Prices in the crypto market have reset somewhat after the hot start to the year. This is especially true for altcoins. CoinMarketCap shows that the market dominance of altcoins has decreased 0.19% over the last 24 hours. Currently, the market dominance of Bitcoin (BTC) stands at 41.40%.

The blockchain analytics firm, Santiment, tweeted yesterday that investors may find it beneficial to reallocate their portfolios to open positions in altcoins that have a low MVRV. Altcoins with a low MVRV indicate that traders and investors that had previously opened positions in these specific altcoins, and continue to keep these positions open, are “under water”.

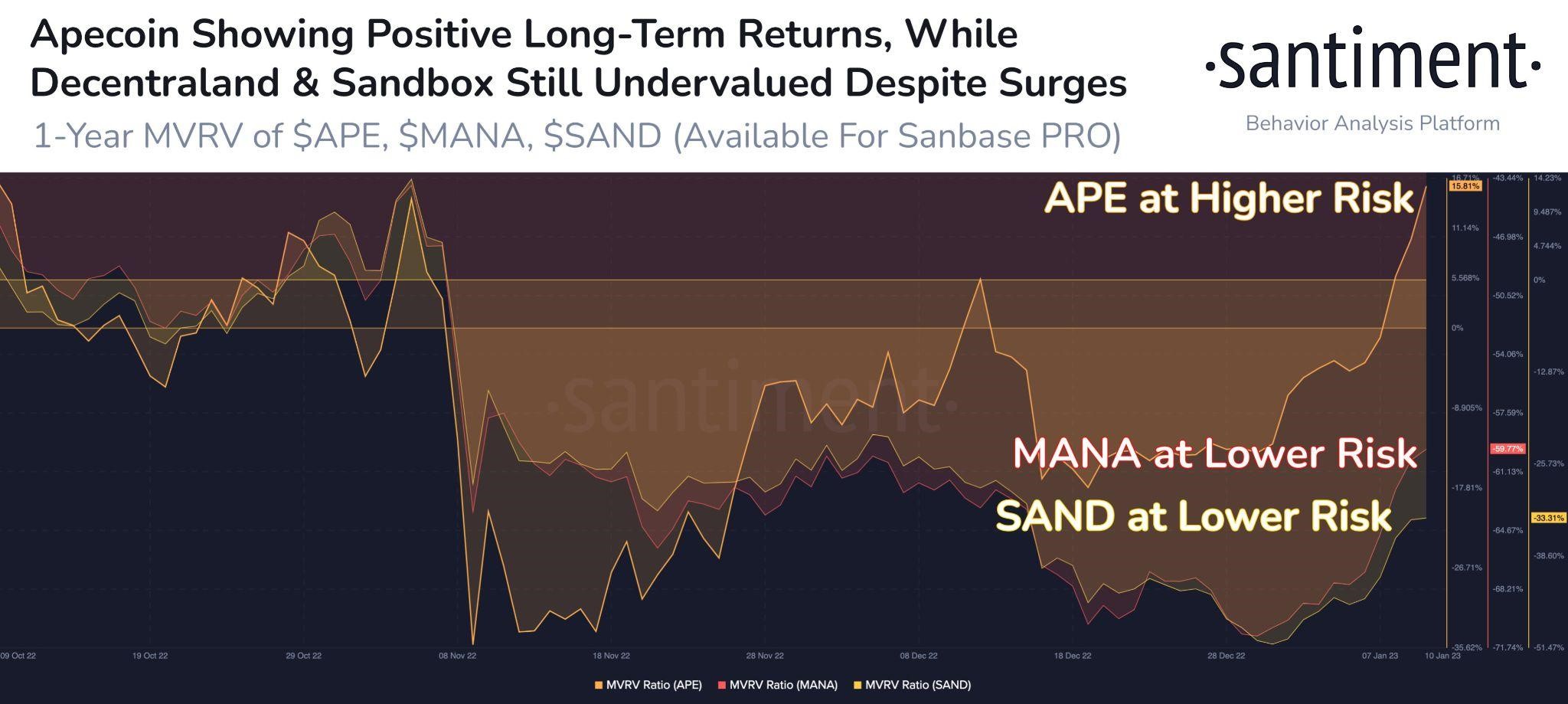

In the tweet, Santiment shared that Apecoin (APE), Decentraland (MANA) and The SandBox (SAND) may be good altcoins to keep an eye on. According to the analytics firm, APE’s 1-year MVRV is at +16%. Meanwhile, the 1-year MVRV for MANA and SAND is -60% and -33% respectively.

The tweet also included a graphic of the potential long-term risk and rewards of MANA, APE, and SAND. The graphic shows that SAND is the least risky long-term investment of the three cryptos highlighted in the tweet.

MANA is the altcoin with the next lowest long-term investment risk given that its MVRV is below 0, similar to SAND. Meanwhile, APE is the riskiest long-term investment of the three given its low, but still positive, MVRV of +16%.

At press time, the prices of all three altcoins are down. SAND’s price is down 1.64% and is trading at $0.7128. APE and MANA are trading at $4.61 and $0.664 after 5.13% and 3.50% respective drops.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com