Blockchain: transforming our worldview

Blockchain's increasing significance is often compared to the early years of the Internet. Its implementation is supposed to change the world by simplifying interaction between individuals and bringing more transparency to relationships with banks, public agencies and other institutions. Despite growing numbers of blockchain supporters there are still many opponents who remain skeptical about its role in the future. Where does the truth lie?

Extent

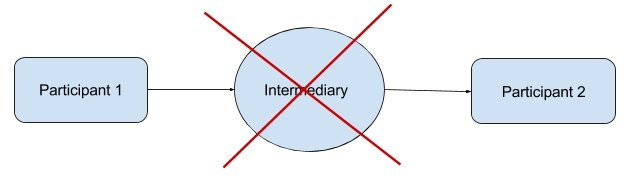

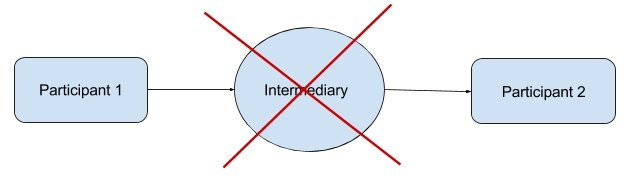

"At the moment every contract includes a third party: state, court, notary or anyone else who

authenticates a deal and fixes your intellectual property. Blockchain serves exactly as a means of automatic verification of transactions", - says Irina Pegusova (Hyperboloid).

In other words implementation of Blockchain will make unnecessary a wide range of functions performed by banks and authorities to earn big money. All the participants whose interests may be affected by this innovation are carefully studying it and thinking of a profit it can bring (or at least of minimizing losses).

Expenses caused by implementation of this technology may exceed potential income for intermediaries left on the sidelines. If it happens they will try to block and drag down spread of this technology by any means necessary (for example in medicine its development may take place faster than in finance.

Blockchain will definitely not die. It keeps on evolving technologically and will become increasingly widespread in finance when society is fully prepared for it.

"Market cap is growing rapidly every day. At the moment it amounts to more than 101 billion dollars, not much in general. More and more major players have been entering the market. Blockchain is a popular topic at conferences and in the media, it is discussed with colleagues and friends. We can see that explosive and rapid growth in knowledge and use of this technology will go on at least for the next 2-3 years. By that moment its adoption may become widespread", - believes Vladimir Smerkis, founder and partner of The Token Fund.

However in general investments in Blockchain-based projects are declining. "At the moment additional funding is only provided to the projects that have already been launched. Investors are laying low until some concrete results are achieved, both financial and practical. According to Gartner, 90% of Blockchain-based projects launched in 2015 fail within 18-24 months. It is mostly because this technology tends to be applied even in those areas where it is not really needed and not suitable for the purposes", - points out Ivan Basov, chief analyst at FinTech Association.

Blockchain technology is expected to be gradually implemented where it is needed after media hype dies down.

Experience

"There are some crypto friendly countries in the West. For example since last year the Swiss town of Zug has been accepting payments for municipality services in bitcoins. American businessmen look forward with optimism to the future of cryptocurrencies. The Securities and Exchange Commission is considering registration of cryptocurrencies-based funds. These applications are rumored to be approved in the coming months. In EU there are many restaurants and cafes beginning to accept cryptocurrencies.

But these places are usually a venue for local bitcoin communities. You can see them in Prague, Amsterdam and Berlin. However they haven't become widespread so far. It's interesting to observe how cryptocurrencies are treated in Japan.

In March 2016, the Japanese cabinet approved bills which elevated bitcoin and other digital currencies to the same status as fiat money. Three years earlier People's Bank of China had issued a notice banning use of cryptocurrencies. It dramatically affected bitcoin's price falling from 1242$ to 600$. The interesting thing about it is that the Chinese are active crypto traders and China is the country with the highest volume of trading. It were the Chinese who pumped up bitcoin price from 177$ to more than 500$ by buying BTC in the autumn 2015", - says Alexei Tarapovsky, head and founder of AnderindaFinancial Group (AFG).

Cryptocurrencies

When considering implementation of Blockchain-based technology one has to come to understand that currency can be issued not only by a state. There are many opinions on the role of cryptocurrencies in the modern global economy. Some people believe it is a positive fact that will help to get rid of excessive role of a state in economy, while others see it as a big threat.

Here's example of a positive attitude: "We believe that cryptocurrencies may complement existing fiat money. Whereas monetary instruments may switch to blockchain which can significantly lower the costs and increase transparency in the financial sector. States around the world have realized that it's impossible to prohibit development of this technology that is why they will work with it. Some good examples are: Japan recognized Bitcoin as a legal method of payment on April 1; Russian Central Bank announced that Russia is planning to develop a "cryptoruble" and consider cryptocurrencies as digital assets", - points out Vladimir Smerkis, founder and partner of The Token Fund. It should be mentioned that Vladimir doesn't mean a full transition to cryptocurrencies but talks about complementing existing fiat money.

And here's example of a negative thinking: "It should be noted at the outset that Blockchain technology is largely overrated nowadays. It is seen as a means to challenge censorship and restriction of freedom.

If we assume that in the future title units and money will be generated outside of a state then cryptocurrency may become one of the biggest projects for the last years. However let's not forget that such a large-scale transition is its weakness itself.

Professional miners are those who profit the most today. As soon as cryptocurrency replaces fiat money at a state level, state will be able to use mining technologies on its own. We can even expect a development of protocols which will monitor and detect all of the citizens' transactions.

And of course special attention should be given to the possibility of controlling every cryptocurrency by a state when it is linked to a subscriber's device. Every user has a transaction history. And such public organizations as research institutes and FSUE (federal state unitary enterprises) that can not be restricted will easily develop special algorithms of countering free circulation of cryptocurrencies.

Thus we can say that positive aspects of implementing Blockchain and cryptocurrencies are still uncertain, whereas the negative impact is too visible", - says Sergei Voronin, lawyer, managing partner of "Legal decision" LTD.

Here is one more negative opinion on cryptocurrencies' rise in publicity and implementation of Blockchain in non-financial industries: "From my point of view scenario when cryptocurrencies replace fiat money is possible, but highly unlikely. At the moment there are more than 850 Blockchain-based cryptocurrencies in the world. And many of them in one way or another have been created with Bitcoin technology. Meanwhile Bitcoin's transaction capacity limit and potential for modernization (the same applies to cryptocurrencies based on its API systems), de facto ban on independent monetary policy by Central Bank, risks of sliding into a deflationary spiral - all this makes conventional currency much more attractive means of payment with regard to for example public interest.

The most promising spheres for use of Blockchain are those demanding a unified register with a built-in protection against errors and counterfeiting. In theory Blockchain might be used to control distribution of medicines and etc. Blockchain has already become a widespread technology, it is implemented in various areas in tens of countries", - says Timur Nigmatullin, financial analyst at FINAM.

"Despite rapid development of cryptocurrencies we can hardly expect emergence of a national virtual currency in the nearest future. Its implementation requires a definition of a new digital trend and a study of numerous aspects. The Central Bank will be able to uncover some details only in 2-3 years, while at the same time significant efforts have to be made for further development of the system", - believes Roman Kuznetsov, senior analyst at QBF.

Bank of Russia's position

Bank of Russia as well as other regulators is studying technologies of distributed database, their prospects and all the risks involved. For these purposes Bank of Russia together with the major participants of financial market has set up an Association for Financial Technologies Development (FinTech Association). This initiative is aimed at exploring the ways of using these technologies regarding various segments of Russian financial market.

One of the main FinTech Association's activities is implementation of distributed database projects. Their potential benefits are: possible facilitation of transactions, high level of service continuity, reduction of the need for providing deals with documents, greater transparency as well as a constant maintaining a database of deals.