I Have To Dig Deep Into The Question. TOON #10

A bit more than a month ago we started a new section, so now the time has come for the first small anniversary of Bitnewstoday TOON. Our colleague, cartoonist Maxim Smagin always finds a unique ironic touch to any serious topic that we cover.

The digital economy is developing rapidly, and we try to create a special tone of voice, to speak about every event that takes place, as no one did before us. We are searching for the trends that others didn’t notice. We are looking for numbers, facts and comments that would explain events and collisions of the old and the new approaches in the business world. Also, we are detecting political snares that seek to restrain and control the rapid growth of startups and ideas; digging deeper into the legislation systems of the countries and how it affects the global market. We are telling how the traditional ways of the world economy are disrupted by the fundamental changes.

We see that you appreciate our work with the growing numbers of views of our stories. Today we present you the most read articles for the last few months. It’s time to remind which stories appeared to be interesting for our audience.

FinTech geography. Who’s in the vanguard?

As Bitnewstoday.com wrote earlier, the Policy Department of the European Parliament (Econ) published a report about competition in the field of FinTech, which certainly made the market players consider FinTech as the force to be reckoned with. Even if this force is currently in the very beginning of its development. In addition to the main topic and the particularly resonant thesis that Bitcoin and other cryptos are under threat from banking institutions, this study contains a lot of interesting statistics. A review of analytics and reports can lead to an important insight about the state and development of the FinTech companies worldwide. Let's try to draw conclusions where previously only numbers could be seen. (read more)

$500 Million — The Price of The Islamic Economy Global Expansion

Can the economy be influenced by global paradigms? Examples of the influence of religion on entrepreneurship are in the centuries: Protestant business ethics, the Buddhist cult of labor, and the Jewish entrepreneurial spirit. The digital age was not an exception. Despite the fact that Islam is the youngest religion, it influences the newest digital economic model. Therefore, the FICE crypto exchange, based on the norms of the Sharia law, started working in the United Arabian Emirates. (read more)

All of a sudden, for fintech partners, go to Africa

We continue to explore the intricacies of the FinTech geographical distribution around the world. As Bitnewstoday.com wrote earlier, the Policy Department of the European Parliament (Econ) published a report about leaders of FinTech. US world leadership is almost indisputable, as well as the “underdog” role of the European Union. Time has come to see what’s going on in the developing countries’ territory. (read more)

Over $3 billion for a coffee maker, washing machine and refrigerator

In May 2017 Yekaterinburg submitted to the Bureau of International Expositions (BIE) its candidature to host World Expo 2025. By the end of last year, the number of costs in case of Russia's victory was announced, which at that time ranged from 1,6 to 2,3 billion dollars. However, a few days ago, the head of the Ministry of Industry and Trade Denis Manturov announced a new amount of expenses – more than $3 billion. What can such money be spent for? (read more)

How DLT Can Reshape The Power Redistribution

Even though blockchain “took the world by the storm” and “walks all over,” it’s success in energy were seriously lacking for a long time. R&D prices were way too high, it benefits was inconclusive, hopes were far from reality. But with the passage of time, the situation has changed. What can blockchain give to the industry, aside from lots and lots of buzzwords, that are used to in ICO presentations to mooch out few millions out of the naive investors? (read more)

Gallup: 26% of investors are intrigued by crypto. But they are not buying it

Digital gold is a thing that everyone is talking about - tales and fables, scandals with everything surrounding made bitcoin a real legend. But that does not mean that it became mainstream. In fact- Mastercard CEO Ajaypal Singh Banga called cryptocurrency junk, only a couple of days after payment processing giant got a patent for cryptocurrency transactions via plastic cards (read more)

India becomes an epic battleground for the USA and China. Again. For crypto market now

One of the world's largest crypto instruments is the Chinese Huobi. It launches a peer-to-peer P2P platform for trading various cryptocurrencies for rupees without commission in India. And this is against the background of how all the country's crypto community is waiting for the verdict of the Supreme Court about the future of the virtual currency. By the way, the court does not hurry to make a decision, and the entire digital economy of India has been in limbo for 3 months already. In general, today India is one of the main newsmakers of the crypto market. So many events are not happening in any country of the world. What is the intrigue? Maybe the 200 years-old story is repeating itself? (read more)

Revolution Or Sabotage: Scaling Through A Bag of Bitcoins' Blockchain

Scalability - this is an endlessly painful theme and constant headache for the blockchain enthusiasts and everyone blockchain or crypto-curious. If we forget about the technical detail - the thing is that blockchain at this point of time does not scale well and that puts considerable boundaries on it's usage. Sure there are solutions. “Lightning” network and similar systems work, but potentially they take the "crypto" part out of the "cryptocurrency". Sharding works fine but in most cases it requires a hard fork that causes numerous technical issues and overall difficult for the development team. Various ICOs offer a solution but in most cases it ends up being a fun game of the “Spot the scammer” among thousands and thousands of CEOs offering to speed up to the Visa and Mastercard transactions.(read more)

British Banks Sabotage The Royal Coin. Are They Voting For Dollar?

Great Britain was the first country in the Western world, which announced the plans to create a cryptocurrency. The release was to be held in 2018. Two-thirds of the year has passed, but not a word has been said about the British crypto miracle yet. The latest reports about this project are dated by December 31 last year. (read more)

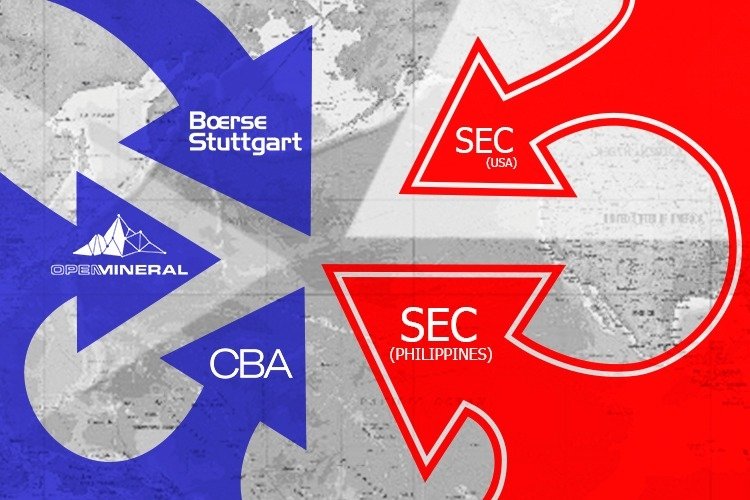

Resource-based token as an excuse for a new geopolitical struggle round

Like all roads lead to Rome, interests of business and power always meet in one point, called geopolitics, national interests and domination strategy. This oncoming traffic is proved by several facts. The real sector of the economy seems to have finally believed in cryptology. And regulators believe in the real sector. Therefore, in the foreseeable future, the digital market is expected by regulations, control, sanctions and other amenities of the familiar economy. Where is such confidence from? (read more)