Neobanks have arrived — is the market trembling?

04 October 2019 08:04, UTC

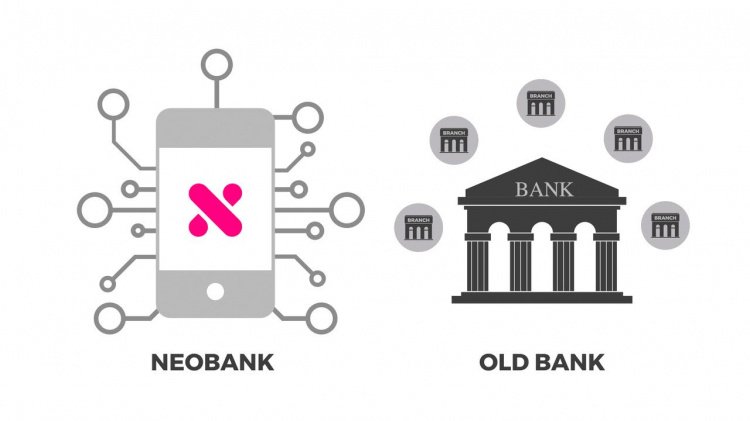

Neobank is an unofficial, but fairly common name for a company that provides services similar to traditional banking, but without the ordinary offices. They work only online via a special application

Neobank is an unofficial, but fairly common name for a company that provides services similar to traditional banking, but without the ordinary offices. They work only online via a special applicationIn the UK they have another name — “challenger bank”, which in general provides almost the same services as neobank. It’s a service that competes with ordinary banks in the field of opening accounts, payment for services and money transfers. We can also recall other, less popular names for neobanks: branchless, virtual, mobile, digital, direct-bank.

29-01-2019 11:35:36 | News

This leads to the following:

- such enterprises are not bound by strict reporting standards applicable to public organizations;

- they are financed by venture investors;

- indicators of the current situation are the amounts received during the investment tours;

- private estimates of the value of companies, often received from interested parties — owners or venture capitalists.

27-02-2019 14:38:54 | Investments

Popular neobanks: three examples

N26

The transfer and payment service called “Number 26” was founded in 2013 in Germany. It initially worked without a bank license, but in 2016 there were some changes:- the first investment round brought 10 Mln euros;

- the service received a new name – N26;

- a banking license was obtained from BaFin, the German financial market regulator.

The company’s activities are regulated by the laws of the countries in which their customers reside, and therefore the conditions are different. In some countries there are no restrictions on the number of cash withdrawals at ATMs, in others, for example, free of charge — no more than five times a month. There is a pleasant feature for users of the most neobanks which is also present at N26: transfers are carried out very quickly and there are almost no commissions on these operations.

Now N26 is actively developing, continues to receive investor money and expands its presence in the market. The last well-known, fourth round of investments brought the company $170 Mln. The total amount invested by investors reached $682.6 Mln. The company's market value is estimated at $3.5 Bln.

This neobank is popular in many countries of Europe, and recently it has opened a new direction in the USA, and it has some plans for starting operations in Brazil. The total number of customers is 3.5 Mln.

Monzo

A neo-bank from the UK was founded in 2015 under the name Mondo, but a year later it was renamed due to the fact that another company claimed the original name, which won the dispute.Monzo provides its users with a full range of services typical for a modern financial service: opening an account, issuing a card, payments and transfers using only one application. The company neither holds nor receives minimal commissions when making cross-border payments and cash withdrawals from ATMs (with some restrictions, of course).

In June 2019, the fifth round of financing increased the total amount of funds invested in Monzo by 113 million pounds. The total figure is 417.7 Mln US dollars. Monzo's market value, according to some estimates, is about $2 Bln.

This company, like the previous one, is one of the leaders in a new direction of banking. Monzo is quite popular, the number of its clients is about 1.9 Mln people at the moment. Like N26, the company began to penetrate the US market, entering into partnerships with local enterprises.

Revolut

Revolut is another revolutionary banking service from the UK. This neobank was launched in 2015 and quickly gained popularity, attracting customers with services that compare favorably with those offered by traditional banks: currency exchange, transfers, payments, cryptocurrency exchange with small commissions or no commissions at all.Eleven rounds of Revolut funding are known for sure. The total investment is $336.4 Mln at the moment, and the company’s value is estimated at $1.7 Bln. The current number of Revolut customers is about six million people, and the volume of their operations exceeds 40 Mln pounds.

Is the world at the feet of new banks?

The success of the “new banks” is obvious: the rapid growth of companies in this field, popularity among users, investor investments are clear evidence of this fact. However, you should not overestimate the achievements.It would be strange if traditional financial systems simply gave a significant part of their profits to the upstarts. In any case, none of the trendy digital services with a limited license has been included in the list of the hundred largest banks in the world so far. There are the good old participants — banks: state-owned, run by influential financial groups with a long history.

Neobanks face the limitations and barriers that financial regulators impose on them. It narrows the range of opportunities and forces them to limit the usability of their services to customers.

19-03-2019 15:09:00 | Technology

For example, the companies mentioned in this article managed to take part in the following scandals:

- Within six months, almost half a million Monzo personal PINs were open to the company's technical service staff;

- German financial regulator BaFin handed N26 a restriction order, which immediately led to numerous denial of service to a large number of users;

- The investigation revealed the inside of Revolut's corporate culture: unpaid refining, psychological pressure, harsh atmosphere, and staff turnover.

However, newcomers have repeatedly shown that they know their onions. They will not give up trying. And anyway, consumers will be beneficiaries.

Image courtesy of Australian FinTech