BeInCrypto looks at five altcoins that increased the most in this week’s crypto market, specifically from Feb. 24 to March 3

These popular altcoins have stolen the crypto news and cryptocurrency market spotlight:

- Maker (MKR) price increased by 22.73%

- ssv.network (SSV) price increased by 13.13%

- SingularityNet (AGIX) price increased by 10.10%

- Casper (CSPR) price increased by 9.38%

- Threshold (T) price increased by 9.12%

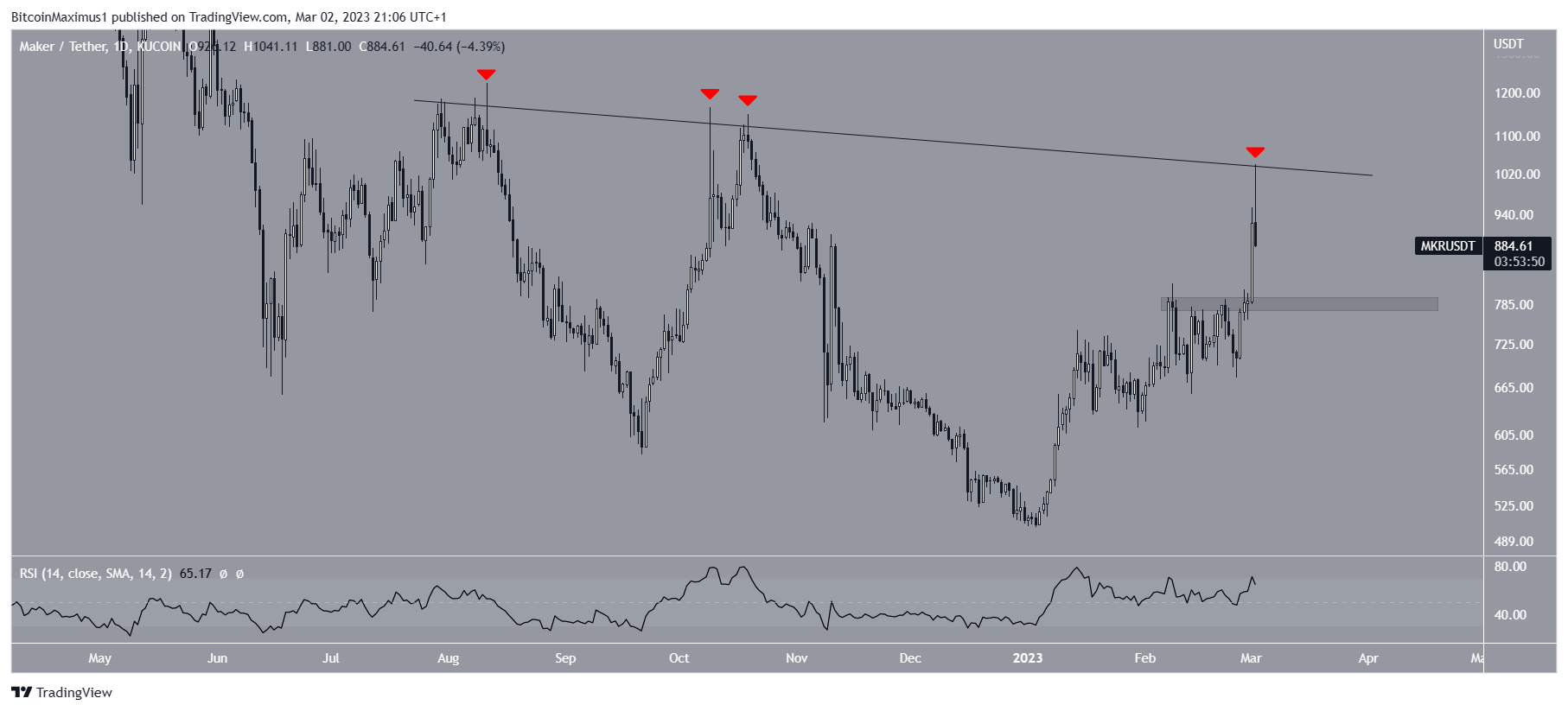

Maker (MKR) Leads Altcoin Gainers

The Maker price has fallen under a descending resistance line since July 2022. The line caused numerous rejections so far, the most recent on March 2. Then, the digital asset created a long upper wick. It has fallen since.

If the downward movement continues, the closest support area would be at $788. However, if the MKR price breaks out from the resistance line, an increase toward $1,200 could follow.

ssv.network (SSV) Breaks Out Above Resistance

The SSV price broke out from a descending resistance line on March 3. It reached a high of $45.90 the same day.

However, the price has not moved above the 0.618 Fib retracement resistance level at $44.73. If it does, it could increase to $50.

However, if the price gets rejected, it could fall down to the $41 support area.

SingularityNet (AGIX) Risks Breakdown From Channel

The AGIX price fell after reaching a high of $0.67 on Feb. 8. Afterward, it began its recovery on Feb. 13. It has increased inside an ascending parallel channel since. Such channels usually contain corrective movements. Therefore, a breakdown from it would be the most likely scenario. This is supported by the rejection from the channel’s resistance line on March 1 (red icon), which also coincided with the 0.618 Fib retracement resistance level.

If the AGIX price breaks down from the channel, it could fall toward $0.30. However, a breakout from the channel would invalidate this bearish forecast and could lead to an increase toward $0.80.

Casper Network (CSPR) Altcoin Creates Double Top Pattern

The Casper (CSPR) price created a double top pattern on Feb. 4 and March 6, respectively. Besides being a bearish pattern, the double top was combined with bearish divergence in the daily RSI (green line). Therefore, a rejection and decrease is the most likely outline for the future movement.

If that occurs, the CSPR price could fall to the 0.618 Fib retracement support level at $0.033.

However, in case the previous upward movement resumes, the CSPR price could increase to the next resistance at $0.05.

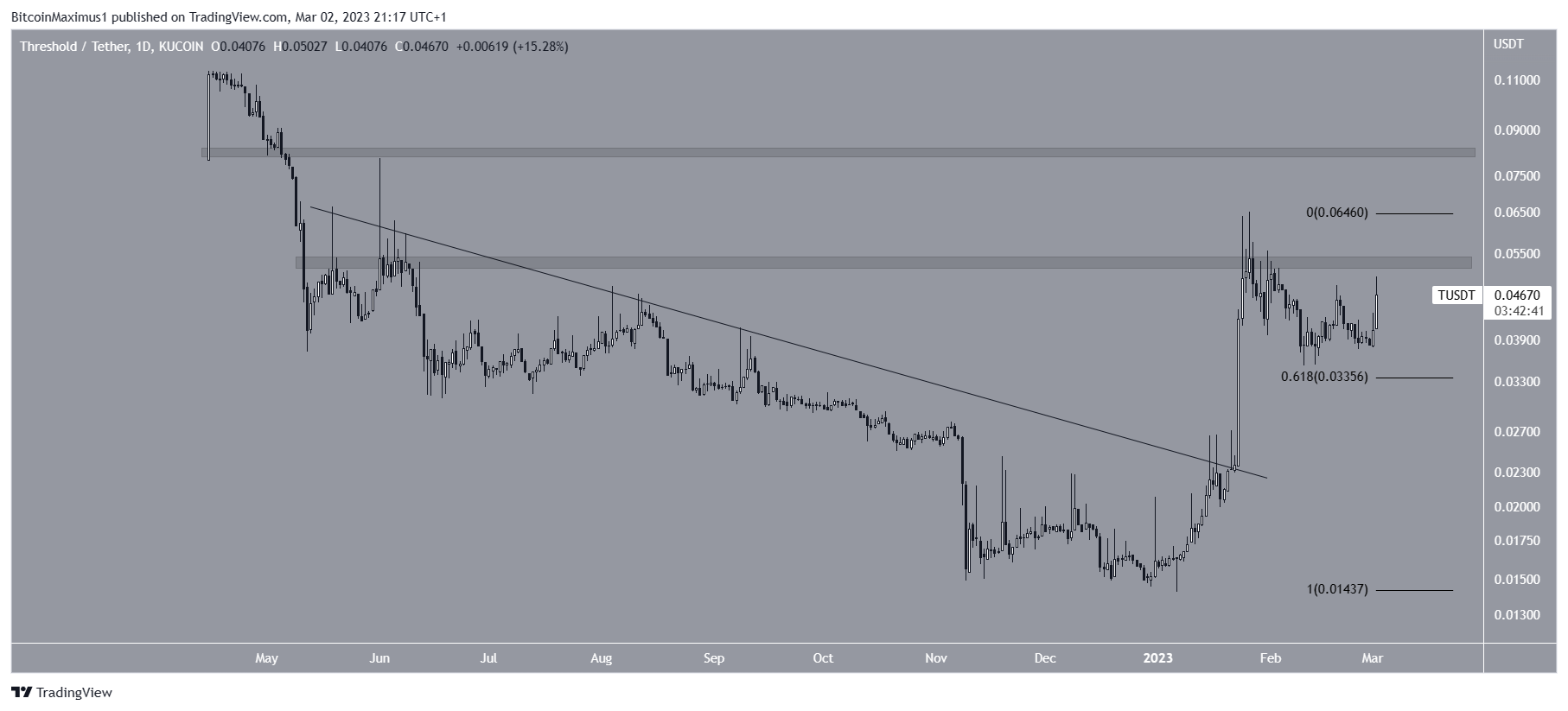

Threshold (T) Breaks Out Above Resistance

The Threshold price has increased since breaking out from a descending resistance line on Jan. 23. The upward movement led to a high of $0.065 on Jan. 26.

However, the price created a long upper wick, getting rejected by the $0.054 resistance area.

After a bounce at the 0.618 Fib retracement support level of $0.033, the price is currently making another attempt at breaking out. If it is successful, the price could increase to the next resistance at $0.08.

However, if the Threshold price breaks down from the 0.618 Fib retracement support level, it could fall toward $0.023.

beincrypto.com

beincrypto.com