What will the Bitcoin turbulence end in: stability or disaster?

After the Bitcoin value skyrocketed almost up to $3000 this June, everybody started to talk about it. Even the common people complained that they should have bought the cryptocurrency when its cost was mere pennies. However, the overall hype and uncertainty led to a total ‘rate quake’. Will this currency succeed in getting out of turbulence in the near future? Bitnewstoday.io finds out.

Ups and downs

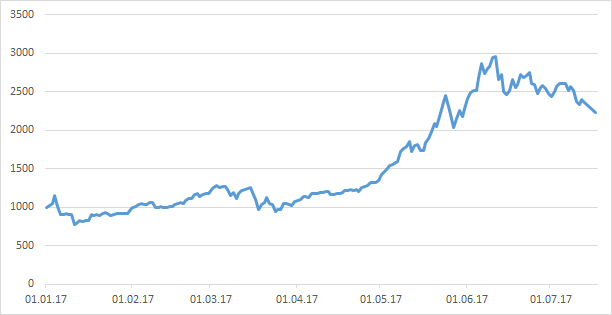

During the last two weeks, Bitcoin lost more than $200 of its value. On the moment of writing this article, the cryptocurrency was trading $2228.54, while in June it was trading up to $2500.

The hottest day for Bitcoin was July 7, when the value decreased to $2498.87 and increased to $2916.14. Nonetheless, the rate stabilized at $2518.66 before the close of exchange.

Chart 1. Bitcoin Price Index in 2017

What shapes the Bitcoin rate

The Bitcoin value is determined by three factors. The first one is the costs of Bitcoin mining, search and production. The second one is the miners’ fee. And the third one is escalating speculation process formed by the growing number of laypersons on the market, experts say.

“As a matter of fact, speculative markets are good in a way that you can earn a considerable revenue if you guess the trend correctly and, accordingly, lose much if you don’t. Therefore, depending on your strategy, you can try to fish in troubled waters. Or, rather, to fish Bitcoin on its low rate, expecting the value to grow. If Bitcoin continues to function properly, if there are no cataclysms, the value will increase”, – points out Konstantin Korishenko, head of Stock Markets and Financial Engineering Department of the Faculty of Banking and Finance in the Russian Presidential Academy of National Economy and Public Administration (RANEPA).

Uncertainty

Experts connect the fall of Bitcoin exchange rate in recent weeks primarily with the uncertainty that emerged due to upcoming changes in the cryptocurrency protocol. The growing number of Bitcoin-related operations leads to the growth of transaction prices, as well as increase in time allotted for their processing. All this resulted in a new problem — scaling of the cryptocurrency.

In order to give Bitcoin the capacity to develop and efficiently deal with the growing amount of operations, one must consider the increase of transactions in every block.

The solution of this problem becomes even harder as there is no one responsible for the development of Bitcoin (or any development center), so any changes are possible only as a result of consensus achieved among all cryptocurrency developers and miners. Thus far, attempts to reach the overall resolution proved fruitless, although, according to experts, all key dates connected with any changes in the Bitcoin protocol are usually scheduled from the very end of July to the beginning of August.

“That is why the last week of July and the first week of August are critical for Bitcoin’s future. In case of successful implementation of protocol changes the price of Bitcoin will most likely resume its rapid growth. The lack of success, however, might lead to Bitcoin breaking into two independent cryptocurrencies, and, as a result, to a sharp drop in the value. On top of that, in some cases some transactions made during these days might nullify.

All this keeps the cryptocurrency market in a very strong stress, makes many people refrain from investing and, all in all, weakens Bitcoin. Furthermore, the market is very sensitive to any news connected with the protocol update process. For instance, the recent news on possible vulnerability of Segwit2x implementation (this scalability solution is among the most promising) led to a ~10% drop of Bitcoin at the beginning of the last week”, - notes Igor Runets, the Founder and CEO of Servers.Gloval Corp, the Founder and CEO of Polar Star LLC.

If the actors don’t reach a common ground, this will show the weakness of blockchain as a technology that provides equal rights to all parties and obviates any unified center.

When will Bitcoin leave the turbulence zone?

The analysts believe that Bitcoin will pass through the turbulent stage of its evolution at the beginning of August. However, nobody is sure enough to predict the actual outcome. Some experts think that if the protocol update implementation is successful, one can expect the rapid growth again.