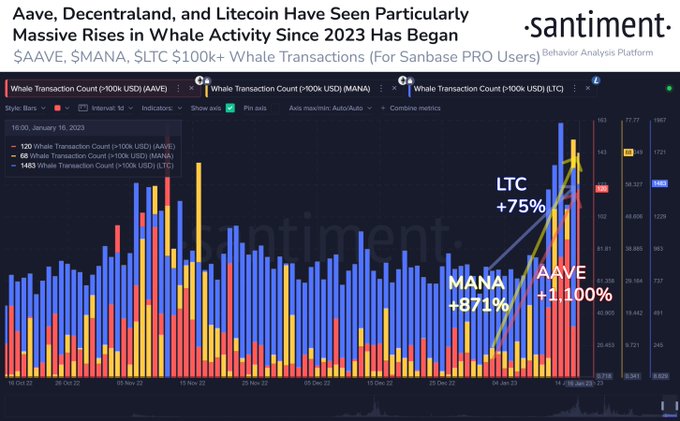

Crypto analytics firm Santiment reports that whale activity on three altcoins has surged since the start of 2023.

Starting with the liquidity protocol Aave (AAVE), Santiment says that the 42nd-largest crypto asset by market cap has seen the number of transactions valued at over $100,000 increase by more than 1,100% year-to-date.

Next up is Litecoin (LTC). According to the crypto analytics firm, the 16th-largest digital asset by market cap has recorded an over 75% increase in $100,000+ transactions since the start of the year.

On the other hand, Santiment says that the decentralized virtual world Decentraland (MANA) has seen an over 871% increase in the level of transactions worth above $100,000 in under three weeks.

“As market-wide pumps have flattened out, for now, several altcoins continue individual runs. AAVE (+1,100%), MANA (+871%), and LTC (+75%) are up big on $100,000+ transactions since New Year’s.”

Aave is trading at $84.63 at time of writing, up by 60% since the start of the year, while Litecoin is changing hands at $86.45, up by 24% since the year began. Decentraland’s market price is quoted at $0.69 at time of writing, up by 130% year-to-date.

Turning to Chainlink (LINK), a source of off-chain real-world information for smart contracts, Santiment says that the number of whales holding the 24th-largest crypto asset has risen by over 26% in the past eight months.

“Chainlink is floating a bit ahead of the altcoin pack today. There are 463 addresses that hold at least 100,000 LINK, and they have ascended +26% since May, 2022. It is encouraging when an asset sees whale accumulation during corrections.”

Chainlink is trading for $6.79 at time of writing, up by 22% year-to-date.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com