There are new indications in favor of the thesis that the upcoming cryptocurrency bull market may be stimulated by Asian markets, particularly China.

The very large amount of cash recently injected into the banking system by the People’s Bank of China (PBoC) correlates with the rapid growth of cryptocurrency market capitalization and the price of Bitcoin.

The People’s Bank of China is Pumping Cheap Cash

The People’s Bank of China has recently injected a huge amount of cash into the banking system. Its aim is to support the country’s recovery from the economic crisis. At the same time, it has stated that it will keep interest rates unchanged.

China’s central bank has injected 499 billion yuan ($73 billion) into a one-year medium-term lending facility (MLF) at an interest rate of 2.75%. Thus, not only is the banking system getting a great deal of cash. But the cost of getting it is still relatively small.

This is a repeat of a similar operation in mid-January. The People’s Bank of China said in a statement that the money injection is aimed at keeping the banking system’s liquidity at a “reasonable level.”

In addition, PBoC also injected 203 billion yuan ($30 billion) into the banking system. It did this through seven-day reverse repos. At the same time, it kept the cost of borrowing unchanged at 2.00%.

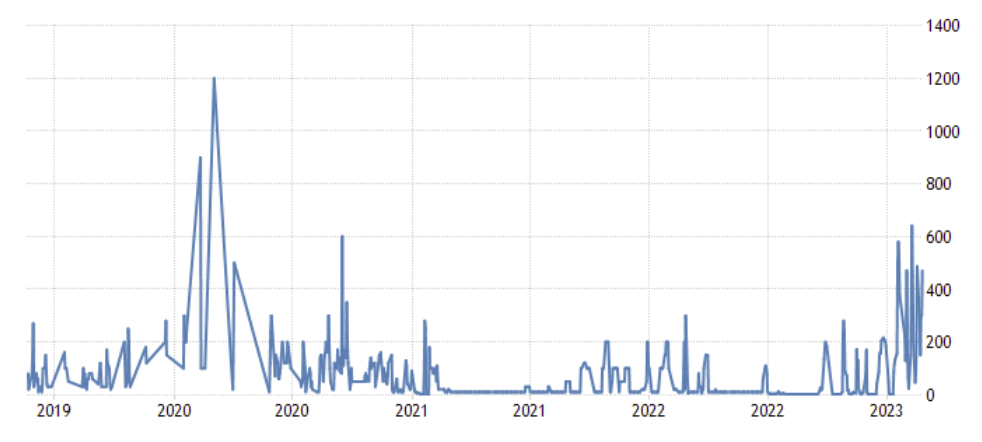

On a long-term chart of this type of action for the past five years, we see that 2023 marks the largest series of liquidity injections into the banking system since early 2020. The Chinese central bank’s rapid response at the time was triggered by the COVID-19 pandemic economic crisis.

Chinese cryptocurrencies on the rise

The People’s Bank of China’s actions is directed at stimulating the domestic economy it seems. However, they may also have an indirect impact on cryptocurrencies. China’s “quantitative easing” has been in correlation with the growth of the total cryptocurrency market capitalization (TOTALCAP). This has been ongoing since the beginning of 2023.

What’s more, this is evident in the massive increases in some “Chinese altcoins.” For example, as BeInCrypto recently reported, Conflux (CFX) surged more than 300% during the past week alone. Another cryptocurrency with Chinese origins, Filecoin (FIL) is currently gaining 162% since the beginning of 2023. A similar performance can be boasted by Neo (NEO). At press time, NEO had increased by about 100% over the same period.

Recent positive reports from Hong Kong, which is aiming to become Asia’s cryptocurrency hub, are not insignificant. This region, which belongs to the People’s Republic of China, intends to completely legalize the buying, selling and trading of cryptocurrencies in June. In addition, it is set to become a cryptocurrency gateway for mainland Chinese institutions.

A Boost for Bitcoin

The People’s Bank of China also seems to be having a positive impact on the price of Bitcoin. Macro cryptocurrency market analyst @tedtalksmacro tweeted a chart of BTC and liquidity injections from PBoC.

It shows that the previous huge liquidity injection in early 2020 was correlated with the macro bottom of Bitcoin price. The next, comparably large injection of cheap cash, which is taking place now, also appears to follow just after the bottom of the passing bear market.

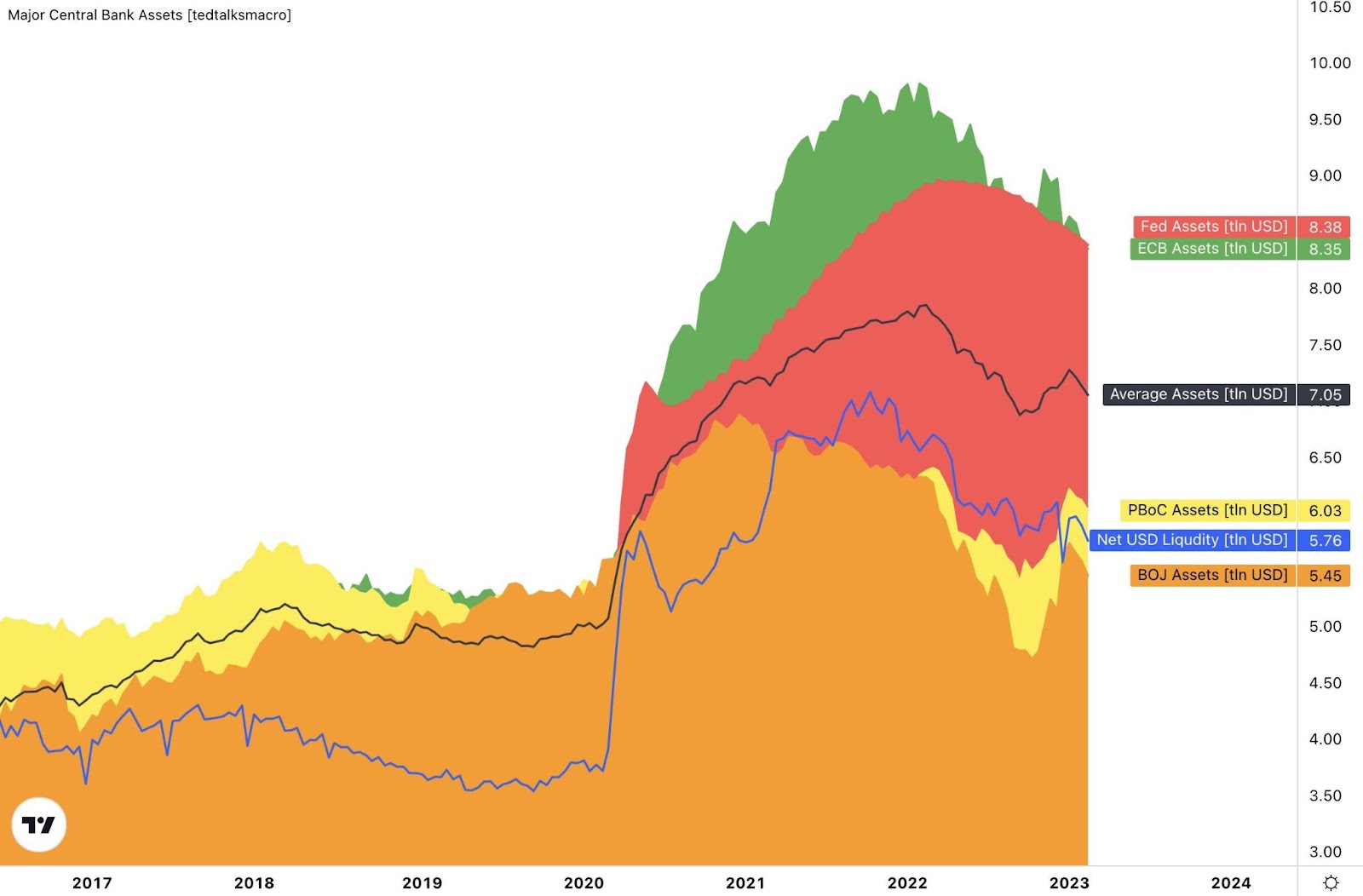

In addition, the possibility of a change in the trend in global economies is confirmed by the chart of assets held by the world’s largest central banks published in the thread below the tweet. On it, we see that while the US Fed and the European Central Bank (red and green) are still in a downtrend. While the central banks of China and Japan (yellow and brown) have been on the rise since the end of 2022.

This reinforces the “Chinese crypto pump” narrative and adds to the argument that the Asian market may catalyze the coming cryptocurrency bull market. Of course, China’s role in this process should not be absolutized. Because the real impact on the economy and financial markets of the ongoing “fiat printing” is still unknown.

beincrypto.com

beincrypto.com