Regulation days: weekly review

The ending business week has had several important regulatory statements in two major crypto hubs of the world – the United States and South Korea. The international organizations have also participated in this ongoing process of ascertainment of what the digital currencies really are and how to use them.

The FATF – or the Financial Action Task Force on Money Laundering – is planning to hold talks on cryptocurrency assets in money laundering and terrorism. This has become known to Bitnewstoday from the FATF representative after the correspondents have sent an inquiry regarding the leaked key points of cryptocurrency risks posted by Elina Sidorenko, the Russian parliamentary working group of cryptocurrency risk assessment head. Thus, the FATF has managed to enter the news both in the present and the future – Bitnewstoday will keep an eye out for the official report on the plenary discussion of this establishment (27-29 June this year).

The Bank for International Settlements has expanded the theme of slow Bitcoin payments already raised by other economists. The organization has offered to envision a scenario in which Bitcoin becomes the number one Internet purchases currency — this will be too much for the Web, researchers think. If true, Bitcoin developers should take these arguments into consideration when making new updates.

In the United States, there are some hints of the future ICO rules tightening, as the Chicago Board Options Exchange (CBOE) head Chris Concannon went as far as to predict the ‘reckoning’ for ICO startup founders. Even secondary actors who helped the main ICO enterprise to manipulate the market can get a subpoena from the United States Securities and Exchange Commission.

The SEC has also managed to win against entrepreneur John McAfee without taking the matters to the local courts. Not so long ago, this businessman has vowed to fight the officials until his last breath, but now he chooses to refrain from ICO advices or advertisement, even telling: “Those doing ICOs can all look forward to arrest”. However, McAfee claims he had come up with a new mechanism of investment attraction similar to ICOs which the SEC “cannot touch”.

As for people with much more serious mindsets and statements - the US lawmakers in Capitol - they, too, have felt the increasing pressure of economic watchdogs on the sphere. According to the latest House Ethics Committee paper, congressmen now have to report crypto revenue both in regular and annual papers.

The best conclusion from the current situation in the USA has already been made this week by the Consumer Protection Financial Bureau head who pointed out that over-regulation would certainly not make the crypto economy better.

Another major cryptocurrency hub in Asia has also seen several initiatives, but instead of increasing the pressure on the sphere, officials and state researchers have discussed how to act on the central bank-issued digital currency and exchange hacks. While the CBDC has been characterized as not requiring immediate implementation due to the high level of the risks that would follow, attacks on the local crypto exchanges and their prevention were mentioned at the joint summit with the United States focused on cybersecurity.

In the world of cryptocurrency, two questionable projects have attracted the attention of the observers. Responding to the report of the University of Texas in Austin composed by professor John Griffin and Amin Shams, Ph.D, Tether has released its own paper about the state of dollar assets allegedly backing their digital currency. Observers quickly noted that this was not a sensible audit and that the last year events mentioned in the Texas University research have not been mentioned at all.

Meanwhile, SkyCoin founder (or a person whose voice strikingly reminds of him) has admitted the existence of insider trading in the community - this has harmed the reputation of the altcoin for at least several weeks.

Bithumb was hacked, $30M in cryptocurrency are stolen. An announcement with a promise to return funds has been deleted which did not help to calm down the public at all. This once again raises the question of the current defense mechanism of crypto exchanges, indicating that the U.S. and the South Korean officials had a solid reason to raise the issue on the aforementioned meeting.

One can note how the news described above were mostly negative, but the crypto initiatives announced or launched this week are actually quite positive. For example, the large exchange Binance has managed to get in the process of establishment of a new startup platform in Malta together with the local traditional stock exchange. British Crypto Facilities have announced new crypto derivatives connected with Litecoin. In Russia, the first consequences of the laws on digital assets are emerging: major companies with close ties to the government are planning to launch crypto portfolios - individuals will be able to trade cryptocurrency through a special proxy firm.

As always in the world of digital currency, there can be actors who just play on the hype of the current events. The blockchain football-themed social media Olyseum has been reviewed by Bitnewstoday. It looks like that this technical innovation will be used only for merchandize and reward system, while the narrative that followed the launch of the site has made an impression that the whole blog system would be put on the blockchain.

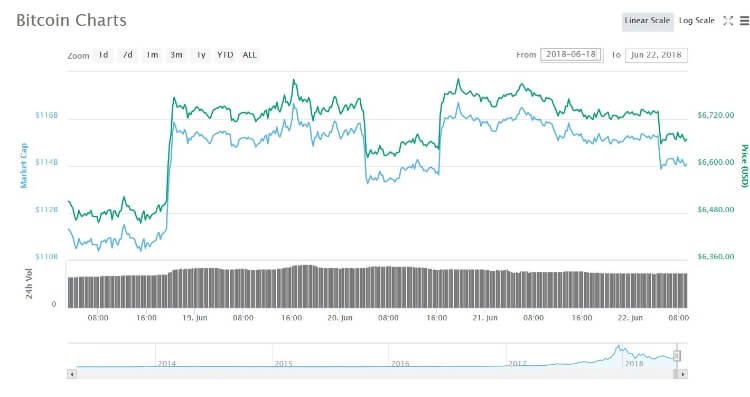

Cryptocurrency prices have shown a simultaneous slow growth after the previous tough bearish week. Notably, the price of Bitcoin has had a strange dip in June 20 as seen on Coinmarketcap - maybe it was connected with the hack of Bithumb after all. One should be careful when trying to explain the price motion by using the situational background, as dynamics don’t necessarily depend on the latest events.

Title image: Lawyer Monthly

All materials presented on this site are provided to you for informational purposes only