Mining Сrisis: Wild West Is Over

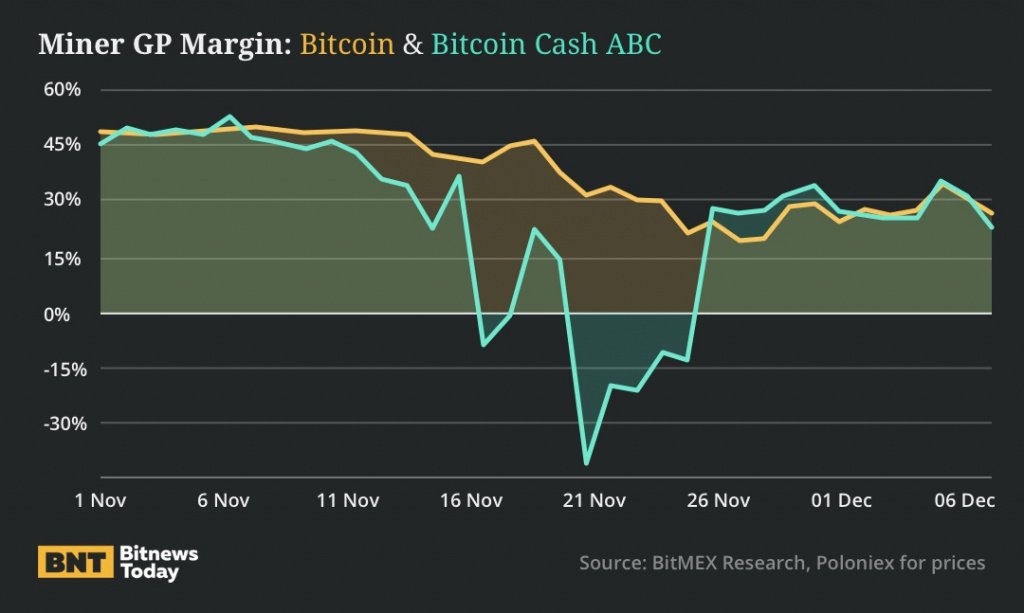

After Bitcoin Cash ABC and Bitcoin Cash SV have parted their ways, the gross profit of Bitcoin Cash ABC went into negative. Two camps mined unequally in a race to have the most work chain.

«The fork was initially positive then turned negative. Anytime and in any industry where there isn't anything backing a service or product it can implode in seconds» - said in commentary for Bitnewstoday.com Trent PARTRIDGE, co-founder of a blockchain based mobile payment solutions company from the UK.

Ten days after the split, on 25th November, the Bitcoin Cash ABC mining profitability quickly rose to about the same levels as Bitcoin. This seems to be the end of the "hashwar", which turned out to be completely meaningless, since the end of the war did not have a noticeable influence either on the coins or on their value.

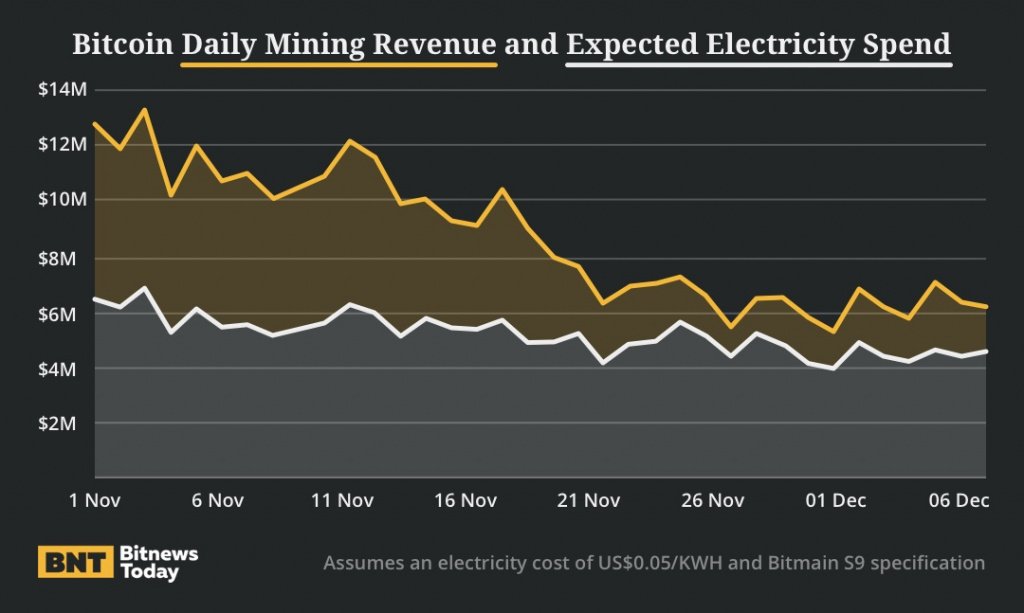

Bitcoin mining industry revenue has fallen from around $13M/day to $6M/day just in one month. From the 1st of November 2018, the Bitcoin price is down around 45%, while the amount of mining power on the Bitcoin network has fallen only by 31% and this represents more than 1 million Bitmain S9 miners being switched off.

The above gross profit margin charts do not show a complete picture because the only cost included is electricity. Obviously miners have other costs, such as the capital investment in the hardware as well as maintenance costs and building costs. Therefore, although the charts below show that the industry is highly profitable when only considering electricity costs, given other costs, the recent price crash has been likely to send almost all the miners into the red. According to real-time data from ASICMinerValue.com, only 2 Bitcoin rigs deemed profitable in December 2018.

Considering the current market situation, investing in mining companies is very risky at this moment and can lead to a complete loss of invested funds. “We are now witnessing a shake out in the mining industry with companies as familiar as Bitmain having to restructure their entire Israel operation as they have made some strategic mistakes in there long term vision. Bitmain is not alone in facing these challenges of a Bear market. There is also Canaan and Ebang which are smaller yet face similar problems,” - summed up in the interview for Bitnewstoday.com Michael GRAUB, the consultant of institutional hedge funds and Bitcoin enthusiast from US.This point of view is also adhered by our expert from Singapore. Michael LEE, the doctor of economic sciences and co-founder of a fintech company says, that mining as it’s today will be going until mid 2020 and obviously will be replaced by the more secured taken economic model. “I’m a bit more skeptical about bitcoin and believe that in early 2020 only a small group will use it or trade with it. I believe utility and security tokens will be the new crypto future. So let’s say in early 2020 I see bitcoin price is of $500-1000 or less!” - Dr.LEE considers.

Numerous experts are making assumptions that current prices might go down to the low-low price point of $2500-$2000 or even lower. And at the moment there are not clear signs where the psychological bottom will be found. However it’s safe to assume that when the situation of 2014-2015 repeats itself and there is a major bounce of 30%-50%, it will lead to an extended period of time of consolidation before the next wave up.

But there is one major problem that threatens the future of the market as a whole. According to Michael GRAUB, the main effect of the crypto winter is the psychological harm that it causes to both retail and institutions.