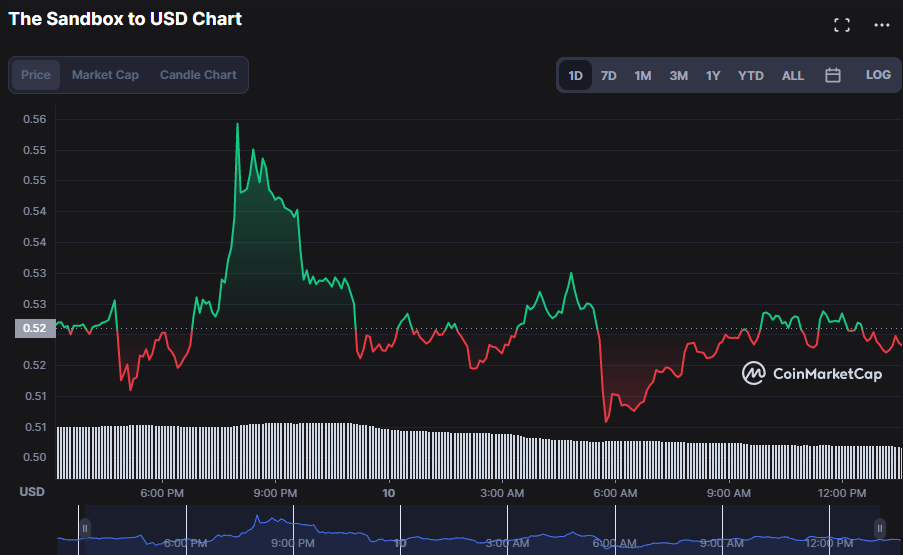

The Sandbox (SAND) market has had a lot of volatility over the last day, with prices fluctuating between $0.5047 and $0.556. However, at the time of writing, the bears had taken control, and the price of SAND had fallen by 0.75%, to $0.5161.

The decrease in market capitalization and 24-hour trading volume by 0.55% to $777,150,329 and 41.42% to $251,320,645 correspondingly further supports the SAND market’s downward trend.

If bearish pressure continues, a break below $0.5047 might bring prices to the next support and resistance levels of $0.4896 and $0.5303, respectively. However, if bulls flood in and push prices over $0.5047, the market may make a powerful move up to stronger resistance levels around $0.5645 and beyond.

With a value of 37.30 and a southward trend, the stochastic RSI suggests the SAND market is bearish, and that the price of SAND is expected to decline in the near future.

With a current value of -2.68, the Rate of Change (ROC) indicator has entered negative territory. This pattern indicates that bear force has surpassed bull inclination, lending credence to expectations of further decline.

Even though the Bull Bear Power (BBP) is now at 0.0116, it is moving south towards the “0” line, suggesting that bear dominance will continue in the SAND market until bulls make a strong comeback.

The green engulfing candlestick pattern, in which the green candle body is bigger than the preceding red candle body, indicates that buyers are prevailing and driving prices upward, signaling that the SAND market is in correction.

Finally, in order for SAND to achieve new highs, bulls must push prices higher to bolster support and entice additional investors.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com