Real Fees For Crypto Transactions Or How To Make A $182 Million Transfer For Just¢6

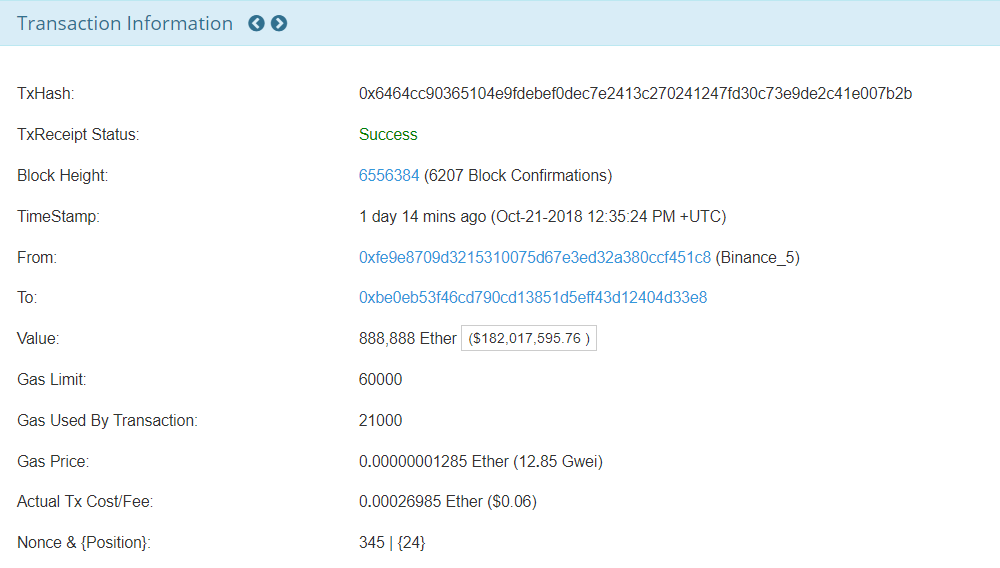

On October 21 an unknown person transferred 888,888 ETH, which amounted to $182,017,595.76 on the moment of the transfer, from a wallet on the Binance exchange to a personal address. The transaction cost accounted for only $0.06. On October 16 there was a similar case when a user of the Bitcoin network transferred 29,999 BTC worth $195 mln, paying a commission of $0.1. Why is the transaction cost so minuscule and can cryptocurrency payments be more attractive than traditional global transactions from an economic point of view?

To understand the question, first we have to figure out what stages a crypto transfer goes through and how the transaction cost is determined. Once you have signed and sent a payment, it goes to the node, which in turn puts it in the pool to all signed transactions. Miners take it from the pool, include it in the block and add it to the chain. Once a transaction enters a blockchain, its data is stored there forever. In order for miners to accept and process your transaction as promptly as possible, you must set a competitively attractive fee for their calculations. Put simply, transactions with higher fees are the first that get taken by miners and added to the next block. Therefore, the more money you are willing to pay for the transfer, the faster it will be accepted and executed.

Ethereum has its own internal unit of pricing for payments called Gas. The network introduced it to guarantee the use of effective code and eliminate the probability of useless actions. Since Ethereum was created not only as an alternative to the fiat currency, but also as a tool in the smart contract execution, the Gas amount per operation varies from the complexity of the calculations needed for an operation processing. For example, a simple transfer from one address to another is cheaper or requires less Gas than the execution of a smart contract.

As you can see from the image above, which describes the characteristics of that transaction held on October 21, there are such terms as Gas Limit and Gas Price. The first means the maximum amount of Gas, that can be written off during a transaction, and it protects you from significant losses in case of an error or a system failure. If you set a limit above the required one, the system will return the unused Gas to your address after processing the transfer. But if you specify a limit below the required, then the system will not confirm a transaction notifying you about the error called "out of gas”, and the money spent on the attempt will not be refunded. For ordinary transfers from address to address Ethereum has set a standard limit of 21,000 Gas. With participation in ICO and other operations, for information on the cost of smart contracts execution you can apply to their developers.

As for Gas Price, which interests us to a greater extent in this article, you can also set it as you wish. However returning to the question of the processing speed, the higher you set the price, the sooner miners will add it to the block. In the considered case, the price for 1 Gas was 12.85 Gwei, which was enough for the miner to accept the transaction and process it, despite the fact that the average transaction fee in Ethers on October 21 was equal to 13.4 Gwei according to Coin Metrics. At the first glance the situation seems to be very paradoxical. But in fact, it is necessary to take into account two factors. Firstly, as described above, transactions in Ethereum may not be simple transfers, but smart contract operations, which are more expensive and therefore they increase the average fee of the Ethereum transfer.

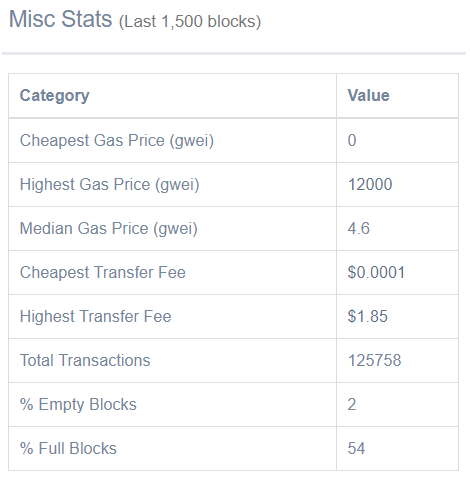

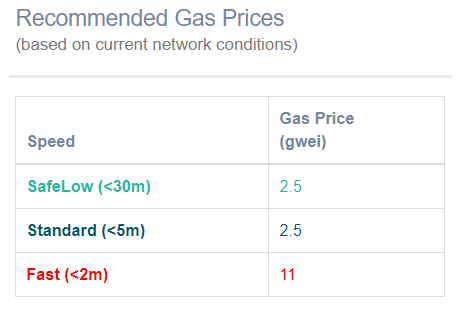

Secondly, the moment chosen for a transaction plays an important role. For example, at the time of writing on October 23, the median value of a transaction was even lower and amounted to 4.6 Gwei for the last 1,500 blocks - exactly half of the transfers were carried out at a price higher and exactly half at a price lower than 4.6 Gwei.

At the same time, the recommended price for the most rapid payment execution (less than two minutes) was equal to 11 Gwei.

It is obvious that the user who transferred 888,888 ETH on October 21 for 12,85 Gwei, could use a similar resource (ethgasstation.info), and based on the statistics determined the Gas Price at the rate which was enough for the transaction to be executed at that particular moment.

Herewith, 1 ETH is equivalent to 1bln Gwei, which indicates a direct correlation of the transaction cost with the currency exchange rate - the lower the Ether value is, the lower the payment fee is. Therefore, we can assume that such a transaction in January could cost at least 6.65 times more - $0.4 (the Ether rate on January 14 reached the mark of $1,377.72, and on October 21 was at $207,28 per coin). Moreover, if we take into account that the 24 h transaction volume also fell by 2.12 times (from 1.0816 mln to 518,014), in order for the operation to be processed as quickly, in conditions of increased load on miners, the fee rate should have been two times higher. Thus, on January 14 such a transaction would have cost at least 14.1 times more - $0.85.

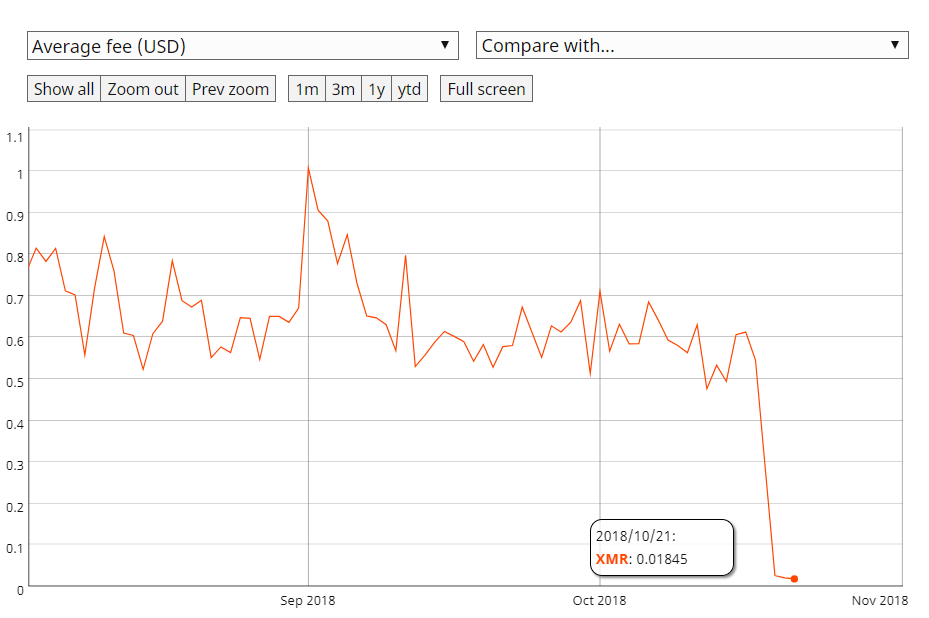

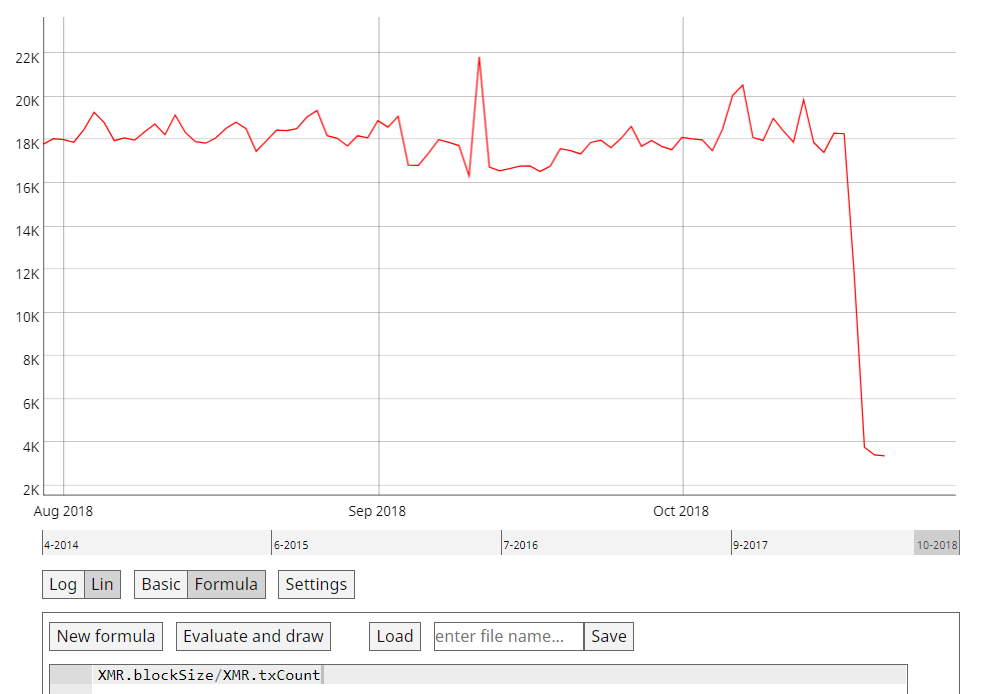

If operations with Ethereum have become cheaper because of the bearish market and the respective exchange rate drop, other cryptocurrencies are specifically working to reduce the cost of transactions in order to acquire a competitive edge not only over other digital currencies, but also fiat money. For example, after the activation of the Bulletproofs protocol, payment fees in the Monero network fell by 33 times - the average transfer cost declined from $0.6 to $0.018 in accordance with Coin Metrics.

The decrease of the transaction fee became possible due to the reduction of the calculations required to process payments by almost 82% - from 18.3 KB to 3.4 KB. In other words, on average, one transfer takes up less space in one block of the network, which allows miners to include more transactions in one block or make blocks lighter.

In general, there are prerequisites for the beginning of a new trend that implies lowering of transaction fees in the crypto space. By doing so the developers are trying to increase the popularity and use of digital currencies as a means of payment. The Core Lead Developer at Litecoin Adrian GALLAGHER believes in this as well, pointing out that the current daily volume of transactions with the altcoin does not reach the block limits, and since the situation will not change over the next 3-6 months and the market will continue to be in the bearish stage, he considers it possible to reduce transfer fees.

If the cost of transactions in virtual currencies depends on the amount of data contained in payments, in traditional financial operations, the transfer commission includes currency conversion fees and fees of correspondent banks and payment systems. The SWIFT document of 2016 on the global payments innovation initiative provides an example of the transfer of $480,000 from Germany to the United States. The transaction goes through four banks, and each charges a fee. Total operating expenses amounts to $70 or 0.0145% of the payment amount. It would seem a ridiculously small price for the fact that after 6 hours a large sum of money will reach its destination. But if we take the transaction of October 21 for more than $182 mln and carry it out via the SWIFT system through the same route, the fee of 0.0145% will exceed $26,000, which is almost 440,000 times higher than the cost of the transaction with Ethereum. This example proves that payments in cryptocurrencies can be more cost-effective than transfers through international payment systems. But in order to seriously compete with them, digital currencies need to become more stable, as well as their protocols, which are still subject to technical failures