What happened on the crypto market this January: top hot topics

The nerve-racking price of Bitcoin

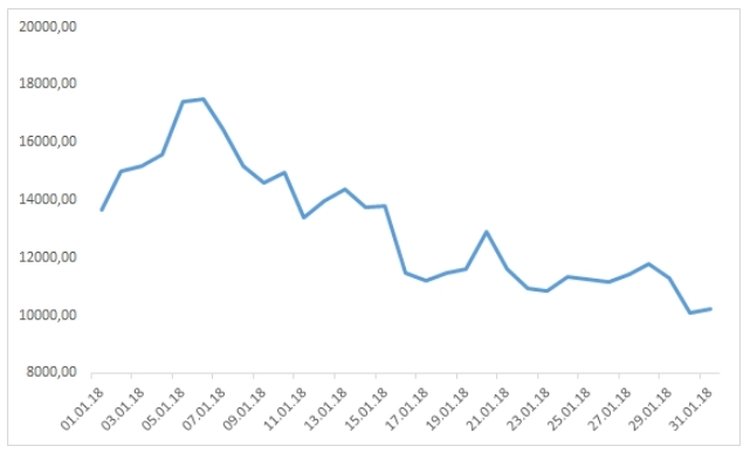

Cryptocurrency investors had a rather exhausting January: time and again, Bitcoin (together with a group of altcoins) was hitting psychologically important minimum values. After the upbeat growth to the level over $17,000 during the first week of the new year, the price of BTC has rapidly rolled down and at the end of January it has reached $10,000 in this continuous roll. There’s even more, several times BTC has went below this rock bottom: in January 17, the exchange rate of the coin has dipped to $9,402, and in January 31 – to $9,777.

Pic. Bitcoin value dynamics, January

Source: Coinmarketcap data

There might be several reasons of this Bitcoin price dive. Firstly, last year, the price of BTC was growing with a breakneck speed and it had to be stopped and change into the phase of correction simply due to the natural market patterns. Secondly, the messages on how China was planning to block access to crypto marketplaces, and it’s worth noting that both regional and foreign exchanges were taken into consideration; other messages on the intentions of the South Korean government to ban cryptocurrency trades; and reports on the plans of Indonesia to find those who conducts Bitcoin transactions and punish them.

Hands off the Korean crypto dream!

In January, South Korea was the most mentioned region in the cryptocurrency-related reports. During the first days of the month, a scandal burst out due to the governmental statement on the plans to prohibit cryptocurrency exchanges. This aside, Bithumb and Coinone were searched by the law enforcement and accused of tax evasion.

The local opposition has immediately stated that the draft on cryptocurrency exchanges’ prohibition is a mockery towards the citizens of the country, as any imprudent statements lead to the downfall of prices and cryptocurrency investors lose money. Furthermore, the active citizens petitioned the authorities (200 thousand signatures). In this petition, they noted that people who invest in crypto are not fools, but they want to embrace the fourth technological revolution and demanded not to shatter their “crypto dream” from the government.

Apart from these events, the South Korean Financial Supervisory Service (FFS) is checking the information on possible inside crypto market trading in which the high-ranking officials were involved. Allegedly, they sold their crypto assets before additional demands for the local crypto exchanges have been announced.

Indonesia vows to punish companies which use bitcoins

The regulator of Indonesia has stated at the beginning of January that it does not recognize Bitcoin and altcoins as legal means of payment within the state territory. This was followed by the vetting of companies in Bali. The Bank of Indonesia has threatened to punish any company which conducts Bitcoin-related transactions.

Infighting

The cryptocurrency community was alerted by the statement of the Block Explorer team in which they outlined the possibility of calling Bitcoin Cash a real Bitcoin, while actually this altcoin is a result of the fork of the original Bitcoin. They explained this by saying that Bitcoin Cash can be used in daily operations, while Bitcoin is more like a collectible by now.

New big crypto score

Coincheck, a Japanese exchange, has been robbed of the vast number of its assets. The wallets lost 533 million dollars in NEM, a cryptocurrency. As a result, the exchange will have to compensate losses for 260 thousand of investors.

World-famous cryptophobes allayed towards cryptos

Jamie Dimon, JPMorgan Chase top manager, has expressed his regrets over his previously-voiced Bitcoin hate speech. He still noted that the blockchain technology actually deserves much more interest.

Goldman Sachs analysts believe that major cryptocurrencies might become low-yielding assets and prove as a safe haven akin to precious metals. But specialists believe that the market of cryptocurrencies demonstrates all ‘red flags’ of the speculative bubble.

Experts have reached a conclusion: the concept of cryptocurrency is itself rather interesting and can introduce benefits for the society in the form of transactions’ minimization, decrease of corruption and it can also ensure property rights. But they believe that Bitcoin is not capable of doing so.

However, skeptics deem the death of the crypto market imminent. In one of the most noteworthy examples, Warren Buffett, one of the richest people on Earth, thinks that the cryptocurrency market would ultimately fail. Steve Wozniak, co-founder of Apple Inc., has expressed his disappointment in cryptocurrencies and sold all his bitcoins.

The end of the month was marked by the ban of cryptocurrency-themed and ICO-related ads imposed on Facebook. The official statement says that FB would delete all such advertisement and called for the help of users in this endeavor.

Bitnewstoday will further monitor the events related to the cryptocurrency industry.