The ApeCoin (APE) price is trading inside an ascending parallel channel. It is possible that the entire increase is corrective and new lows will follow.

Positive ApeCoin news hit on Dec. 12, when staking finally went live. Every Bored Ape Yacht Club (BAYC) holder will be allowed to stake 10,094 for each BAYC they own. This has caused concerns that the APE supply could increase considerably as more and more people jump into staking.

APE has a total supply of one billion, of which roughly 37% is circulating. The project uses a linear vesting schedule, in which tokens are released on the 16th of each month. This puts the 2023 inflation rate at a massive 52.75%. So, even with positive ApeCoin news, the token faces an uphill battle to maintain its current price or increase.

ApeCoin Breaks out After Deviation

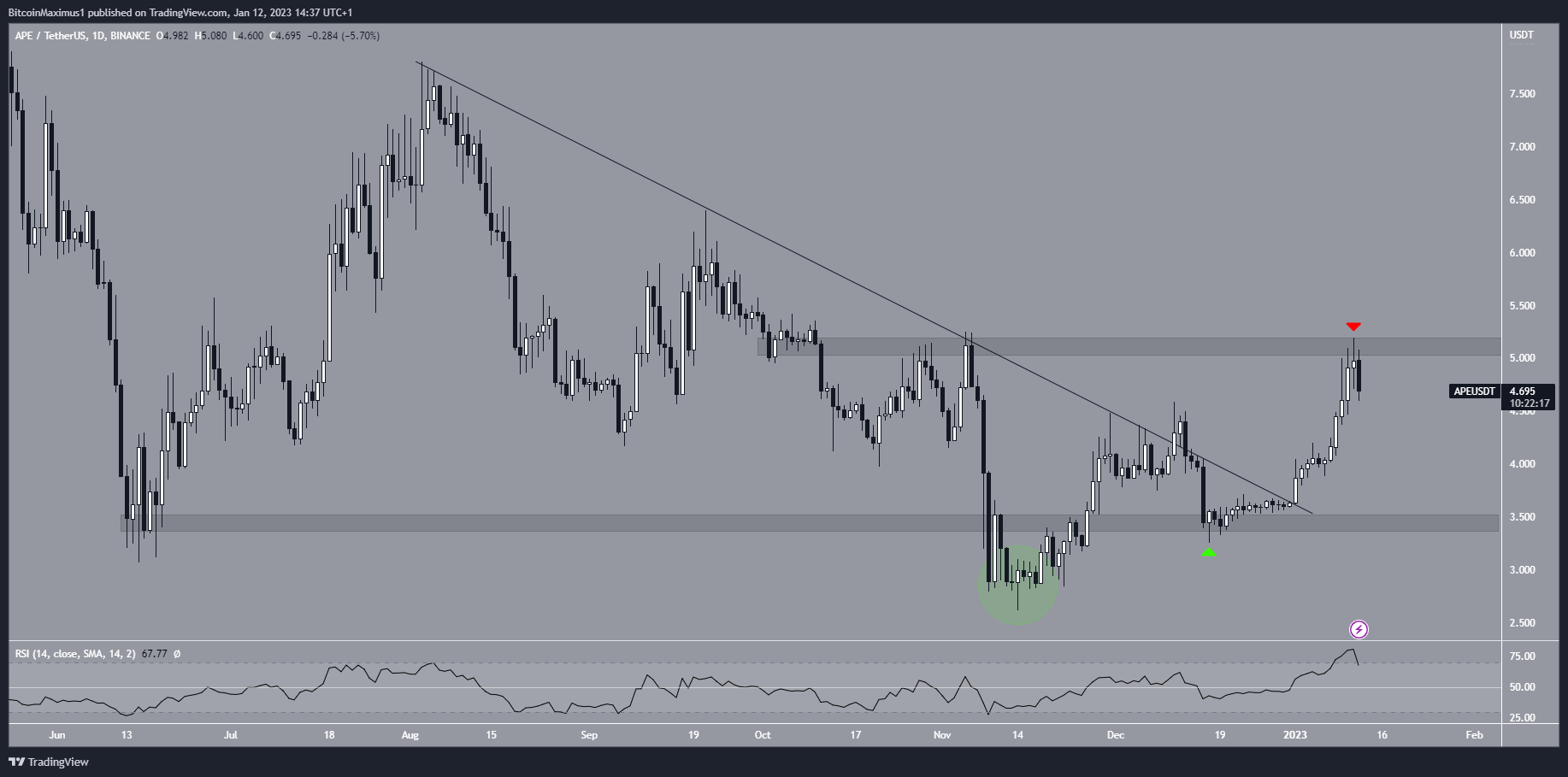

The APE price had decreased under a descending resistance line since Aug. 3. The downward movement led to a minimum price of $2.62 on Nov. 14. This seemingly caused a breakdown from the $3.45 support area, which had been in place since June. However, the APE price reversed trend almost immediately afterward and reclaimed the area, validating it as support on Dec. 17 (green icon).

Next, the ApeCoin price broke out from the long-term descending resistance line and reached a maximum price of $5.20 before decreasing. In turn, this validated the $5.10 area as resistance.

So, the APE price is now trading in a range between $3.45 and $5.10.

The daily RSI is overbought but has not generated any bullish divergence yet. As a result, the direction of the future trend cannot be determined by looking at the daily time frame alone.

Don’t get Fooled by the Relief Rally

While the technical analysis from the daily time frame gives a fairly neutral reading, the six-hour time frame gives a bearish ApeCoin price prediction for Jan. There are two main reasons for this:

- The price has seemingly completed an A-B-C corrective structure, in which waves A:C had a 1:1 ratio. This is the most common ration in such corrective structure.

- The price is trading inside a short-term ascending parallel channel, which is considered a bearish structure.

Therefore, the trend is considered bearish unless the ApeCoin price breaks out from the channel. If a breakdown occurs, the APE future price could fall below $3.

To conclude, the most likely ApeCoin price prediction for Jan. suggests that the price will drop toward the channel’s support line and possibly break down. A breakout above the channel’s resistance line would invalidate this bearish APE price analysis

beincrypto.com

beincrypto.com