Bitcoin was quite volatile after the US Federal Reserve announced the latest interest rate hike, which ultimately resulted in tapping a new 5-month high. Since then, though, the asset has calmed at around $23,000.

Several altcoins have outperformed it in the past 24 hours, including Shiba Inu, which has soared by double digits.

Bitcoin Drops Back Down to $23K

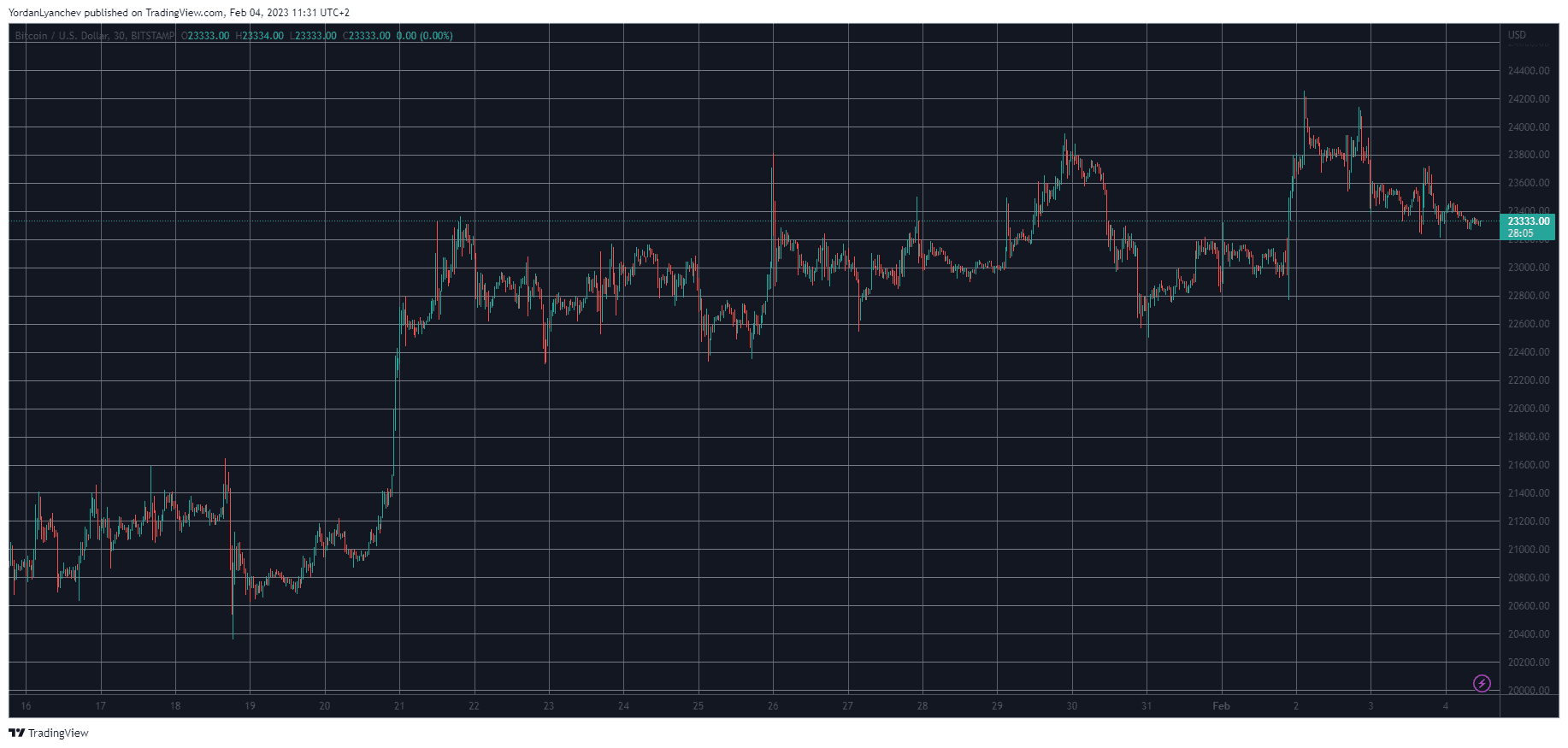

Despite losing some ground at the end of January, BTC still closed it well in the green, posting its best month since October 2021 with gains of roughly 40%. February started on a calmer note, with the cryptocurrency sitting below $23,000.

All eyes were on the Federal Reserve on February 1 when it concluded its first FOMC meeting of the year, increasing the key interest rates by 25 basis points. Bitcoin didn’t react at first, unlike previous hikes, and just dipped to $22,800 later.

However, the bulls stepped up in the following hours and pushed the asset north hard, gaining over $1,500 at one point and registering its highest price tag since mid-August.

However, BTC failed to continue upwards despite another attempt to decisively overcome $24,000 and fell back down to around $23,000, where it’s currently situated as well.

Its market cap is still around $450 billion, but its dominance over the alts is down by over 1% in the past week or so to 41.6%.

SHIB Takes the Main Stage

Most altcoins have posted more impressive gains in the past 24 hours, led by Shiba Inu. The second-largest memecoin has soared by almost 11% on a daily scale and has tapped $0.000014. Next in line is OKB, which is above $41 following a 5% surge.

Polygon’s native cryptocurrency is up by 3.5% and sits at just over $1.2. Ethereum, Binance Coin, Cardano, Dogecoin, Solana, Polkadot, Litecoin, and Avalanche are also slightly in the green now. Ripple is among the few exceptions from the larger caps, posting a 1% daily decline.

Nevertheless, the cumulative market cap of all crypto assets has added around $10 billion daily and is up to $1.080 trillion.

cryptopotato.com

cryptopotato.com