The Ankr (ANKR) price has reached an important resistance area at $0.058. A breakout above it could lead to an upward movement of another 100%.

On Feb. 21, Microsoft announced that it would partner with Ankr in order to support enterprises and organizations that need access to blockchain data by making use of the node hosting service, in which Ankr utilizes verification nodes to ensure that the quality and safety of the network are maintained. This service will soon be available through Microsoft’s Azure marketplace.

Furthermore, Tencent Cloud signed a Memorandum of Understanding to develop a full suite of blockchain API services, enabling builders to power their Web3 projects. On the same day, the price of ANKR increased by 77%. However, it has cooled off a little and is now trading 48% above yesterday’s open.

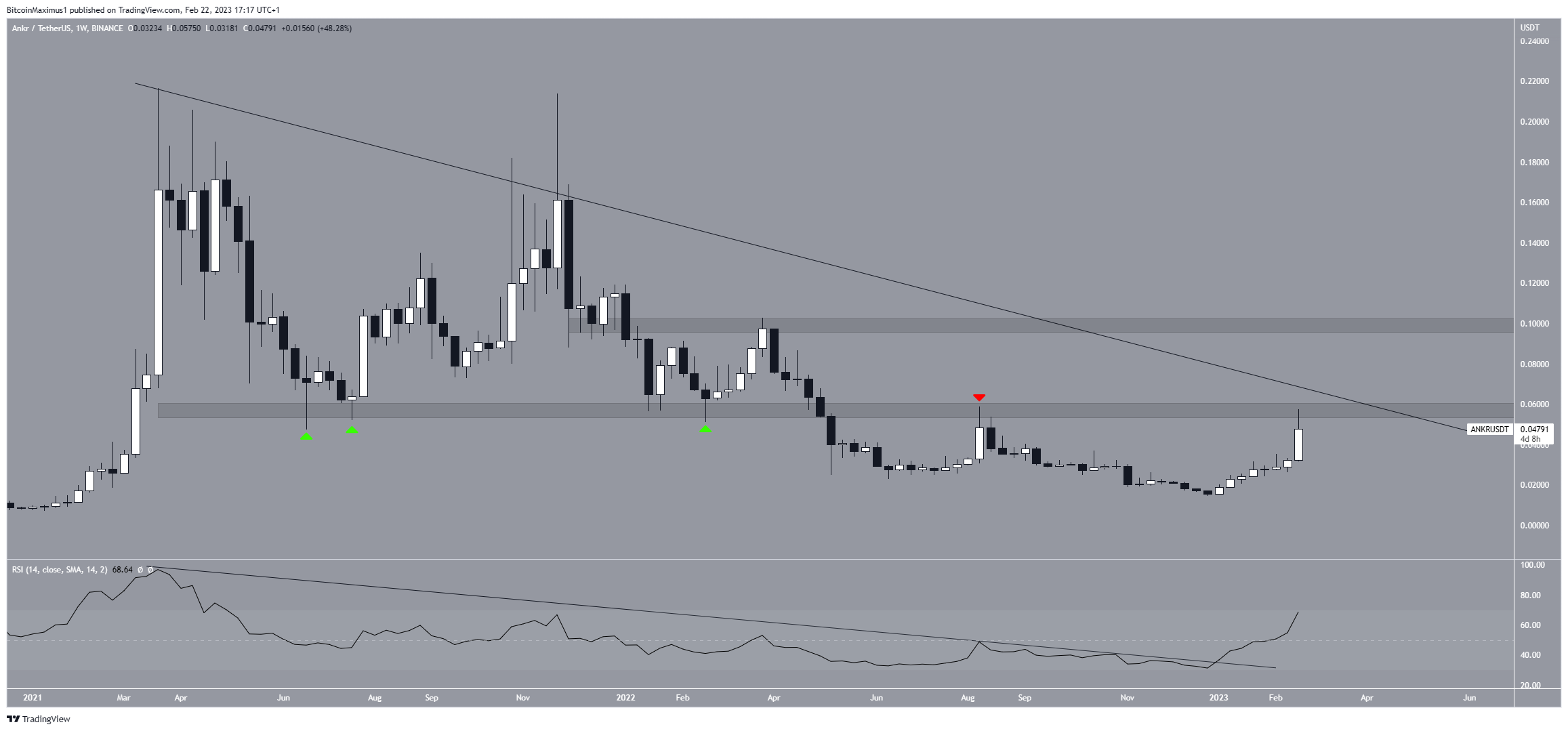

Ankr (ANKR) Reaches Crucial Resistance

The ANKR price has decreased below a long-term descending resistance line since reaching its all-time high price of $0.216 on March 22 2021. The downward movement led to a low of $0.014 on Dec. 26 2022. The price has increased since then. The rate of increase accelerated considerably this week, due to the result of the partnership mentioned above.

However, the token price has not exceeded the confluence of resistance levels at $0.058. This is required for the trend to be considered bullish.

The $0.058 horizontal resistance area and a descending resistance line create the resistance. If the ANKR price breaks out above it, it could increase to the next resistance at $0.100, a 70% increase above the breakout level.

Since the weekly RSI has broken out from its own trend line and moved above 50, a breakout is the most likely scenario.

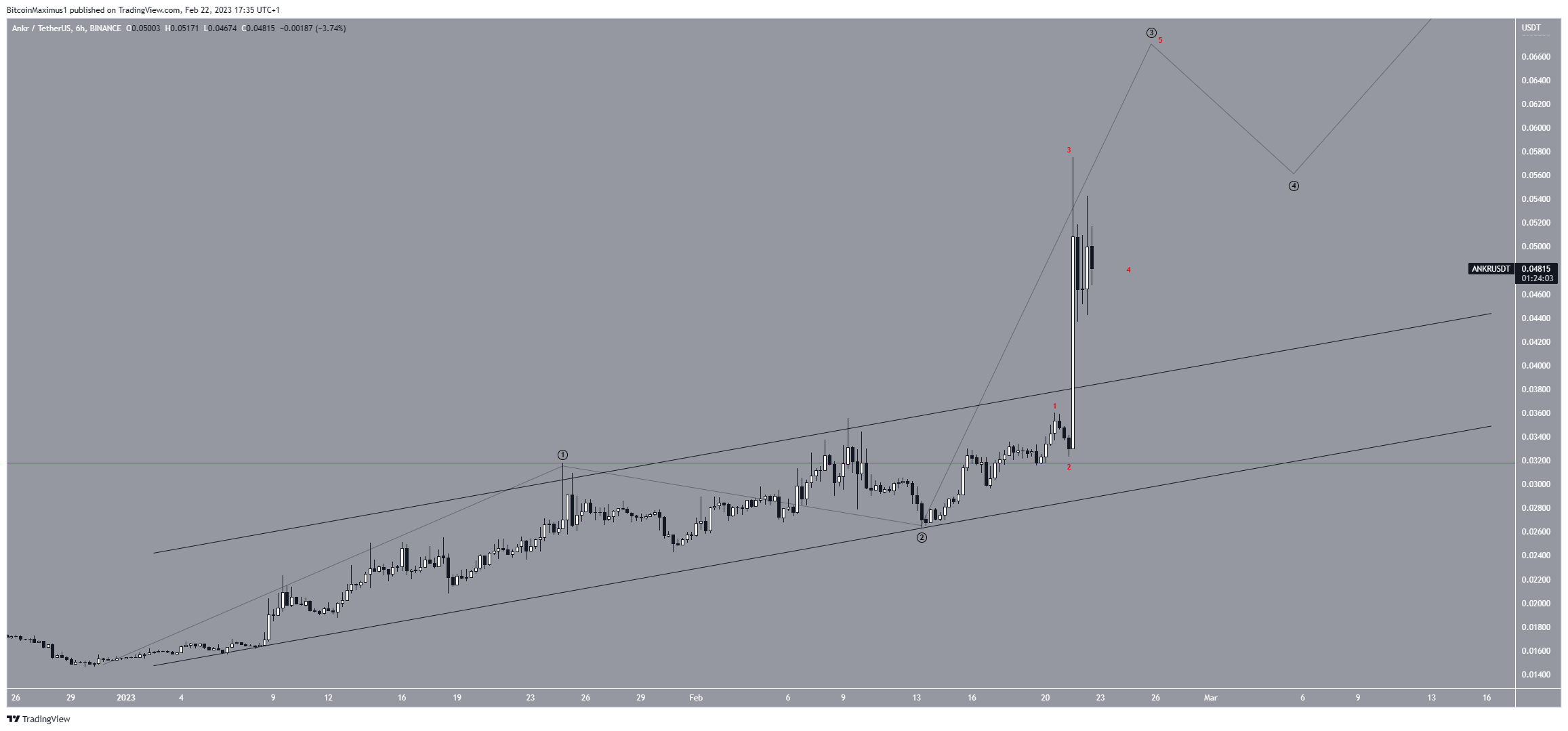

Short-Term ANKR Chart Shows No Weakness

The technical analysis from the short-term six-hour chart shows that the ANKR price broke out from an ascending parallel channel. Such breakouts usually signify that the movement is impulsive and new highs will follow. They are often part of a sharp wave three (black). The sub-wave count is given in red.

If the count is correct, the ANKR price will make another high before correcting. This would likely cause a breakout above the $0.058 area before its validation as support as part of wave four.

However, a decrease below the wave one high (red line) at $0.032 would invalidate this bullish forecast. In that case, the price could fall back to $0.022.

To conclude, the most likely price forecast is a breakout from the $0.058 long-term resistance area. This could catalyze an increase toward $0.100.

However, if the ANKR price gets rejected and falls below $0.032, this bullish hypothesis will be invalid. In that case, the price could fall to $0.022.

beincrypto.com

beincrypto.com