Roger VER vs Craig WRIGHT: How Bitcoin Cash Hardfork Turned Into Battle Between Bitmain and CoinGeek

On November 15, a hard fork of Bitcoin Cash resulted in the cryptocurrency division and birth of two new virtual assets: Bitcoin ABC (BCHABC) developed by the original BCH team led by Amaury SÉCHET and supported by the Bitmain Co-Founder Jihan WU and the Bitcoin.com CEO Roger VER; and Bitcoin SV (BCHSV) by the blockchain technological company nChain owned by businessman Dr Craig WRIGHT and supported by the CoinGeek mining pool of a billionaire Calvin AYRE. What led to the split and the emergence of two opposing camps?

In the essence itself, a hardfork is not something out of the ordinary - basically, it's just a technological update: in order to increase scalability and therefore accelerate the processing of transactions, a little more than a year ago, the Bitcoin hardfork took place. The result of which was a self-functioning currency Bitcoin Cash, which by the way, could not get around his parent, settling on the honorable, but still fourth place with a market capitalization of $9 billion (on November 14 before the hard fork). Miners execute a hardfork, and when there is no conflict of interests and the procedure is done, everybody moves to an improved model, and the currency continues to exist in a new form. However, this time parties did not manage to reach consensus, which caused the creation of two new coins.

BCHABC updates the Bitcoin Cash protocol with a canonical transaction ordering (CTOR), which in comparison to a topological ordering (TTOR), where child transactions spend the outputs of parent transactions, can provide the following benefits according to the developers:

- CTOR is easier to implement than TTOR, the complexity of which is the requirement to order parent transactions before children.

- Miners no longer have to figure out the payments order, which takes about 70% of the time to create a block template. The child-pays-for-parent code implies that a miner can approach dependent transactions as a group for the total amount of commissions and process a child transaction, for which a higher fee is offered, before a parent one, which will increase the network performance.

- Intermediate states during blocks validation, which, for example, have negative effects on the Ethereum scalability, will be eliminated and parallel validation will become possible.

- Allowing nodes to only communicate those transactions that differ between their mempools and a recently published block will make block encoding and transmitting easier.

- CTOR reduces system complexity by eliminating a whole class of attacks where a fraud miner can publish a large block with a transaction ordering that is as slow to validate as possible.

In fact, the CTOR makes a profitable transaction more accessible to miners, but the structure of this transaction also implies that operators along with it take into processing less profitable transactions that were previously stuck waiting in line. This modified fee structure may reduce fees for typical transactions. The Bitcoin SV supporters insist that the new technology hasn't been tested yet and therefore its implementation can be of high risk. Moreover, they believe that at the moment there is no need to change the transaction ordering, while scalability and thus the network performance can be achieved by increasing the maximum block size to 128 MB from the current 32 MB. Apparently, the opponents of Bitcoin ABC want to maintain all the power in the process of selecting, accepting and processing payments in miners’ hands. Here's why.

Let's say the client decide to transfer a virtual coin, offering a fee of $1. Meanwhile, other users make orders to validate their transactions for $10. As a result, the first payment gets stuck and waits for hours in order to get confirmation. However, the first client already wants to conduct the next transaction, a child one, for $15, but it can be added to the block only after the first parent payment get processed for $1. If the miners of BCHABC primarily verify child transaction, then they will be forced to take parent payment into processing, while the miners of BCHSV have an opportunity of not to accept the parent payment until the decline in the network load when the average size of a fee will get closer to $1. It turns out that the miners of BCHSV have a wider choice, and therefore the network is more dependent on them. That is why the control of the BCH hashrate at 75% before the hardfork was on the side of miners supporting Satoshi Vision. But why did the mining giant Bitmain come to the other side of the barricade?

Firstly, BCHABC continues to work on the BCH Protocol, while the BCHSV team restores several old OP-codes of the Bitcoin protocol and in the future plans to make the network closer to the 0.1.0 protocol version of 2009, which completely destroys the association of the new currency with BCH. But Bitmain has serious amount of assets in BCH, which even with a strong desire the company would not have time to sell by this point.

Secondly, the BCHSV mining and processing of transactions with this coin does not require the most technologically advanced equipment, assumes the CEO of the Singapore blockchain company Seth LIM. A priori the support of this project cannot be economically beneficial to the largest manufacturer of mining equipment, which recently announced the release of new ASICs on 7-nanometer chips.

Thirdly, it seems that this confrontation is the power struggle among former partners, each of whom wants to dominate a new network. "If SV wins, it will replace a vibrant ecosystem of full node implementations with only a single piece of software controlled by one person", - our expert Seth LIM thinks of the possible protocol monopolization by Craig WRIGHT. The self-declared Satoshi, who supposedly hold millions of Bitcoins on his wallets, is thus an influential figure in the crypto community, but if Satoshi Vision succeeds, he will gain even more power.

In addition, most of the operations with the new BCHSV are computed by CoinGeek, who previously had to compete with Bitmain mining pools and Bitcoin.com. In its official statement, the billionaire Calvin AYRE said: “Because of the miners who should drive the roadmap in the Bitcoin space, CoinGeek and other miners asked nChain to create a professionally-driven implementation of the Bitcoin full node software (for use on BCH) that restores the original Bitcoin protocol. CoinGeek is sponsoring the project and intends to mine with Bitcoin SV".

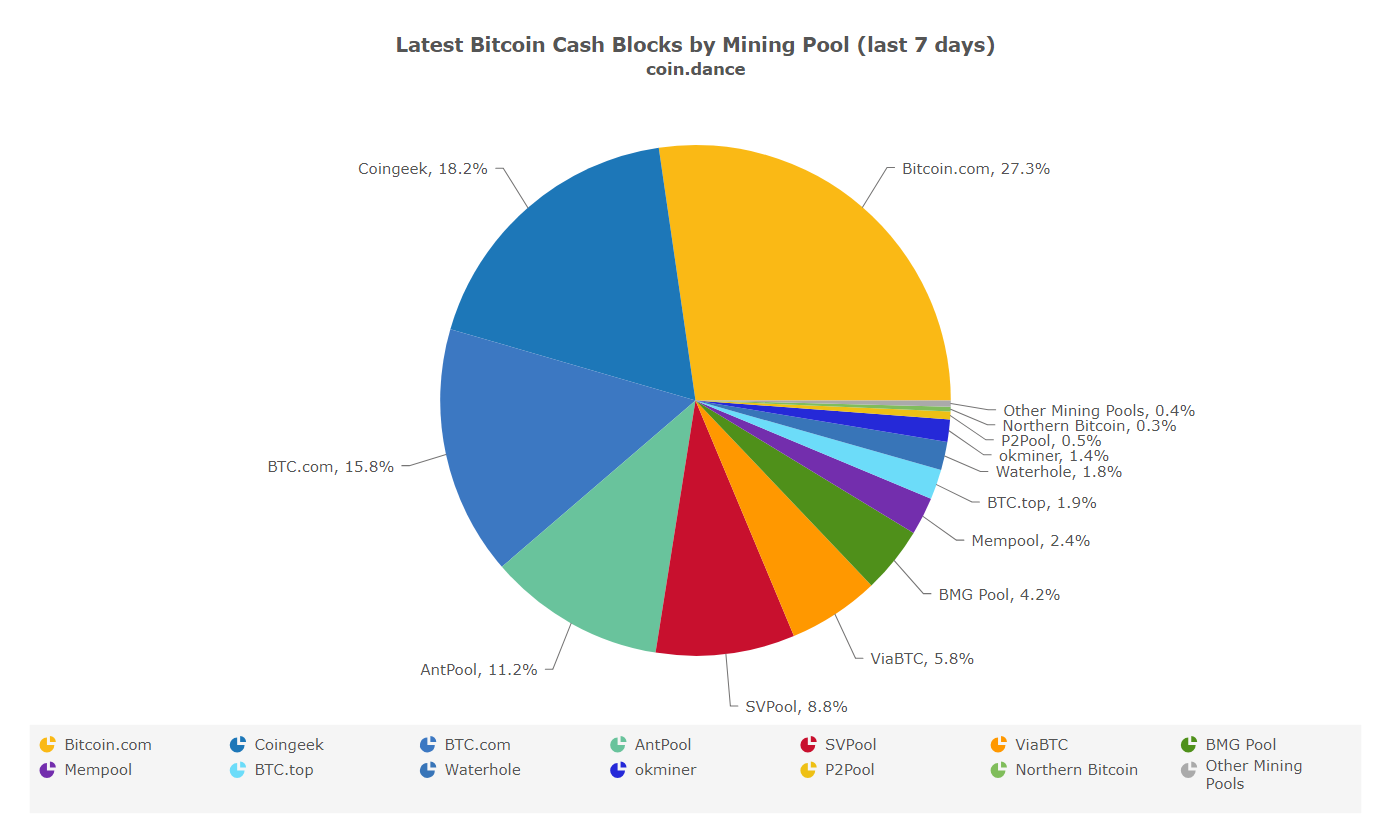

In the diagram above, you can see that Bitmain-controlled mining pools BTC.com, AntPool, ViaBTC computed 33% of new blocks, Bitcoin.com of Roger VER - 27.3% and only 18.2% of the new blocks were conducted by CoinGeek during the last week. If Bitmain and Bitcoin.com have to share BCHABC mining surveillance, the pool of AYRE has a mining monopoly in the processing of the BCHSV transactions.

On top of that, CoinGeek chose the most appropriate moment to put pressure on Bitmain's authority. The Chinese company is clearly experiencing financial difficulties, holding rounds of financing one by one - in June and August it raised $263 mn and $442 mn respectively. What is more, the mining giant is eager to hold an IPO, for which it has to disclose its not the most impressive financial figures and even make its board restructuration. Thus, Chinese sources reported about the possible departure of Jihan WU from the post of Chairman of the Board of Directors and his transition to the Supervisor position, but the company later denied these rumors. However, this news background can have a negative impact on the willingness of investors to finance Bitmain, and in case of the BCHABC failure the success of the initial public offering may be under a big question, which cannot but please his mining rivals, including CoinGeek.

It turns out that each of the parties to the conflict pursues their own interests, which has a very negative impact on the entire crypto market. In the next article, we will figure out what consequences this clash among four influential members of the crypto community has already created.