The past 24 hours brought some more pain for the bulls as BTC slipped to another three-week low at under $21,500.

Most altcoins are in no better shape, including the ETH liquid staking coins, many of which have seen double-digit price drops.

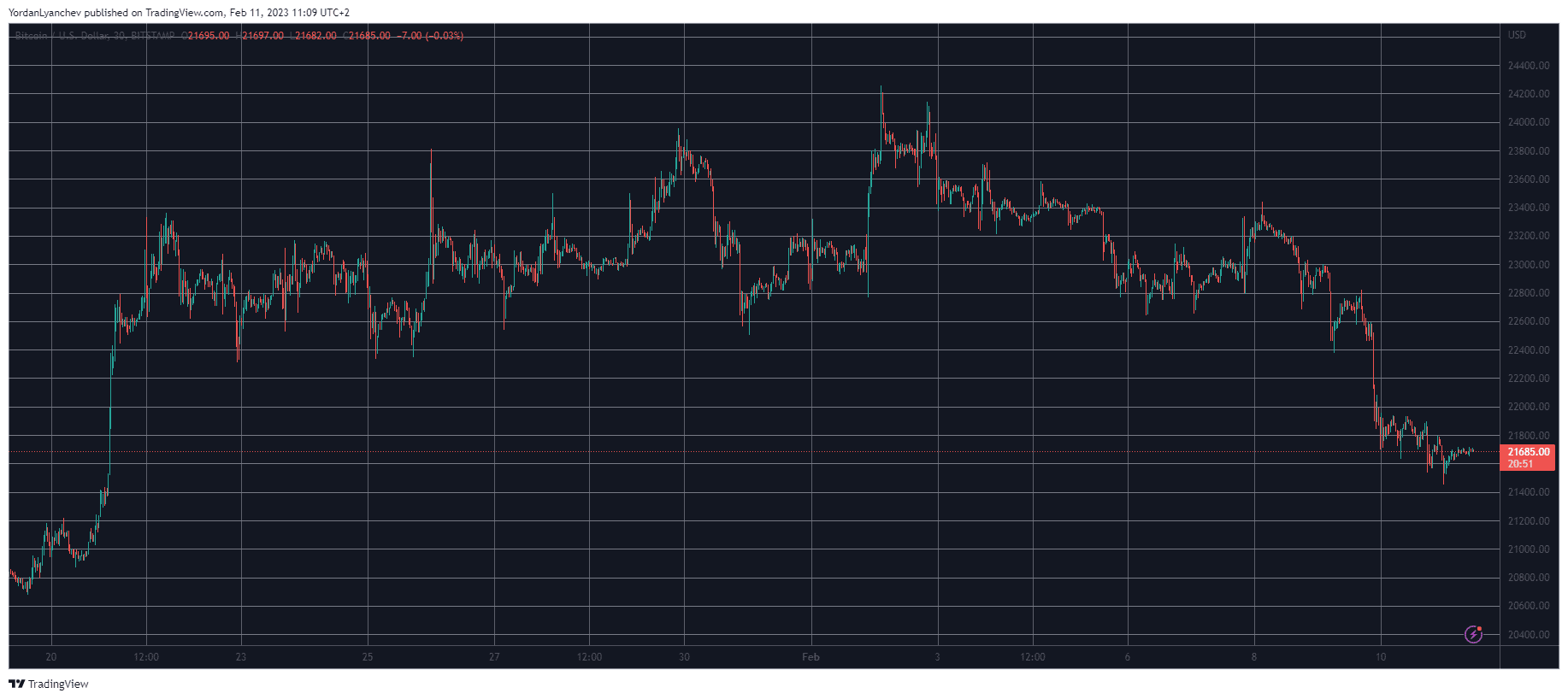

BTC Drops Again

The start of the month was highly positive for the primary cryptocurrency, which pumped to $24,200 after the latest interest rate hike by the US Federal Reserve on February 2. However, the landscape changed in the following days, and the asset retraced to around $23,000.

After sitting quietly there for a while, bitcoin started to lose value rapidly at the end of this week once the US SEC intensified its clampdown on crypto staking. While industry experts continue to weigh in on how these regulatory actions will affect the market, BTC slumped below $22,000 yesterday and fell to under $21,500 today.

The latter became its lowest price tag since January 20. As of now, the cryptocurrency trades a few hundred dollars above that line, but its market cap is under $420 billion. Its dominance over the alts stands still at 41.4%.

ETH Liquid Staking Alts Dump Hard

Some of the biggest gainers for the past few days were precisely ETH liquid staking altcoins, such as LDO, FXS, and RPL. However, they have retraced hard after the SEC’s actions, and all three are down by over 10% in the past 24 hours alone.

The larger-cap alts are calmer today, even though most are in the red as well. Ethereum is down by 2% and sits just inches above $1,500. Ripple, Cardano, Dogecoin, Polygon, Solana, and Polkadot are also with minor losses now.

Binance Coin, OKB, Shiba Inu, and Litecoin, on the other hand, have marked insignificant gains.

HBAR is among the few impressive gainers on a daily scale, surging by over 16% to $0.09.

The total crypto market cap has remained stuck at around $1.01 trillion after losing $70 billion in the past two days.

cryptopotato.com

cryptopotato.com