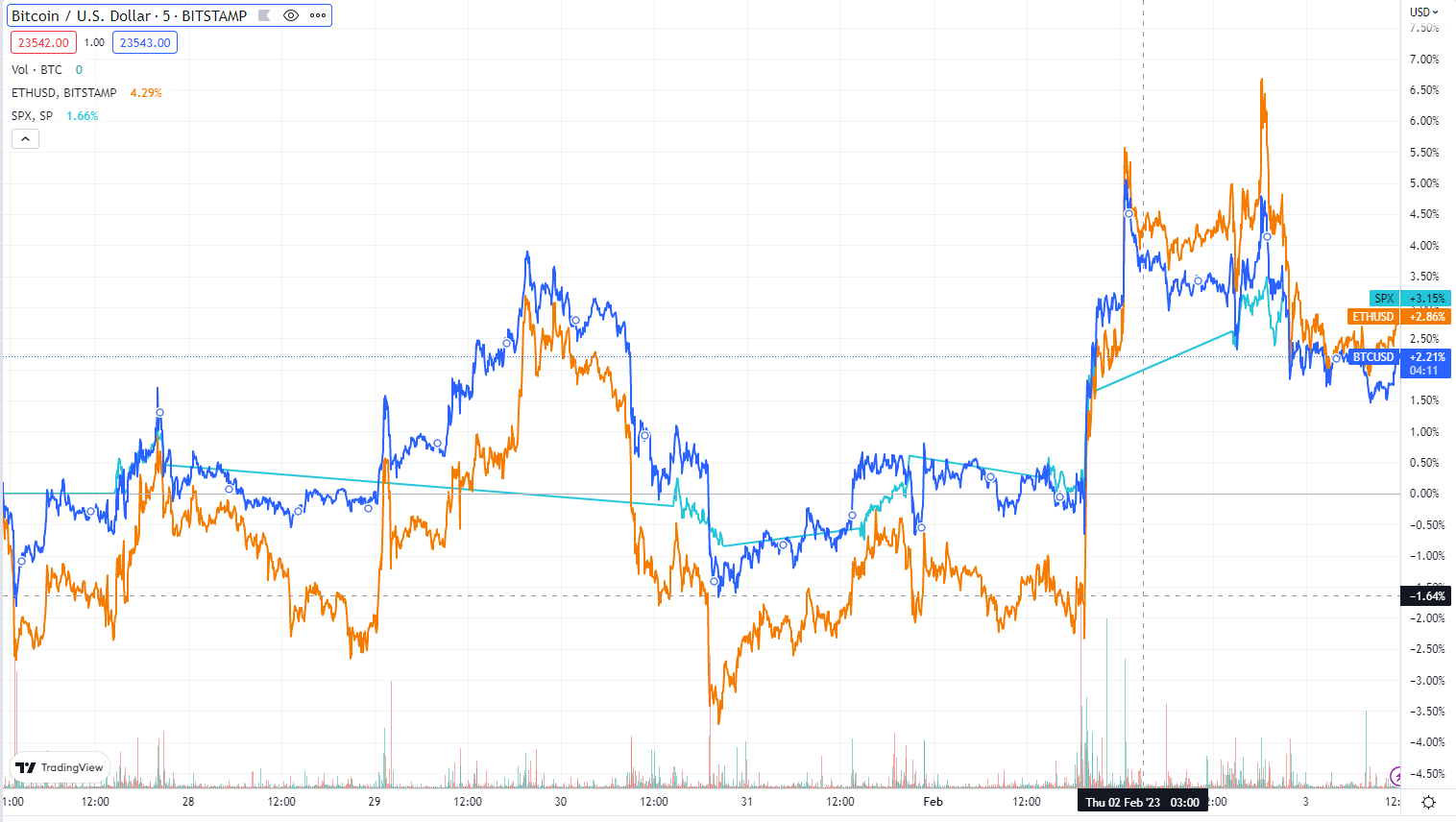

Bitcoin, the world’s largest cryptocurrency by market capitalization, rose 2.50% in the week from Jan. 27 to Feb. 3, trading at US$23,528 at 8 p.m. on Friday in Hong Kong. Ether gained 4.47% in the same timeframe, to change hands at US$1,648.

Bitcoin surged 39.93% in January, rallying from US$16,496 at the start of the month to US$23,954 by Jan. 31, making it the best month since Oct. 2021, when the cryptocurrency also rallied more than 39%.

Dinesh Goel, founder of play-to-earn ecosystem One World Nation, said US$23,000 was a “wait-and-watch level” for Bitcoin holders. “Investors were optimistic that the Federal Reserve would give positive news but were also cautious of the impending recession fears. Overall, it has been a balanced outcome from the [Fed],” wrote Goel in an email. Bitcoin will advance upwards, slowly and steadily, he added.

The U.S. Federal Reserve has signaled that it plans to raise interest rates further, but economist George Brown said the latest 25 basis point rate hike may have been the Fed’s last.

“Economic activity is beginning to soften as rate rises have gained traction. And forward-looking measures such as the Conference Board’s leading indicator are flashing red.” wrote Brown in a report shared with Forkast. “The labor market is showing tentative signs of turning… [and] inflation has convincingly moderated and should continue to do so.”

Polygon’s Matic was the week’s biggest gainer among the 10 largest non-stablecoin cryptocurrencies, up 10.43% on the weekly chart, trading at US$1.19.

The global crypto market cap stood at US$1.08 trillion on Friday at 8 p.m. in Hong Kong, up 2.85% from US$1.05 trillion a week ago, according to CoinMarketCap data. Bitcoin’s US$461 billion represented 41.9% of the market, while Ether took up 18.7%.

Biggest gainers

The Render Network’s token (RNDR) was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap.

The token jumped 103.09% to trade at US$1.70 after Render Network said it received governance approval for a burn and mint mechanism for its native token.

The Render Network allows idle GPUs (graphics processing units) to be used for the digital rendering needed in fields like 3D modeling, gaming imagery, and virtual reality.

Decentralized derivatives exchange dYdX’s native token (DYDX) rose 49.22% to US$3.19, making it the week’s second-best gainer, after the exchange announced a lock-up extension for over 150 million tokens, meaning these tokens will only be released to early investors in December this year instead of February.

See related article: Bitcoin mining fund soars as BTC powers into 2023

What’s ahead?

“The general outlook and guidance are positive, which will ensure Bitcoin stays above $23,000 for a while,” wrote Goel, adding that he expects more bullish momentum and that “Bitcoin will start testing the $25k level towards the end of this week.“

“The crypto market may see better days in the coming week since the market sentiment has been risk on. The FED’s 25 basis point rate hike on Feb. 1 sent the dollar sliding. Based on the idea of the recent rate hike, cryptocurrencies may have a strong run-up going next week,” wrote Adam Robertson, crypto market analyst and reporter at crypto.news.

Asset management giant ARK Invest published the seventh edition of their report, Big Ideas 2023, on Feb. 1. The report estimates that the price of one Bitcoin could exceed US$1 million by 2030.

Ark outlines three scenarios for Bitcoin in 2030: a bear case, which puts it at US$258,500 with a 40% compound annual growth rate (CAGR); a base case, which estimates US$682,800 with a CAGR of 60%; and a bull case, which predicts that Bitcoin will grow with a 75% CAGR to reach US$1.48 million by 2030.

One World Nation’s Goel said this prediction may be exaggerated: “What they mean to say is — We believe in crypto, we believe in Bitcoin and it is the future,” he wrote.

“A US$1 million price will peg the Bitcoin market cap at US$21 trillion, ~17% of the world’s 2030 projected GDP of US$126 trillion. This would need Bitcoin to be used by almost everyone in the world. And the current challenges are technology and regulation, which will take a while to get solved,“ said Goel.

Bitcoin analyst Willy Woo wrote that the recent gains can be linked to institutional buyers.

“This recent rally coincides with a new pattern emerging of stablecoins flowing into exchanges during work days only. Seems to me like the heat signature of large institutions doing the buying,” Woo said.

“Since this rally began, spot flows are dominant and leading over derivatives,” wrote Woo, adding that spot buying is moving the price, which “implies that long-term institutional investors are coming in via spot buying and moving to custody.”

Pseudonymous crypto analyst Rekt Capital tweeted: “BTC would need to break beyond ~US$26500 to break the macro downtrend this February.” “The price point that would represent the macro downtrend next month is ~$24600.”

See related article: New Bitcoin protocol may shake up the NFT market

forkast.news

forkast.news