The past 24 hours were a complete rollercoaster throughout the cryptocurrency market and were packed with action.

Bitcoin’s price soared above $26K only to retrace below $25K later in the day, while many altcoins pained massive double-digit gains. Let’s dive in.

Bitcoin’s Price Rollercoaster

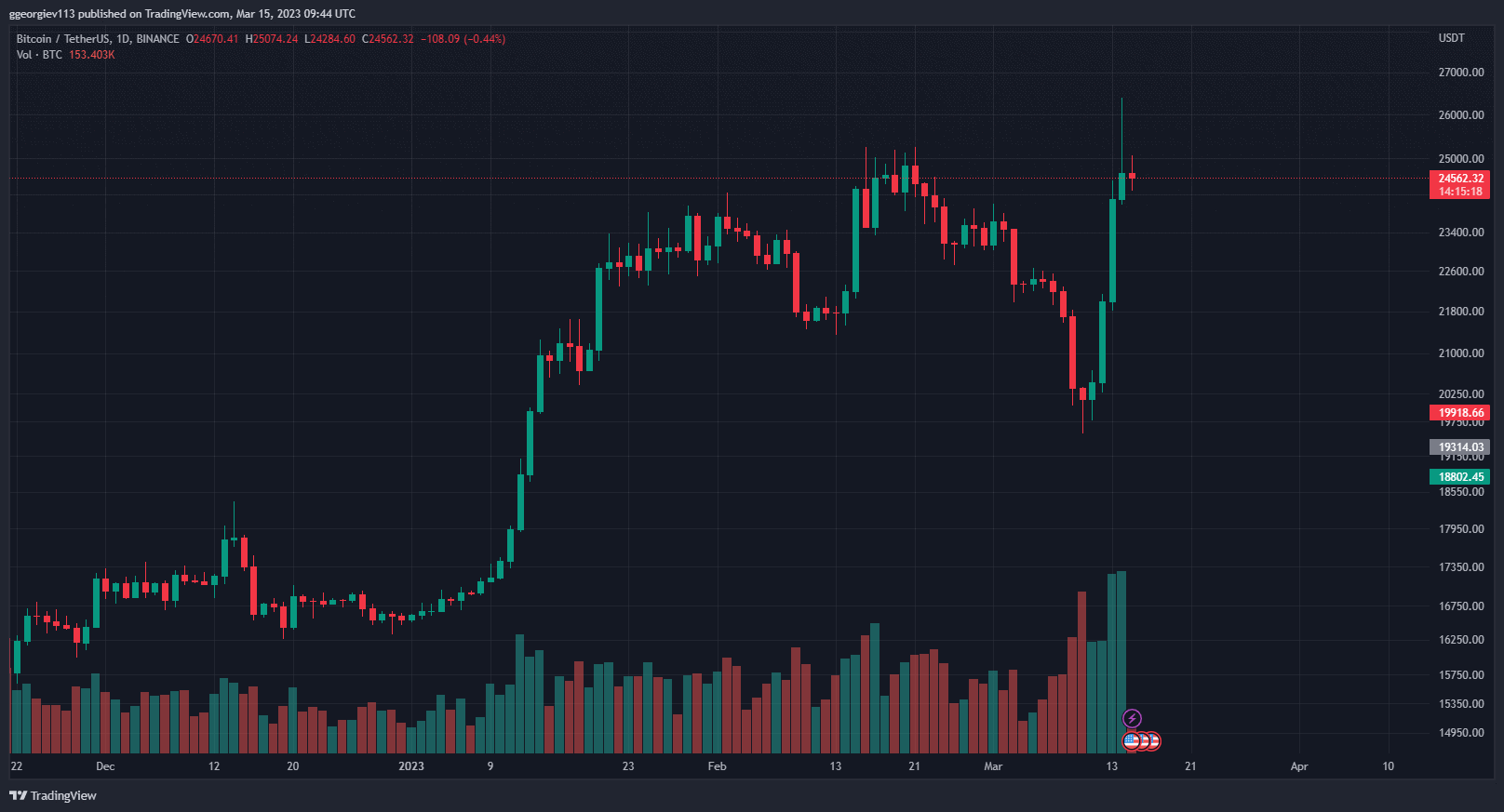

First things first, it’s important to note that yesterday the Bureau of Labor Statistics published the numbers for the Consumer Price Index for February. The CPI for all urban consumers clocked in at 6%, which was interpreted by market participants as an indication that inflation in the country is slowing down.

Immediately, Bitcoin’s price took for the skies.

As seen in the chart above, the cryptocurrency pushed a lot higher, and it reached $26,386 (on Binance). This was the highest price since June 2022. It stayed there for hours to come but was unable to sustain the momentum and ultimately declined to where it’s currently trading at around $24,500.

Now, many are expecting a lower interest hike because the Fed is being pressured to prevent any additional strain on the US banking system, given the turmoil with SVB, Signature Bank, and Silvergate Bank.

Altcoins Printing Gains

Despite the decline, Bitcoin’s price remains well in the green, but some altcoins have managed to considerably outperform it.

As seen in the above heatmap, from the top cryptocurrencies by means of total market cap, ATOM is performing very well, followed by the likes of MATIC, DOGE, UNI, AVAX, LTC, LINK, ETC, and others.

However, from the top 100 coins, SingularityNET’s AGIX exploded by a whopping 40% in the past 24 hours, making it the best-performing altcoin from that list. It’s followed closely by Conflux (CFX), which is up about 35%, and Stacks (STX) – up 32%.

On the other hand, Monero’s XMR and Maker (MKR) failed to capitalize on the latest surge and are charting very slight declines of around 2% in the past day.

The wild ride of the past day saw a total of around $300 million in leveraged positions being liquidated, with roughly 60% of them being short.

cryptopotato.com

cryptopotato.com