Bitcoin, Exchange and Two Bot Wallets or How Bitfinex Manipulates The Market

As we expected, after a short break, Bitcoin continued to fall over the weekend, breaking through another level of support - $4,000 and updating its annual minimum of $3,593 per coin. Apparently, the crypto market decided to join the Black Friday madness and hold a sale for all virtual assets. Bitcoin has already started to recover, and while it is entering a phase of positive price correction, we decided to find out who were the main organizers of the last weekend promotion.

Institutional investors are the first actors that come to mind. First of all, ICE announced the postponement of the launch of the long-awaited platform Bakkt, which is expected to attract significant amounts of liquidity to the market from institutions. The launch date is moved to the end of January of the next year, which minimizes the chances of the last December's boom to reoccur this year. This news led to the strengthening of bearish sentiments, and a bigger number of large investors could take advantage of this opportunity to buy cryptocurrencies at the lows. Just like one owner of the wallet, on account of which there are more than $150M in Bitcoins, did. His last purchase of 20,000 coins took place on November 20, right after the publication about the postponement of the Bakkt launch being made by the CEO Kelly LOEFFLER.

Such large transfers on crypto exchanges would not go unnoticed, and would provoke fluctuations on the market. At the moment, institutional investors are not interested in the whole community to be aware of their purchases, as in this case, traders and retail investors in all the excitement would rush to buy crypto, raising the demand for it and inducing its rate growth. It is profitable for them to buy the desired amount of crypto assets through OTC deals and inconspicuously gain their market share. Moreover, as they build up their reserves of digital assets, they can also offer a small portion of coins for sale on exchanges to create panic among traders, inspire them to put their coins up for sale as well and thus drop prices of virtual assets, which will allow them to purchase more at a lower cost in the future. In other words, price dumps on the cryptocurrency market could be organized by whales as well.

However, not only institutions are engaged in the market manipulation, but also exchange operators, that are always interested in greater transactional activity, since the main source of their income is still transactional fees. Therefore, they analyze the market situation and decide in which direction it should develop for the volume of operations to increase. They can, for instance, intentionally send coins between their wallets to present the appearance of a new trend that traders should join.

So, on Monday seven different addresses of the Bitfinex exchange together transferred a total of about 10,000 BTC. The exchange users could have the impression that seven major investors were getting rid of their digital assets, which negatively affected the Bitcoin rate and made traders to sell their coins as well. The trading day on Bitfinex was closing with the Bitcoin price that was by more than 10% lower. Were whales behind this provocation? Let's have a look at one of these addresses.

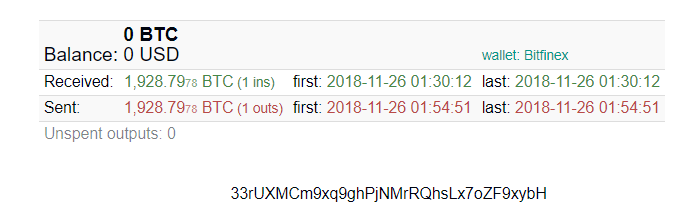

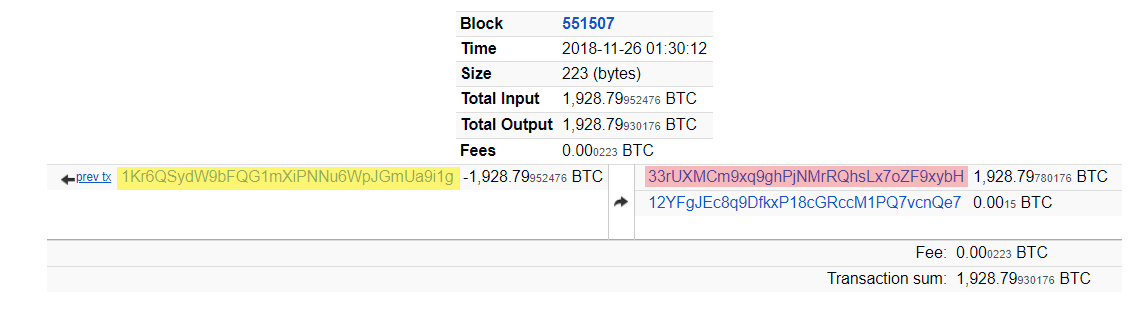

From the screenshot above you can see that the sum of 1,928.79 BTC entered the wallet (highlighted in red on the screenshot below) on November 26, and that was the first and only transfer to this address.

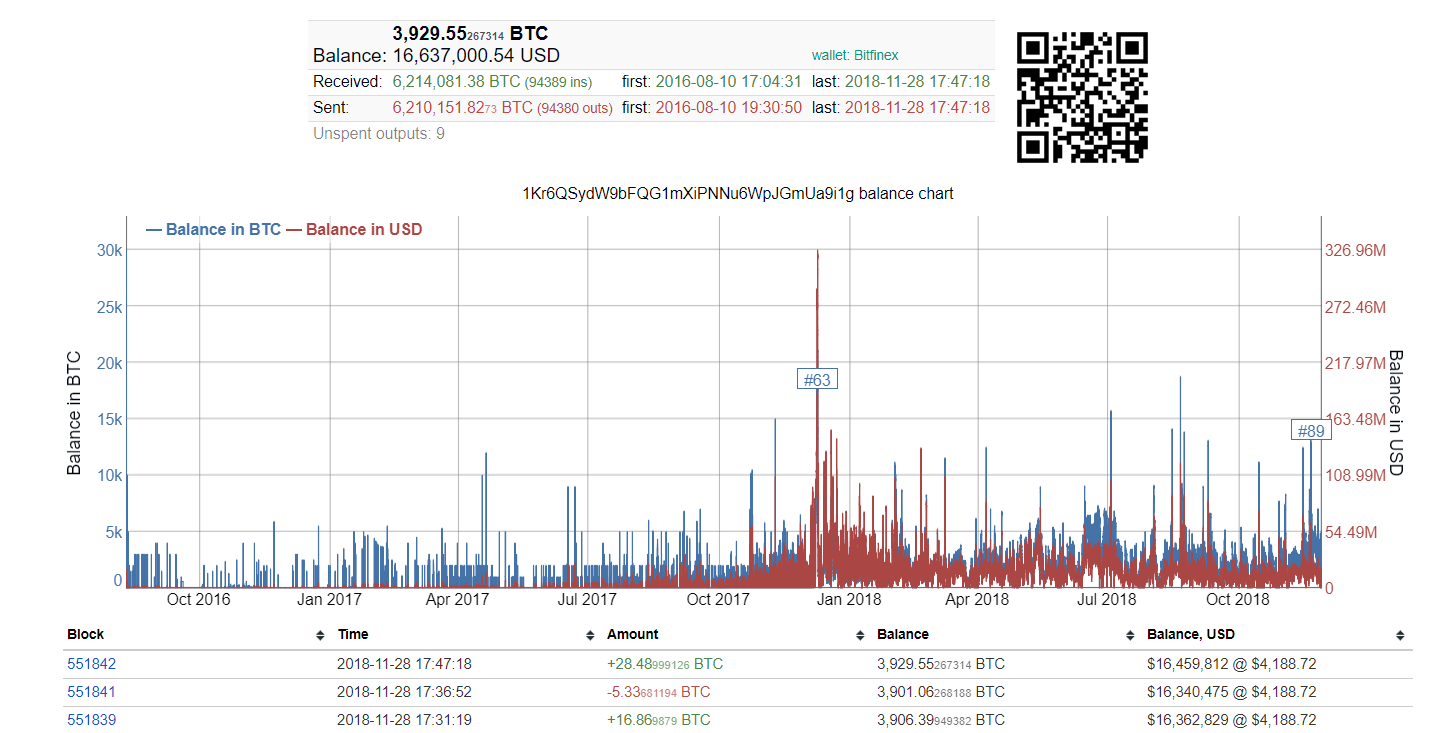

The wallet, whose address is highlighted in yellow, is also registered on Bitfinex, and its owner is way more active.

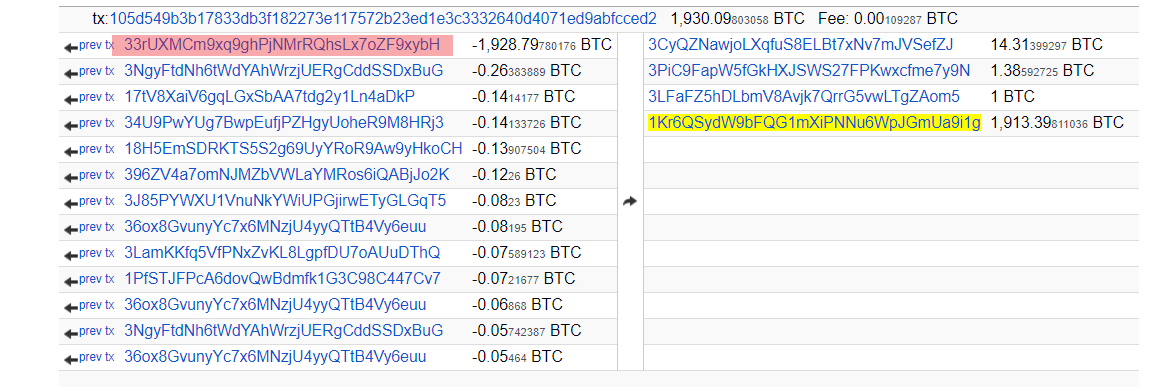

It is important to note that since August 2016, the wallet has received 6,214,081 BTC while 99.9% of these coins have been subsequently sent to other addresses. There did not appear to be anything strange about that: an active trader, the owner of the yellow wallet, sold 1,928.79 BTC to a large investor, the owner of the red wallet. But less than half an hour later, this large investor for some reason dumped the entire amount, and since then no coins have been added to his address. And he dumped not to anyone, but to that same trader.

It turns out that there was no investor or trader or whatsoever. It was Bitfinex itself that used bots to manipulate the behavior of its users. After analyzing all the other six addresses, which together transferred 10,000 BTC on November 26, we found out that they were also registered on the exchange and had only two transactions in their history - the receipt of Bitcoins from the yellow wallet and the reverse transfer.

Wash-trade, which is practiced by many exchanges, is not the only tool to manipulate the market Bitfinex has in its arsenal. The U.S. Department of Justice is still conducting a criminal probe into the involvement of the exchange and Tether Ltd. to pump the Bitcoin price in 2017 through the issue of USDT tokens.

The idea of the Tether stablecoin is that the value of the token is tied to the US dollar rate in a 1:1 ratio, and each coin has to be backed with $1, the reserves of which must be stored in the company's bank accounts, therefore USDT is considered to be less subject to volatility rather than other cryptocurrencies, and be a more attractive investment tool on the crypto market. However, the company has not published any official documents, which could confirm its reserves in the fiat currency, thus the security of its stablecoins is under great question, and the new tokens, additionally issued by Tether, can appear to be just “money from the air”.

But how are Bitfinex and the Bitcoin exchange rate connected to Tether? Bitfinex became the first exchange where USDT tokens appeared. The choice fell on it not by chance: the exchange shares the same management with the stablecoins provider. While the value of Bitcoin has turned out to be closely correlated with Tether. Last November the USDT additional issuance caused a rapid jump by the Bitcoin rate on Bitfinex. From 8th to 10th of November, the company issued 70M tokens, which led to an increase by more than 11% performed by the main cryptocurrency in three days from 11th to 13th of November.

Professors of the University of Texas John GRIFFIN and Amin SHAMS in their study revealed that from March 1, 2017 to March 1, 2018, Bitcoin demonstrated growth by 488%, where 245% were the result of 87 hours of active trading with the USDT at certain times. Scientists found that Bitfinex traders used stablecoins to buy Bitcoin when its price was in decline, thereby supporting the main cryptocurrency and not allowing it to collapse. Such activity was observed only in the periods of negative returns on Bitcoin and after the additional issue of USDT, and has proven its effectiveness, as after such interventions, Bitcoin has shown a positive dynamic. For example, on January 4, the coin began to sag, having lost more than $600 in its value in just seven hours.

In the evening of the same day, the capitalization of Tether increased by $100M in an hour. Since USDT is a stablecoin and its value can perform only minor fluctuations from the main level of $1, a significant increase in capitalization in a short period of time can be only explained by an additional issue of tokens. It was obvious that the company released another 100M of USDT that day.

After this event, Bitcoin recovered and began to grow again, which indicates a close correlation of the value of the main cryptocurrency with operations with stablecoins, the distribution of which implies the major coins allocation to Bitfinex. In this case, the exchange can be considered almost the main manipulator of the crypto market, whose contribution to the inflation of the last year's winter bubble can be estimated at 50% on the basis of the above-stated study.

By the way, the news about the continuation of the investigation can also be regarded as someone's manipulation, as the criminal probe was initiated at the end of 2017. Another reminder that once Bitcoin bursted like a bubble, only strengthens the bearish trend and puts additional pressure on the market. So we face a paradox again: not technology determines the direction of the industry development, which was based on the concept of independence from any regulators and managers, but the ambitions and business interests of all the same big players.