In the first half of 2021 data aggregator CoinMarketCap added 2,655 new crypto assets to its database, bringing the total number of listed coins to 10,810, according to data shared with CoinDesk.

For perspective, in 2018, during the peak of the initial coin offering (ICO) boom, CoinMarketCap listed its 2,000th asset on its website.

This year “saw a Cambrian explosion of new crypto assets largely as a consequence of several tailwinds,” said Aaron Khoo, head of listings at CoinMarketCap, referring to the evolutionary event that took place 541 million years ago when large numbers of new organisms seemingly burst into existence.

Like CoinMarketCap, two other data aggregators also added 2,000 or more new assets to their databases in 2021. Singapore-headquartered CoinGecko listed 3,064 new assets on its website while the smaller, Poland-based crypto data and research platform Coinpaprika listed 2,000 new assets. Wojciech Maciejewski, business development manager at Coinpaprika, said the platform is currently inundated with new applications for coin listings.

“We don’t have enough people to go through all the applications,” Maciejewski said.

Representatives from CoinMarketCap, CoinGecko and Coinpaprika agree the 2021 surge in new crypto assets is driven by a combination of bullish price action, the influx of traditional financial institutions, influencers and celebrities to the space, along with the non-fungible token (NFT) boom and the rise of meme coins like dogecoin, shiba and safemoon.

But this is not the first time the crypto space has witnessed a dramatic surge in new assets. After the initial coin offering (ICO) boom kicked off in 2017, new crypto assets poured into the market much in the same way. However, more than three-quarters of those ICOs turned out to be scams, while almost half failed to raise funds.

And if history’s any indicator, of the thousands of new crypto assets that have exploded onto the market in 2021, only a few will survive.

“We have no data to back that but the expectation is that [the new assets] are more or less similar to the 2017 ICO round where only a handful managed to stick around after the initial craze,” Sze Jin Teh, principal product manager at CoinGecko, said in an email.

Behind the numbers

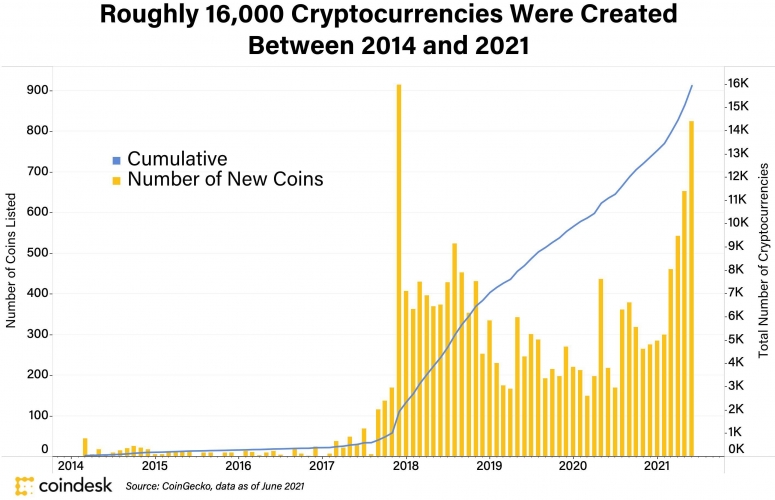

Between 2014 and 2021, almost 16,000 crypto assets were created, according to data from CoinGecko.

But this number includes all coins, both active as well as inactive assets (assets attached to disrupted projects).

For instance, according to Maciejewski, active assets on Coinpaprika account for around half of the 6,342 assets listed on the site.

And a portion of these deactivated crypto assets were born out of the ICO boom.

CoinGecko, for instance, recorded its monthly high for the number of new coins listed on its platform in 2017, according to data shared with CoinDesk. The platform listed 914 assets in December 2017 alone.

According to Kristian Kho, operations lead at CoinGecko, December 2017 was the peak of the ICO craze when retail interest in crypto rose, coinciding with the all-time high bitcoin price at the time. “This was the first time we saw a rush of a new class of tokens being created to capitalize on the success of the first few trailblazers (Filecoin, Tezos, EOS and the like). We even created a dedicated ICO page to track all the ongoing ICOs back then,” Kho said. But a majority of those tokens were short-lived.

“Many of the projects that had raised funds simply dissolved upon exhausting their runways,” said Kho.

But Jin said even more coins have popped up this time around compared to 2017, and across multiple chains including Ethereum, Polygon and Binance Smart Chain.

“There are more and more new ideas, but also more scams that we have to inform our users of,” Maciejewski said, adding that Coinpaprika is receiving up to seven times more requests than it did in 2018.

And these staggering numbers still don’t reflect the total amount of crypto assets floating around the internet.

“The coins listed on CoinMarketCap represent a thin sliver (~20% approval rate) of the total number of new coin applications,” Khoo said in an email to CoinDesk.

According to Khoo, during the first half of 2021, CoinMarketCap received a whopping 10,793 applications from crypto projects and companies seeking to have their new assets listed.

The vetting process

To face the rising numbers of crypto assets and listing applications, each listing platform has its own set of criteria for approving a new asset.

CoinMarketCap reviews an extensive list of metrics shared on its website, but according to Khoo, there is also an element of competitive benchmarking, by comparing the asset to other, similar applicants.

“Listing evaluation by CoinGecko is done holistically with a set of internal criteria used to evaluate each coin. The exact listing criteria are not disclosed to prevent manipulation by the project team,” Kho said in a written statement.

But both platforms, along with Coinpaprika, look closely at the coin’s active trading volume and liquidity, along with other factors including social media presence, community attitude towards the coin and the team behind the project.

According to CoinGecko’s Kho, the rise of decentralized exchanges (DEXs), where the listing is permissionless and fees are low, has made it even easier to create and market coins. This means anyone can tokenize anything, fuelling the strange new world of meme coins, Kho said. “In light of this, CoinGecko has become much stricter in listing new tokens. This is because the instances of scam coins have increased with the rise of DEXs,” Kho said.

Currently, Coinpaprika accepts 95% of requests for assets already listed on centralized exchanges like Binance or Coinbase, discarding only incomplete applications. But when it comes to DEXs, the acceptance rate drops to around 60% or 70% because they do not typically have stable or reliable API endpoints (communication channels) due to their decentralized nature.

Meme coin rush

According to Kho, the highest percentage of applications received at CoinGecko are for meme coins.

“The popularity and price increase of meme coins such as dogecoin and shiba inu coin has inspired many to come up with their own derivative meme coins in the hopes of capturing the success of the former two,” Kho said.

He added that the ease of creating a simple token allows anyone to launch a meme coin, and with it apply for listing at CoinGecko.

“In the last quarter, meme coins (especially those of the canine variety) dominated new coin applications, accounting for roughly three out of four new applications,” Khoo from CoinMarketCap said in an email to CoinDesk.

He also said that in keeping with the meteoric rise of Axie Infinity, a game partly owned and operated by its players, CoinMarketCap is witnessing a modest uptick in NFTs and gaming coins.

But 2021’s meme coins appear to be the assets that most resemble 2017’s ICO tokens in terms of quantity and longevity.

“Meme tokens tend to be ephemeral, and I’d say that approximately 75% of them meet a quick death if they do not go viral within the first few months,” Khoo said.

He explained that the biggest determinants of failure are a hastily cobbled-together team looking to make a quick buck and the absence of true believers rallying around a common cause within the coins’ respective communities.

But it’s still too early to tell the fate of the nascent crypto assets that have just joined the market, according to Kho.

“Quantity is there but quality remains very subjective – among meme tokens and yield farms, there are projects genuinely looking to improve the space so it probably still takes time before we are able to tell,” Kho said.

coindesk.com

coindesk.com