The First Corporate Crypto Platform in Asia, ONE Exchange by Techfinancials Asia

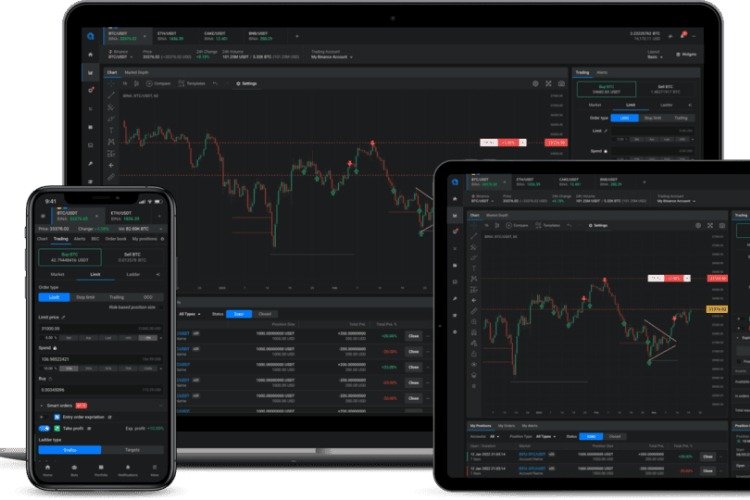

ONE Exchange is the blockchain-based online platform that aims to facilitate global trading for importers/exporters to use digital token for their payment. A pioneering fintech tokens platform which is exclusively made for SME and corporations and to make digital corporate financing first happens in Asia.

In cooperating with Techfinancials Asia Group as full technical system provider, ONE Exchange uses the innovative TEX proprietary algorithm and blockchain technology on credit E-trading. It has overcome lots of main obstacles for global trading companies in dealing with Letter of credits (LC) and payments. To make all global payment with the best transparency, liquidity and digital standardization on corporate crypto payments.

-

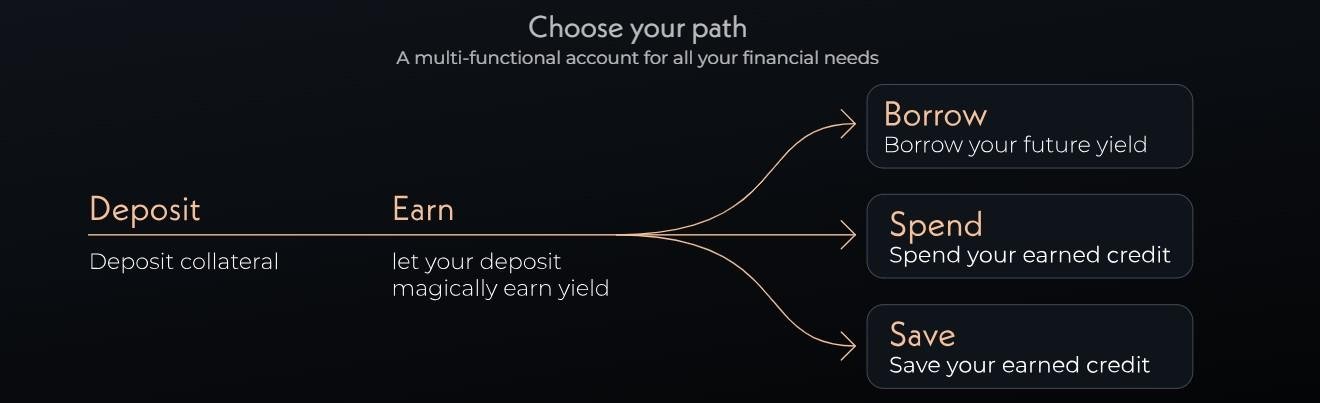

The TEX system can allocate credit of each enterprise and corporation to issue tokenized credit from their collateral crypto asset with ONE Exchange. Their global partners can choose to receive in USDT, BTC or ETH.

-

If the counterparty insisted to take fiats instead of crypto payment, ONE Exchange will arrange local currency within 1 hour for millions of USD to reach to their regional bank account in 200+ countries, which saved a lot of time (normally T+1 for international bank transfer) and transfer cost.

-

One Exchange will customize a digital smart contract and onboarding process for buyer/seller to engage every deal with a strict trade surveillance for due diligence and KYC process. It makes sure to comply with local regulation on AML policies.

-

ONE Exchange is establishing with 500+ SME and corporations in Asia now starting to register on the platform to tokenize their global payment. With sufficient banking data and credit report, the platform can give each enterprise a Crypto Credit line.

-

Trusted DeFi protocol that offers services like borrowing, staking and High loan-to-value (LTV) ratios (70% of the loan value) to organized enterprises. Just same as custodied loan in banking world. A old commercial building in Singapore ( market price 40 million SGD ), ONE exchange can issue a financing of 60% of asset value.

-

Staking — Under the ONE exchange corporate fixed term crypto deposit, as an investor, you can lend your crypto currencies for a period of 7 days, 30 days, 60 days, and 90 days for an rewarded interest back. You can easily withdraw the coins you have deposited before expiry of the fixed deposit and a penalty will be charged. Can withdraw back to fiats in USD globally in 200+ countries.

Corporate Scenario #1

A real estate company from Singapore hope to invest in a commercial project of Los Angeles with 50 million USD. Traditionally they have to go through a complicated and long KYC/AML process from both onshore/offshore banking to make international transfer with this significant amount, which at least may take 2-3 weeks to have a final approval.

With ONE Exchange, it could done within 1-3 days with sufficient AML documents and digital smart contract for both remitter and receiver. Their counter party in California can choose to receive USDT ,BTC or USD in own preference. Whole transaction is on blockchain with 100% transparency and secured. The commercial project afterward could be a collateral for ONE Exchange to release" Crypto credit" in this Singapore Real Estate company for globally payment in future.

Corporate Scenario #2

A global asset management firm is holding 30 million USD worth of crypto asset in their portfolio; they are very speculative and don’t want to sell their position now. Somehow they hope to get extra capital for some other opportunities in a short period of time, One Exchange can issue a Crypto Credit of 10-15 million USDT immediately (assuming that 30 million as custodied collateral) so they can be more flexible to manage their fund since normal banks won’t be able to take crypto assets that borrower pledges as security for a loan. ONE Exchange will charge a certain interest rate by USDT in this digital corporate financing.

Head of Asia in TechFinancials, Calvin Hau commented: “We are delighted to have played a pivotal part in the launch of the first corporate blockchain-based Crypto Credit trading platform for global enterprise in Asia. An exclusive platform for corporations to join digital and crypto market with secured system and regulation like normal banks. This milestone achievement is testament to the innovative capabilities of both ONE Exchange and Techfinancials to build a new, ground breaking platform and we look forward to updating the market on its progress in due course.”

Calvin Hau — Head of Asia from Techfinancials — will lead the project to launch in Singapore, to penetrate the SME and corporate payment market for global digital credit and tokenized payment. He was with exceptional experience in Forex and Crypto global market from previous prestigious Swiss FX bank and a London based Prime broker, himself is holding an MBA from Imperial College of London in Innovation & Entrepreneur.

Since joining Techfinancials, Calvin proceeds with serval launching of successful global projects, such as Wechat Digital Trade (The first Tech company to make crypto could be traded on Wechat in China) & CEDEX (Diamond tokens ICO with Isarel diamond exchange), both projects participated with 30000+ active users and raised 10-22 millions in Asia. And 2022 as executive advisory for NFT market place, the MetaWords Art NFT which released by a NASDAQ listed tech firm (The Lion Group).

We believe ONE exchange will be the next hot project to keep an eye on in future. A digital platform only designed for all corporations and institutions in Asia.

This exciting project is funded by Pinetree Asia Capital Partners for its venture investment on disruptive and innovative enterprises software and it will be the advisory board for the group in future development. All custodian and transactional services will be provided by SEBA Crypto bank group.