The bullishness in the week has Bitcoin trading above $50,000 and Ether near $4,000 on the weekend. The total market cap is also all set to hit $2.4 trillion, very close to $2.55 trillion ATH. The greenback, meanwhile, is falling after a much weaker than expected US payrolls report. Given that Federal Reserve officials said that they are looking at the job numbers to determine the timing to pare its massive stimulus measures, it is likely that the US central bank may not do so. The long-awaited jobs report triggered small moves in the equity market that saw the S&P 500 sliding a bit while traders turned to the safety of tech giants. Overall, the stock market was relatively quiet this week as trading typically slows down ahead of the Labor Day weekend since markets are closed Monday in observance of the holiday.  Nonfarm payrolls increased by 235,000 in August, while economists forecasted 728,000. The unemployment rate also slipped from 5.4% in the prior month to 5.2%. The data sent the dollar index to its lowest level since early August at 91.9; currently, it is at 92.12. Last week, Fed Chair Jerome Powell said that while tapering could begin as early as this year, it would only be if the job growth continues. Not to mention the rising COVID-19 cases in recent weeks have yet again brought back the concerns on economic recovery. “It adds more concern or focus on the October number because now we want to see if there is a trend," said JB Mackenzie, managing director for futures and forex at TD Ameritrade. With the Fed “trying to telegraph that if the economy continues to heat up and they need to take action,” we are not seeing a huge reaction to the downside “because the market feels as though they have been given that clear direction.” According to Bank of America Corp, in the run-up to the jobs report, equity funds attracted $19.2 bln of inflows, and $12.7 bln was allocated to bonds. Meanwhile, outflows from cash funds were the biggest in seven weeks at $23 bln.

Nonfarm payrolls increased by 235,000 in August, while economists forecasted 728,000. The unemployment rate also slipped from 5.4% in the prior month to 5.2%. The data sent the dollar index to its lowest level since early August at 91.9; currently, it is at 92.12. Last week, Fed Chair Jerome Powell said that while tapering could begin as early as this year, it would only be if the job growth continues. Not to mention the rising COVID-19 cases in recent weeks have yet again brought back the concerns on economic recovery. “It adds more concern or focus on the October number because now we want to see if there is a trend," said JB Mackenzie, managing director for futures and forex at TD Ameritrade. With the Fed “trying to telegraph that if the economy continues to heat up and they need to take action,” we are not seeing a huge reaction to the downside “because the market feels as though they have been given that clear direction.” According to Bank of America Corp, in the run-up to the jobs report, equity funds attracted $19.2 bln of inflows, and $12.7 bln was allocated to bonds. Meanwhile, outflows from cash funds were the biggest in seven weeks at $23 bln.

The Only Way Is Up

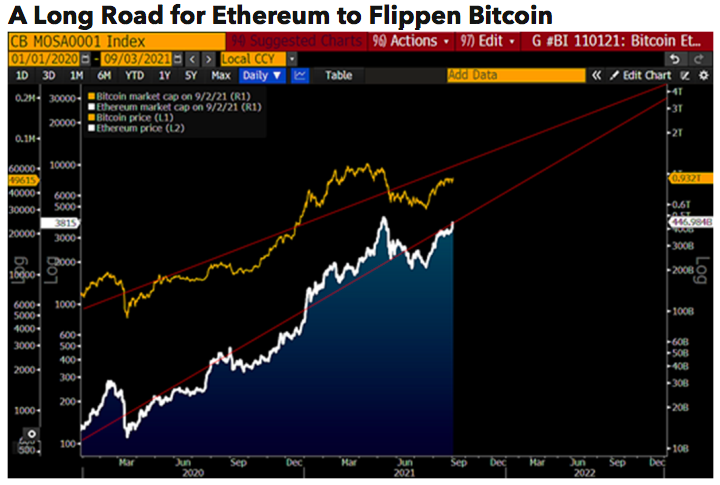

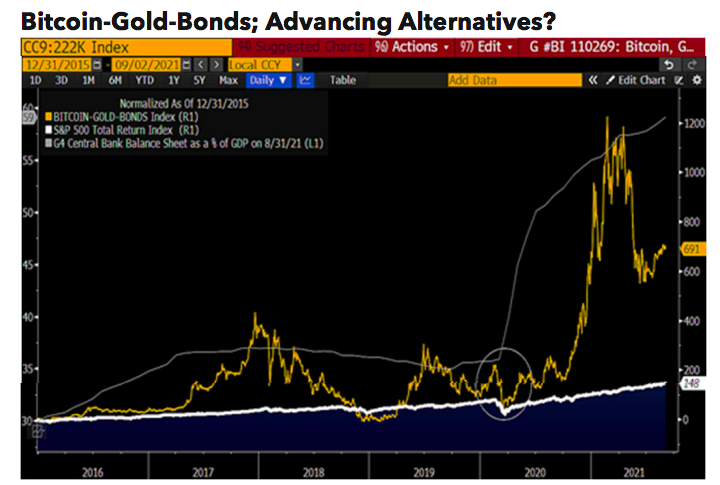

According to the September Bloomberg Crypto Outlook report by senior commodity strategist Mike McGlone, Bitcoin at $100k and Ethereum at $5k is the path to least resistance. According to the report, “bulls are in control” and in thriving mode after surviving the deep correction. “After enduring a gut-wrenching correction, we see the crypto market more likely to resume its upward trajectory than drop below the 2Q lows,” notes McGlone. Ether is currently propelled by the NFT mania and EIP 1559 implementation that has effectively made it a deflationary crypto asset. The second-largest network is also facilitating digital dollar dominance with Tether (USDT) and USDC at the top.  Ethereum is leading the market this time which “appears well-positioned for further price appreciation” as it becomes “the money of the internet” while seeing an incremental drop in supply due to EIP 1559, which led to the burn of roughly 200,000 ETH worth more than $640 mln in a month. Following Ether, Bitcoin can also march towards $100k. Halving that took place in 2020 also works in the leading cryptocurrency’s favor as after last year’s supply cut, Bitcoin has only appreciated 4x in 2021, which is tame in comparison to 55x in 2013 and 15x in 2017. Furthermore, while increasing demand and adoption are facing diminishing supply, only the fact that it may be just hype and speculation could stop the onward-and-upward trajectory. “Or it could be a revolution in money and finance that's in early price-discovery days,” he added. McGlone is a bitcoin bull, and to him, it is on its way to becoming the digital reserve asset in a world going that way. If U.S. Treasury yields resume their enduring downward trajectories, following Japan and most of Europe, gold and Bitcoin have high potential to continue advancing in price. Not to mention, the Bitcoin-Gold-Bond index has been outperforming the S&P 500 since the end of 2015, notably from the start of 2020.

Ethereum is leading the market this time which “appears well-positioned for further price appreciation” as it becomes “the money of the internet” while seeing an incremental drop in supply due to EIP 1559, which led to the burn of roughly 200,000 ETH worth more than $640 mln in a month. Following Ether, Bitcoin can also march towards $100k. Halving that took place in 2020 also works in the leading cryptocurrency’s favor as after last year’s supply cut, Bitcoin has only appreciated 4x in 2021, which is tame in comparison to 55x in 2013 and 15x in 2017. Furthermore, while increasing demand and adoption are facing diminishing supply, only the fact that it may be just hype and speculation could stop the onward-and-upward trajectory. “Or it could be a revolution in money and finance that's in early price-discovery days,” he added. McGlone is a bitcoin bull, and to him, it is on its way to becoming the digital reserve asset in a world going that way. If U.S. Treasury yields resume their enduring downward trajectories, following Japan and most of Europe, gold and Bitcoin have high potential to continue advancing in price. Not to mention, the Bitcoin-Gold-Bond index has been outperforming the S&P 500 since the end of 2015, notably from the start of 2020.  [top_coins]

[top_coins]

bitcoinexchangeguide.com

bitcoinexchangeguide.com