Institutional Investors Strategy: Drop The Market, Buy Coins At Lows And Go To Bakkt To Trade

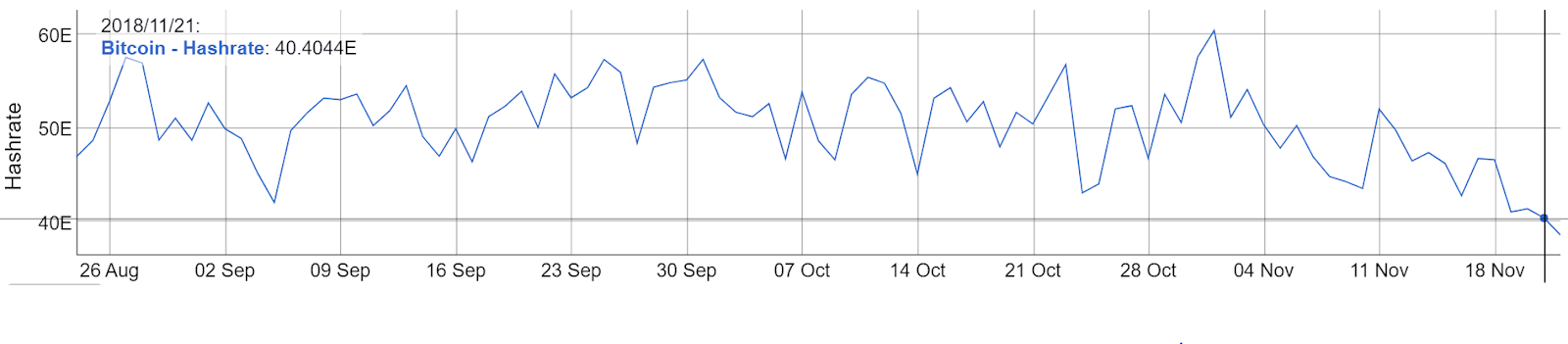

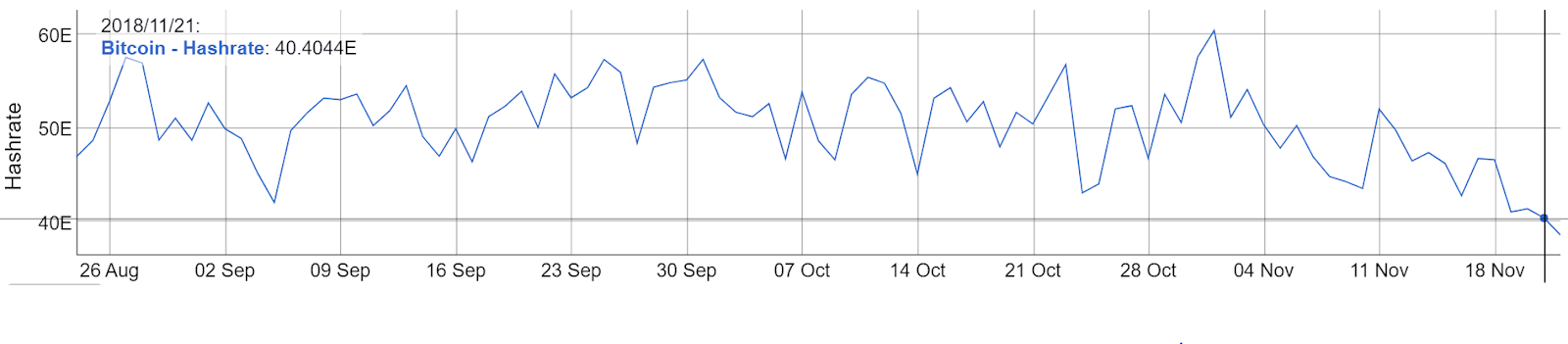

A month ago crypto market participants were talking about the unusual low volatility of the main cryptocurrency, complaining about the lack of dynamics. As the saying goes, you asked for it. Out of the blue, in just a week Bitcoin collapsed in a week by 30% to the level of the end of August 2017. The crash was triggered by the last week's Bitcoin Cash hardfork when the opposing camps began to attract third-party miners in addition to their own existing pools, the computing powers of which were directed to mining of new coins, which led to a decrease in the hashrate of the Bitcoin Protocol. The fall in price caused panic among retail investors, who began to sell their virtual coins out of fear to bear even greater losses. Big investors could take advantage of this fear.

"The recent drop of Bitcoin is a technologically calculated speculation by large capital. There is a number of large financial companies that have long been interested in accumulating a certain amount of funds in order to push the market down and eventually buy crypto assets at lower prices. We believe that the crypto market will continue to grow, but right now it was just critical for a certain number of large investors to push prices down to certain forecast indicators”, - says COO at the company-developer of neuronet software in the field of trading neural networks Alexander ALESHIN.

With all the hullabaloo, it seems that many people have forgotten that a fully regulated trading platform Bakkt is planned to be launched soon. Does the collapse of the Bitcoin price to the annual minimum, provoked by influential figures on the market, take place just by accident on the eve of the opening of the platform, designed specifically for institutional investors? It is hardly so.

You can argue by saying that during a year there were launches of not just one or two products developed specifically for holders of large capital, and the market has already seen bitcoin futures. But the fact is that this very project is presented by the owner of the world's largest stock exchange NYSE - Intercontinental Exchange, in partnership with such giants as Microsoft, Starbucks, and BCG. Moreover, one-day futures will be secured with real coins. In other words, Bakkt will buy Bitcoins, removing them from the market and storing them in its own custodian for the duration of futures contracts, which will provide the opportunity to neither use leverage nor do margin trading. Being backed by real coins the Bakkt transactions will have high level of security, which is an important feature, especially for serious investors.

However, on November 20, CEO at the upcoming trading platform Kelly LOEFFLER announced the postponement of the launch from December 12 to January 24 of the next year, noting the high interest shown by investors and remaining large amount of work that needs to be done before the launch. What could have happened?

Bakkt is still waiting for approval of the first federally regulated contract with physical delivery of bitcoin from CFTC. Or maybe the Commission is ready to register the Bakkt product, but not all the interested institutions had time and managed to take advantage of the recent Bitcoin drop, or they expected a much more significant reduction in prices, which would have caused larger sales by more scaremongers and thus bigger purchases by large investors. And what if Bitcoin, which is staying now at the level of $4,300-4,500, just takes a break, but in the nearest future will fall even greater? Indeed, its protocol hashrate continues to decline because of the ongoing hashwar, and due to the rising cost of electricity and unprofitability of Bitcoin mining at the current rate.

It is also worth noting that financial institutions such as Citigroup, Goldman Sachs, Fidelity, Morgan Stanley, which enter the market with their products, also need reserves of crypto assets, which, obviously, they would like to purchase at lower prices.

What can banks and large investors do best? Make money. First they drop the market and then inflate it, and so forth and so on. And the digital asset market seems to be an attractive alternative to the stock market, especially now. The US trade war with China, together with an increase in the key interest rate by the Fed and the subsequent sale of the US Treasury bonds and some growth in their yield led to the fall of the US stock market, which triggered a decline of quotations on the Asian market. New anti-records were broken in October, and the collapse in the crypto market took place a month later, just before the launch of the trading platform designed specifically for institutions. The puzzle is put together nicely: large investors take capital from the stock market and bring it to the crypto market, and their involvement in the fall in prices for digital assets becomes more than obvious.