Good morning. Here’s what’s happening:

Prices: Bitcoin, ether and other, major cryptos continue to surge in weekend trading.

Insights: Ark Invest's Cathie Wood is correct in thinking that, despite market uncertainty, disruptive innovation technologies that address issues have gained traction.

Prices

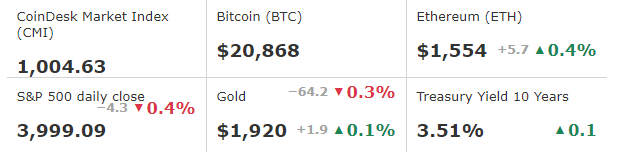

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Bitcoin surges, then holds near $21k

by James Rubin

Still riding the tailwinds of falling inflation and a more upbeat view of the economy, bitcoin cracked $21,000 in early weekend trading for the first time since early November before retreating slightly.

The largest cryptocurrency by market capitalization was recently trading at about $20,830, roughly flat over the previous 24 hours but up a whopping 25% this year, most of the gains occurring since last Tuesday when BTC was still hovering near $17,400. The surge comes amid renewed investor confidence that the U.S. central bank is taming inflation without casting the economy into recession, a trend that has sent most riskier assets higher this year.

"We see the current rally in digital assets as a market reversal and NOT a bear market rally," wrote Mark Connors, head of research at Canadian digital asset manager 3iQ, in an email.

In a weekly markets analysis on Friday, Connors wrote that an early January rally in altcoins, including SOL – which is up about 80% year-to-date – had "rolled into core Layer 1s." Noting recent, less hawkish comments by Fed governors, Connors added that "the potential for a reduction in hikes and balance sheet reduction...was a wink that the sharp reduction" in money supply may be ending."

"Significant, as the reduction over the past 12 months was the largest since 1959," he wrote. "This is relevant to digital assets as BTC is deemed to be a hedge against debasement, NOT inflation."

Ether followed a similar pattern to bitcoin, continuing its late-week momentum into Saturday to hit a two-month high before falling slightly. ETH was recently changing hands above $1,550, approximately where it stood same time, a day earlier. Other major cryptos were mixed with some rising a couple of percentage points and others dropping, although FTT, the token of embattled crypto exchange FTX, recently jumped 35% to trade just over $2. Seven months ago, FTT was trading over $35. SOL, the token of the Solana blockchain, which has been rallying over the past few weeks despite its intertwining with the FTX debacle, fell back about 5%.

MANA, the token of 3D virtual reality platform Decentraland, was up more than 16%.

U.S. equity markets will be closed Monday in observance of Martin Luther King Jr. Day, which honors the late civil rights activist. Major indexes rose slightly on Friday to continue their own 2023 rally. The tech-heavy Nasdaq and S&P 500, which has a hefty technology component, are up more than 5% and 4%, respectively.

Still, the upswing in assets may be short-lived if economic news falters, as a number of observers are predicting.

In a Wall Street Journal quarterly survey, nearly two in three economists expect the U.S. to fall into recession this year, approximately the same percentage as in the previous survey, although many believe the economic contraction will be mild.

And in an email to CoinDesk, Joe DiPasquale, CEO of crypto fund manager BitBull Capital, wrote warily that "market participants should practice caution during such spikes and await more stability and cons."

"We continue to remain positive about accumulation at $18,000 and below, and our long-term outlook remains the same for 2023 – accumulating during range lows."

Biggest gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Decentraland | MANA | +15.9% | Entertainment |

| Terra | LUNA | +8.2% | Smart Contract Platform |

| Loopring | LRC | +5.9% | Smart Contract Platform |

Biggest losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | −5.0% | Smart Contract Platform |

| XRP | XRP | −2.2% | Currency |

| Chainlink | LINK | −2.2% | Computing |

Insights

By Sam Reynolds

Cathie Wood is Right: There’s a lot going on in Blockchain and tech that got overlooked because of a ‘wall of worry’

ARK’s Cathie Wood probably had a lot to worry about in 2022.

The growth investor, and self-confessed bitcoin HODLer, saw her major funds like the ARK Innovation ETF (ARKK) and the ARK Next Generation Innovation ETF (ARKW) decline by over 50%. Crypto was chaotic, as well-documented by CoinDesk, and tech didn’t fare much better, with layoffs alongside a cooling venture capital market.

But Wood, in a blog post from Jan. 12, that all this worrying made us miss out on a lot too.

“In my 45 years on Wall Street and more than 30 years in portfolio management, I have never seen markets this dislocated,” she wrote. “Plagued by fears of entrenched inflation and higher interest rates, the wall of worry in the equity markets has scaled to enormous heights.”

But despite the uncertainty of the market, she believes that disruptive innovation technologies that address issues have gained traction during turbulent times.

The market was too focused on carnage to notice all the advancements that happened in 2022, Wood wrote, pointing at disruptive tech like ChatGPT, a next-generation artificial intelligence platform, new developments in autonomous vehicles, the continued rise of digital wallets, and, of course, blockchain.

“Despite the recent collapse of crypto exchange FTX, underlying public blockchains like Bitcoin and Ethereum have not skipped a beat in processing transactions,” Wood wrote.

Not skipped a beat indeed: In the last month bitcoin has risen 25.6%, with the world’s largest digital asset experiencing one-day price jumps that haven’t been seen in months. It’s been a rather positive start to the year, with exchange volume trending upwards.

So too, has it for Wood’s funds. ARKK is up 18.2% since the year began, and ARKW is in the green at 8.2% on-month.

Tech is ubiquitous and it scales quickly. That’s why software is eating the world.

The market has shown that demand is still there for blockchain and crypto. If anything, the turbulence of 2022 was an exercise in shaking out bad actors and reinforcing the positions of good ones. Let’s just make sure that we don’t miss out on what the good ones are doing with this “wall of worry” in front of us.

fxstreet.com

fxstreet.com