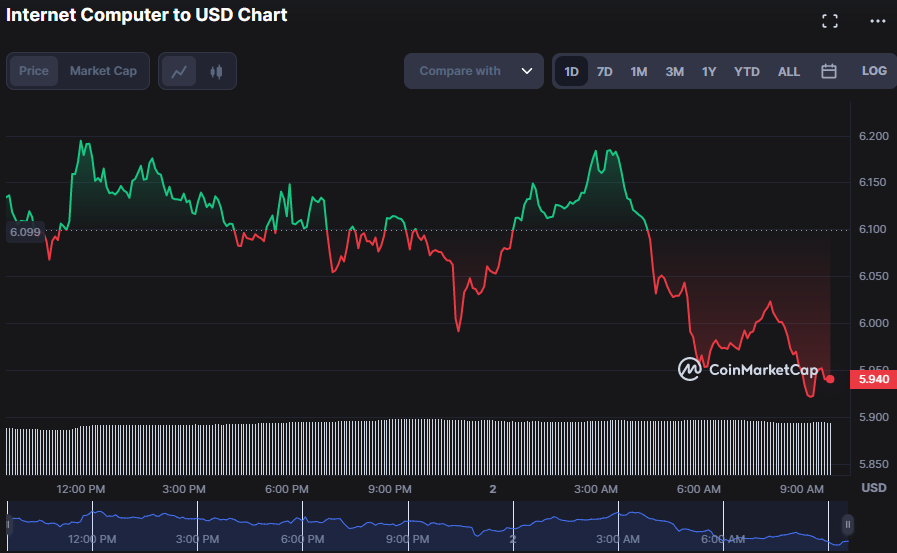

Despite a bullish start to the day, negative pressure persisted, effectively pushing the Internet Computer ($ICP) price down to a session low of $5.92. The bears have seized control of the market, and the $ICP is now trading at $5.95, down 2.82% from its high of $6.20.

The 2.83% drop in market capitalization to $1,732,128,858 illustrates the current adverse attitude and may weigh on the price soon. However, irrespective volatile market, the 24-hour trading volume increased by 12.36% to $46,709,815. This spike suggests that investors are still actively investing in the market and that a possible comeback is still feasible.

The descending Bull Bear Power (BBP) rating of -0.16 shown in the $ICP price chart suggests that the market is now bearish. This trend points to investors liquidating their assets, most likely because of pessimism about the market’s prospects.

Yet, the rising number of trades shows that investors are still confident and willing to take risks in the market. This trend may suggest that traders are becoming more aggressive in the market, actively searching out opportunities and acting swiftly to capitalize on them.

The Coppock Curve is trending downwards at a value of -2.91, indicating that the bearish momentum in $ICP is robust and may remain for some time. Moreover, this pattern suggests that selling pressure may continue to be elevated in the foreseeable future, resulting in more drops in the $ICP index. So, investors should carefully proceed when evaluating $ICP investments and keep an eye on the Coppock Curve for any reversal signals.

The MACD line, with a value of -0.11 and an upward trend, shows that pessimistic sentiment about the $ICP is fading and that it is likely to be ready for a positive comeback. Furthermore, suppose the MACD line continues to rise above the signal line and into the positive zone. In that case, this technical pattern indicates a higher possibility of a significant advance in the $ICP price as buyers join the market.

The fact that the histogram is going higher and is currently in positive territory means that the purchasing pressure will likely continue, and the price of ICPs will probably climb in the foreseeable future.

While the $ICP’s RSI reading of 43.24 on the 4-hour price chart is positive, additional evidence of a bullish breakout is required. If the RSI index goes over 50 and the MACD indicator crosses into the positive zone, bullish momentum in the market may increase, and prices may rise shortly. This shift might hint at a market change, signaling that the bear grip on $ICP is weakening, enabling bullish momentum to take hold.

$ICP’s bearish trend may continue, but the increasing trading volume and positive MACD signals suggest a potential comeback soon

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com