ‘stay away from crypto’ was the reason.”

On Wednesday, Frank told Intelligencer that he was “sort of vindicated — they have not argued that we were insolvent,” referring to FDIC’s takeover under the enormous shadow of the Silicon Valley Bank. This prompted House Majority Whip, Rep. Tom Emmer, to seek an explanation from the FDIC on possible illegal activities by the agency.

It's clear the Biden administration is weaponizing market chaos to kill crypto.

— Tom Emmer (@GOPMajorityWhip) March 16, 2023

This is why I sent an investigative letter to FDIC Chairman Gruenberg seeking additional information yesterday. pic.twitter.com/oPr3WLZtk3

Did Silicon Valley Bank Fail due to Regulatory Oversight?

Silicon Valley Bank is under the regulatory supervision of the San Francisco Federal Reserve. Yet, as the largest bank under its scrutiny. Yet, it came to light that SVB has lacked a Chief Risk Officer (CRO) for eight months since last April, following the departure of Laura Izurieta.

The SF Fed could have noted the suspicious lack of filling that position as the bank effectively gained 4x holdings in just four years. SVB owes this growth to equally explosive growth of VC clientele, such as a16z or Sequoia Capital.

The SF Fed could have also raised concerns when SVB drastically increased its exposure via mortgage-backed securities (MBS) since 2019, worth over $100 billion at a low-interest rate, before the Fed’s hiking cycle. The Fed also did not investigate SVB’s helping to multi-billion credit lines from the Federal Home Loan Bank (FHLB), also based in San Francisco. Given FHLB’s status as the ‘lender of next to last resort,’ seeking a loan from this institution may be seen as a potential risk factor by both credit rating agencies and investors.

As the San Francisco Fed investigates itself over regulating SVB, the full report is scheduled for release on May 1st. This is two months before the launch of the FedNow service, as the linchpin for the digital dollar, which is still in the experimental stage, according to Fed Chair Jerome Powell. In the initial stage, the 24/7 payment rail will be used by the increasingly more centralized banking sector.

tokenist.com

tokenist.com