2022 has been an awful year of cryptocurrencies. Coming from the highs of 2021, where most cryptocurrencies were flourishing, especially in the month of November, where most of them reached record highs, it has been downhill ever since. Throughout the whole year, every crypto has been losing prices, with a few months there and here where we saw a few positive gains. The last month of the year was not one of these positive months, as just 4 cryptocurrencies among the top 30 have seen an increase in prices. In this overview by investfox, we will be taking a look top 5 gainers and losers of the month, and exactly what were the reasons for these price movements. So without further ado, this is a crypto overview of December 2022.

Top 5 gainers

As we mentioned above, there have been only 4 tokens inside the top 30 that have managed to show positive gains this month. This shows us how bad of a month December has been for cryptocurrencies, especially when considering that among these 4 tokens, two of them have seen an increase of just around 3%, meaning that only 2 cryptocurrencies have managed to show respectable gains. This should not be that surprising, as the whole FTX saga still continues, which further damages the cryptocurrencies name. When looking at the ongoing geopolitical state of the world, we can further see the problem. As the war between Russia and Ukraine continues, the tension between China and Taiwan reaches new peaks, and the EU going through an economic crisis, a lot of people are taking out their money from crypto in need of having regular fiat currencies.

Now let’s take a look at the cryptocurrencies that have somehow managed to survive this month, and showed us positive gains in the month of December.

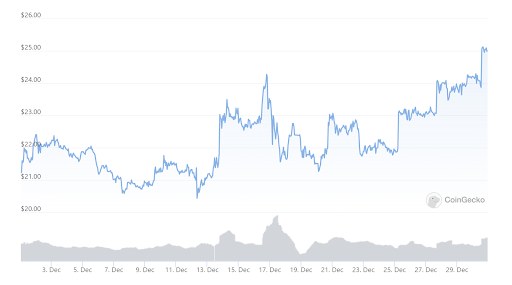

$OKB +37.1%

It might be surprising to many that the cryptocurrency that has managed to gain the most this month is the crypto exchange native token. After the whole FTX scandal, the view on cryptocurrencies, which are created and regulated by exchanges, has shifted to the negative side. But despite this, OKX still managed to have a good month and it is reflected in the price of their native token $OKB, which started the month trading at around $21, and now hovers around $29.

The reason for this growth can be attributed to multiple factors. The first factor is the collapse of FTX. As FTX shut down its operations, many people started to look for alternative exchanges to move on, and fortunately for OKX, Binance had a small scandal themselves, meaning that they managed to snatch up a good number of FTX customers. But just this would not be enough to justify this growth. The main catalyst for this growth is the recent partnership between OKX and NEST Protocol. What this partnership means is that OKX wallet users will now be able to use NEST Protocol services, such as their Futures, Swaps, Options, and NFT functions straight from their wallet. When this was announced, that was the time when the price of OKX jumped, but even without it, OKX has been on a sturdy rise for the past few months, with the exception being November, as FTX collapse had a major impact on every crypto.

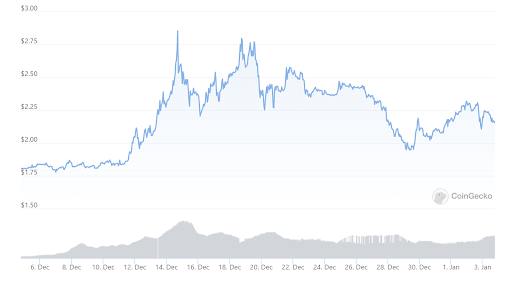

Toncoin +20.5%

Just like $OKB, Toncoin is another cryptocurrency that has been on a rise in the past few months. Coming into December, Toncoin had 9% growth in November, and it outperformed itself by showing 20.5% growth in December. For those that don’t know Toncoin is a cryptocurrency of The Open Network, a layer-1 blockchain created and operated by Telegram, one of the fastest-growing messaging platforms.

The reason for this growth has to do with Telegram itself and the plans for this network. Telegram is growing really fast, and as Toncoin is the crypto launched by them, the fact that there is a huge interest in this coin should not be surprising. A lot of new DAO projects have been launched on The Open Network, which increased the activity on this blockchain. There is also interest from different exchanges, with many of them adding this token to their exchange, and giving users good staking APY rates. All this contributes to the growth of this token, and today Toncoin is one of the fastest-growing altcoins on the market.

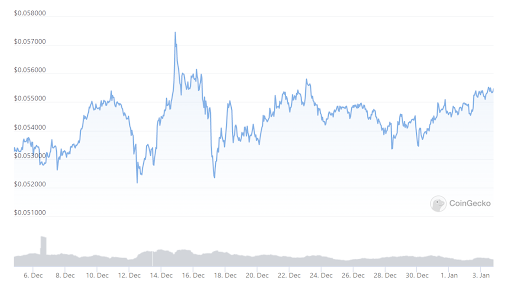

Tron +3%

Calling a 3% monthly increase for crypto a good month might not be the right thing to do. But considering the fact that almost every major token has seen a loss in value in the past 30 days, we should not take away even this small growth. Tron is a blockchain system that aims to help internet decentralization with its blockchain system and different dApps. Their ambition for this was just recently seen, when Tron became the national blockchain of the Commonwealth of Dominica, making it one of the first major blockchains to strike a such deal.

But the thing that kept Tron from following the market is losing the value has to be associated with its latest partnership with Ethereum. In late December, Tron announced that it has joined with Enterprise Ethereum Alliance, an alliance consisting of different blockchains that aim to introduce Ethereum and blockchain technology to modern businesses. But despite this, Tron remains somewhat volatile cryptocurrency, and we would suggest approaching it with a good plan.

Monero +2.3%

Monero is the last token inside the top 30 cryptocurrencies that have managed to show a price increase in the month of December. Being a security-oriented cryptocurrency, Monero implements fully decentralized transactions, giving people anonymity and fungibility when making transactions using this token. This anonymity is what makes Monero stand out from the rest of cryptocurrencies, and the reason it somewhat maintains its value.

There has been nothing major that has happened with Monero in the month of December. The main reason as to why it has not lost value is because other security-oriented tokens are struggling. Monero is the only largest security crypto that offers a high level of anonymity, with the use of invisible addresses and a ring signature system. And considering that cryptocurrencies are struggling right now, most people who are in the need of security tokens, go to Monero, instead of other security tokens, as Monero has managed to grow its reputation for the past 8 years. Stating that Monero will drastically grow this year will be a fullish statement to make, but out of all security tokens, this is probably the one with the most bright future up ahead.

Top 5 losers

Now it's time to move to the biggest losers of December. Unlike top gainers, where only 4 cryptocurrencies were competing with each other, excluding these 4 and stablecoins, every single cryptocurrency inside the top 30 has lost value in the past month. Most of the tokens that managed to lose value in December lost around 11%, but there were a few that lost way more than that. The reasons for this drastic downfall are many, starting with the FTX collapse to the general bad year for cryptocurrencies. FTX collapse is still affecting the market, after almost 2 months, as Sam Bankman-Fried just got expedited to the US, the topic is not dying out and negatively affects the whole crypto system each day. Now, let’s take a look at the tokens that suffered the most during the last month of 2022.

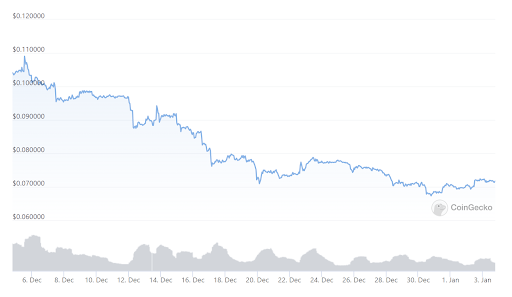

Dogecoin -28.6%

The biggest loser of December is the notorious Dogecoin. Ever since June of 2022, Dogecoin has been on the rise, with a few price drops here and there, but it did not manage to close out the year on a strong note and managed to lose just under 29% of its value in December. It should have been seen from a mile away, that this drop was coming. When looking at the state of the crypto market for the past 6 months, Dogecoin was going in the opposite direction and it was inevitable that price would have dropped.

The initial increase in Dogecoins price has to be attributed the Elon Musk and its purchase of Twitter. Elon Musk is a known advocate of this cryptocurrency and he had publicly acknowledged his love for this token multiple times. Because of this, every time Musk does something big, it also affects the price of this token. With the initial purchase of Twitter, rumors started to float around that Dogecoin might find some use on Twitter, which caused the price to go up, but as we can see the interest has died down, and a good number of people who invested at the start of this rise in June, cashed out their profits, causing the coin to drop significantly in value. This is the fate of meme tokens, but despite this, Dogecoin still remains in the top 8 cryptocurrencies by market capitalization, and if we remove stablecoins from the conversation, it jumps all the way to the 5th spot.

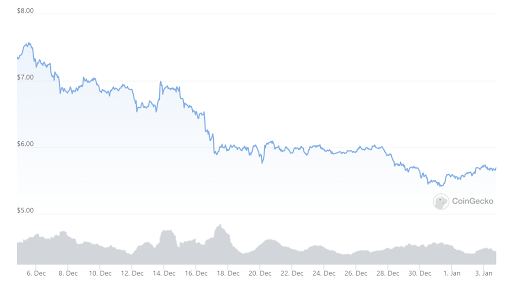

Chainlink -22.3%

The second largest loser of December is Chainlink and its native token LINK. that has managed to lose 22.3% of its value in December. Chainlink is a blockchain network, built on the Ethereum blockchain, with the goal of helping people transfer different data from off-chain to on-chain smart contracts.

The reason for this downfall is the combination of multiple factors. First of all, the obvious reason is the collapse of FTX, as it managed to drag almost the whole crypto market with itself. But coming into December, things did not looked so bad for Chainlink, as it has managed to somewhat rebound from the major fall it took from this FTX collapse. Coming into December, people were expecting that Chainlink's price would grow even further, as blockchain was introducing a new major update at the start of the month. But unfortunately, this update did not go as planned, and people were left dissatisfied with the way blockchain was heading. This caused a downfall to start, and it managed to fall even further down compared to the drop it took when FTX collapsed.

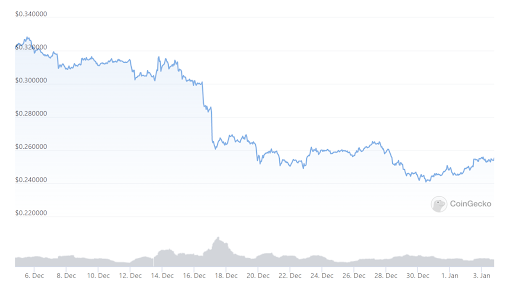

Cardano -21.1%

2022 was a catastrophic year for Cardano, as it has been on a downward trend throughout the whole year. This downfall was caused by multiple factors, as Cardano and its native token ADA went through a year of full disappointments. Things did not start well for the whole market when the whole crypto market crashed at the start of 2022, and it continued to fall for the remainder of the year.

When it comes to the month of December, there was nothing significant or noteworthy that affected the price of Cardano, as this downfall was just investors cutting their losses short at the end of the year. The thing that attracted the investors when Cardano was launched, was its take on the proof-of-stake protocol, and how it was the largest blockchain to adopt this protocol. But ever since then, many different altcoins started to integrate this protocol into their system, with even Ethereum jumping ships. All this caused Cardano to lose a lot of users, and the last month of the year was when another big batch of investors distanced themselves from this project.

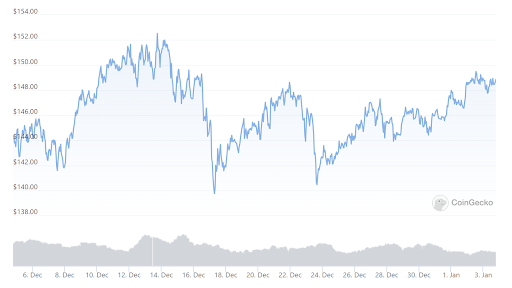

Polkadot -18%

Polkadot is another token inside the top 30 tokens that had a bad month in December. But this fall is not something that was caused in December. Polkadot had an awful year in general, with its price being on a downfall the whole year. The main usage for Polkadot is that it gives different blockchains the ability to communicate with each other, but considering that the crypto activity has been down, and there are also other alternatives available for achieving this goal, the demand for this crypto has fallen.

Because of this, we can not put our finger on one specific reason why Polkadot has lost 18% of its value in December, and this loss is attributed to just people leaving this project all together. But despite this, Polkadot still maintains a good number of active developers working on this project, so there is always a possibility that we might see future updates that will bring this token back.

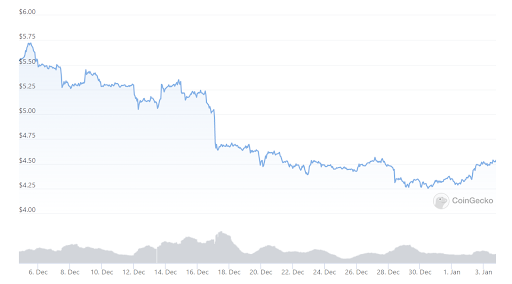

$BNB - 15.5%

The last token on our list is the native token of Binance, $BNB. $BNB has managed to lose 15.5% of its value in December and there are different factors that contributed to this fall. When FTX collapsed, $BNB also took a hit and its prices dropped, but then it managed to rebound and started to grow up until the start of December when it took another minor fall. From that point, $BNB was trading for around $300 for the next 11 days, but from December 11, it went on another downfall and closed the month trading at around $250.

The reason for this mid-December drop can be attributed to the scandal that occurred with Binance. Ever since FTX collapsed, the US government started to look deeper into every major crypto exchange, and with that rumors started to spread that Binance was in some legal trouble with the US government. This caused a panic among investors, who started to sell their BNBs, causing the price to drop. This fall continued for around 9 days and from that point onwards, $BNB maintained its value and was trading for around $245-$250.

Final Thoughts

December was an awful month for cryptocurrencies. When looking at the previous month where most tokens lost value, the majority of these losses were around 5-7%, with few exceptions like December, where an average loss was around 11%. In total, cryptocurrencies lost around $60 billion in December, with every token inside the top 30 losing its value, with 4 tokens being exceptions.

This was an awful year in general, so closing out the year like this should not be surprising. What awaits us in 2023 is still unknown, but what we know is that reasons that caused this drastic fall have not been fixed, so if you are going into 2023 with the hopes that crypto will rebound, you should be ready for the worst as the likely hood of this winter continuing is drastically more, than crypto rebounding and growing to what it used to be.

cryptonews.net

cryptonews.net