Storm Over Bitcoin: Quadrupling Lightning Network May Open Pandora's Box

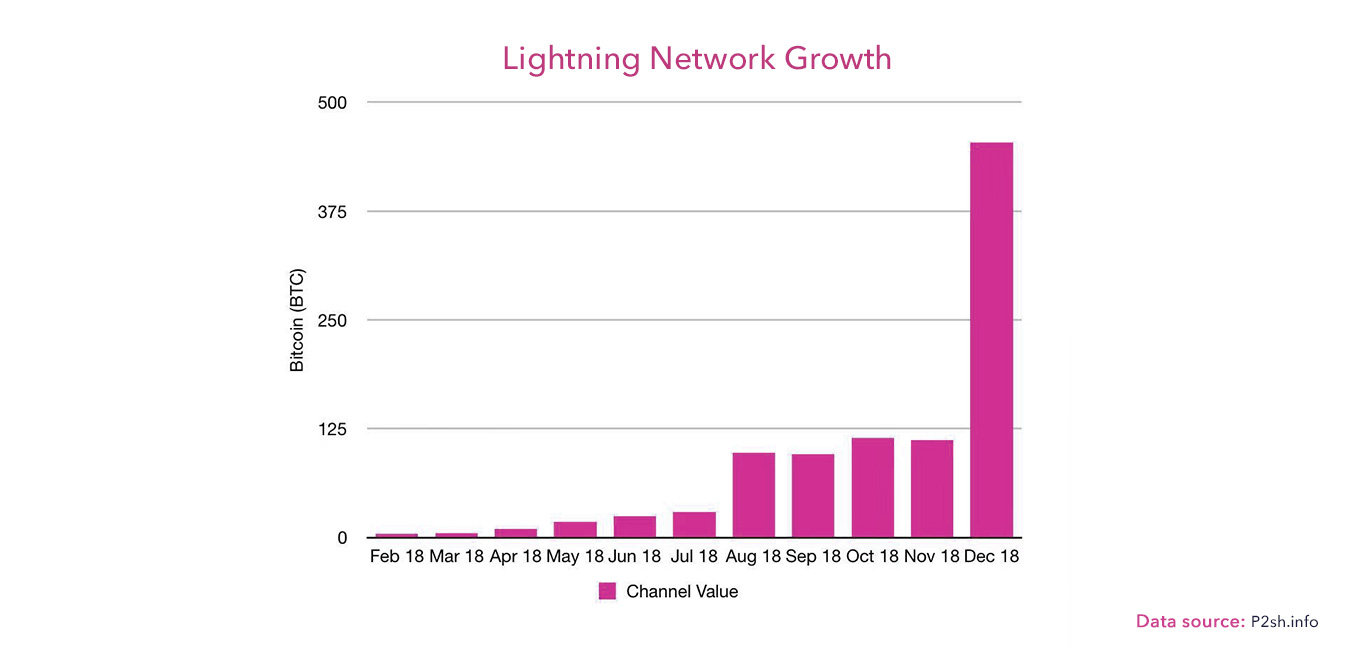

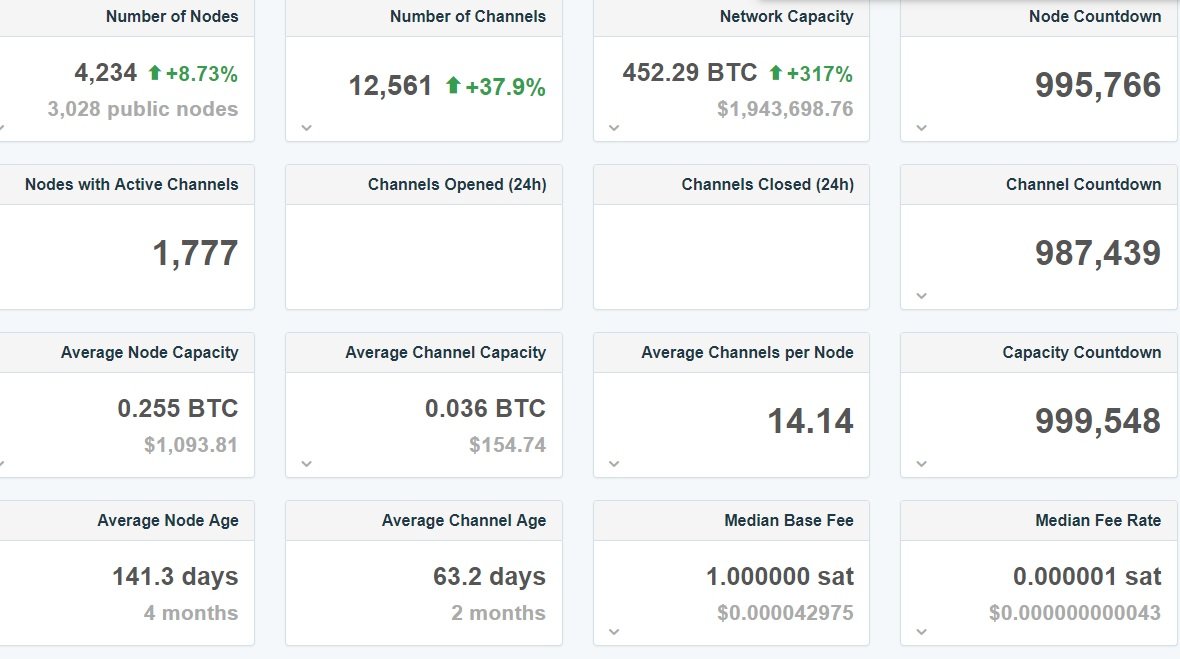

Lightning Network is in the spotlights of crypto community almost every week for the last couple of months. It is breaking new milestones almost on a daily basis, and we couldn’t have avoided the phenomenon. The technology reached the unprecedented levels of adoption, adding more nodes to the network and a considerable amount of Bitcoin to the coffers — currently, LN is supported by 4,300+ nodes. According to p2sh.info, the network has 16,000+ open channels and the capacity had reached 460 BTC.

There is at least one simple explanation for all this growth: the average commission per transaction on the Lightning Network is $0.000000000043 (0.000001sat), while on the Bitcoin network for the same period it is $0.45 (0.00011 BTC or 11000 sat). In comparison, the commission in LN is just scanty. Is this technology really able to solve most cryptocurrency problems?

Lightning quick: how the Network lives up to the name

According to the developers, the advantages of LN are the almost infinite scalability and close-to-zero commission per transaction, while these two problems have become a headache of Bitcoin Core devs. The workload is about 95%, which has repeatedly caused large-scale failures, leading to serious leaks. The speed of transactions in the Bitcoin network is 7 per second, the rate is extremely low, even with an average workload, a transaction can go 10 minutes, and sometimes even for an hour. Against this background, the Lightning Network solution looks quite attractive, since all network transactions occur instantly.

But amidst of all ‘success’ proclamations, it is necessary to remember that Lightning Network is still an experiment in the test mode. LN has been operating since December 7, 2017, and since March 15 of the same year a beta version was launched in the main Bitcoin network. Despite the warranted excitement of the Bitcoin community, there is still a risk that LN could grow ‘too big’ before its robustness has been 100% confirmed.

The idea behind

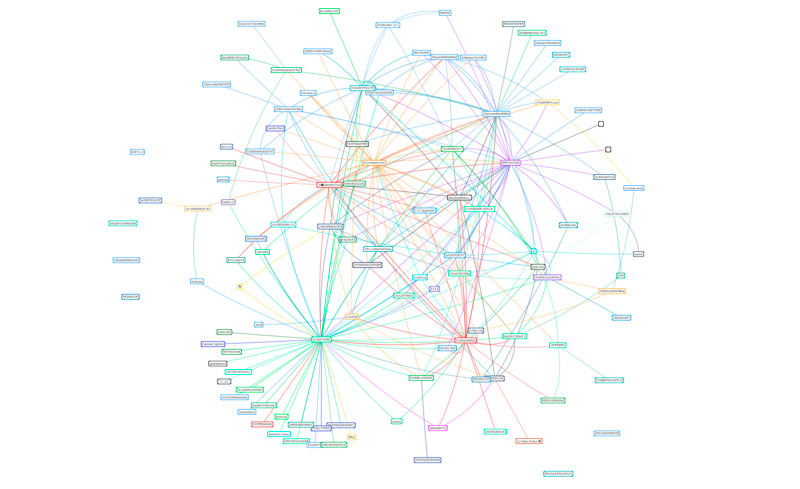

The concept was introduced by Joseph POON and Thaddeus DRYJA in their white paper as a scaling solution for Bitcoin. At its core, LN is a web of payment channels built on top of the Bitcoin network that allows transactions to occur off-chain — it is not necessary to record each transaction in the blockchain, and the payment channel between users is built directly.

These are the so-called atomic swaps that allow one to make transactions without a third-party service, such as a crypto exchange, and the funds do not actually leave the owners' wallets: they only exchange signatures that confirm the transfer of funds in accordance with the established contract. Within this framework, only net transaction results are posted to the mainchain. Due to the fact that this transaction occurs between users directly, it is carried out almost instantly. In addition, the atomic swap applies a hashed time-keeping contract, acting as an insurance policy.

Since the concept's introduction, different groups in the Bitcoin space have started development on Lightning Network-focused projects. A couple of examples include Lightning Labs and the Elements Project.

The Pros and Contras of LN

November 2018 has seen a huge increase in usage, in part due to wider adoption across the industry, and community support. Despite the fact that crypto services still transfer a vast amount of funds to about $96 million, while Lightning Network nodes account for about $2 million, the solution of the second level Bitcoin network is growing in popularity.

The widespread use of Lightning Network in e-commerce is evidenced by the fact that it is already actively used by the CoinMall decentralized P2P trading platform, which promises to be a new eBay, as well as Nanopos — a bitcoin terminal that allows to accept payments in cryptocurrencies in outlets. 4000+ CoinGate merchants added LN support, and the industry sees adoption in use-cases for instant micropayments.

The developers of the protocol claim they are not going to stop at this. On November 12, Alex BOSWORTH, a leading infrastructure specialist at Lightning Labs, announced a list of improvements that the community agreed to implement in LN. The next version of the Lightning Network will make a total of thirty different changes, including extensive payments, channels with double financing, the function of hidden recipients.

However, the solution is somehow controversial, and has its own inconveniences. In order to commit exchange via multi-signature that certifies the transfer of bitcoins in possession from one trader to another, they must have the same amount of coins in their account. Each of them opens a channel through which the node sends an equal amount of bitcoins, and then, acting as a notary, registers the transaction on the blockchain, sending the funds to the “receiver”. The channel is closed and a new transaction is registered on the network, confirming that the new bitcoin recipient is now their owner. In this case, you won’t be able to get the amount you need, if you do not already have the same in the account initially.

This has its own difficulty for the nodes as well, since they act as the arbitrator responsible for the execution of contracts. Such a node must meet the high requirements of AML and KYC. For the users themselves, this system will make the trial process very difficult — unlike the traditional network, where all transactions are transparent, here only the node is in control. And in the case of theft, you either have to raise your bitcoin node to monitor or hire a third party to resolve a financial dispute.

From all this it becomes obvious that the solution proposed by the Lightning Network has practically nothing to do with the traditional blockchain network, since the issues of transparency and decentralization are under big questions. After all, the control, in fact, remains only for the nodes of the network, which is very similar to the traditional financial system.

Too early to conclude — let's observe

We do not make statements, but it is necessary to be said, that the author of the Lightning Network is Blockstream — the company funded by the AXA venture unit. And, in turn, AXA is a multimillion-dollar financial company classified as of great importance for the global economy. Does it support the overall idea of true decentralization? Doubtfully so. Historically, Bitcoin did not need any of this. The questions of fraud, deception and much more from the traditional economic system simply wasn’t a concern for the idea of cryptocurrency. Eventually, the banks liked this picture, and instead of opposing the seeming competitor, they recruited it — after all, if you can buy one, then why fight? The raising interest to LN shows that crypto enthusiasts are not against such developments, but where will it lead — no one knows yet.