The Rise of Merger & Acquisition Due To The Fall Of Crypto Prices

“Get rich quick” schemes are not working anymore, scammers have been restrained by new regulations of KYC & AML as well as increased awareness among investors of how to identify scam ICOs. The regulators has been working hard to alert celebrities to eliminate their influence from obscure ICOs, has issued guidelines for blockchain startups to follow, and are creating online content to help investors spot fraudsters. A lot of milestones achieved, but the cryptocurrency prices suffered a great downfall. The situation looks gloomy for some of the projects trying to survive desperately. However, this is a great opportunity for M&A activities to make the current market much healthier than it is.

The aftermath of turbulent crypto market: losses on all frontiers

The prices of cryptocurrencies were artificially inflated during 2017, partly due to excessive excitement for a new technology and partly due to scams and trading bots which manipulate crypto prices at the world leading exchanges. All of these factors has diminished over time, the masses realized that blockchain will need several years to realize its potential.

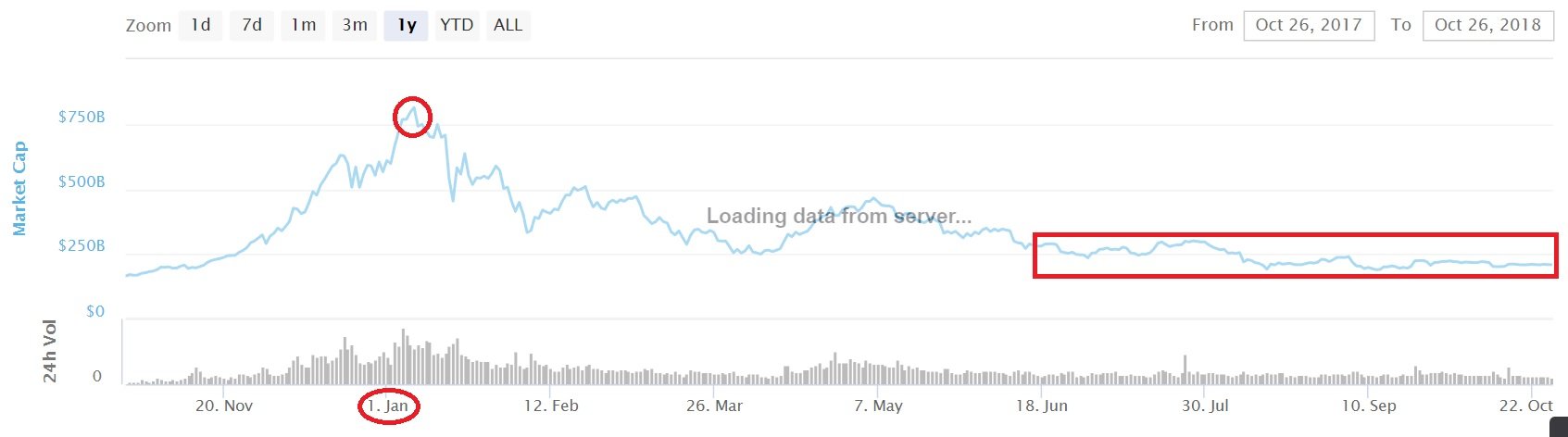

The current market situation seems to have consolidated and reached a common consensus about acceptable crypto prices. This can be seen both from the historically reduced volatility (while keeping similar trading volumes) and the price stability for a longer period of time. If we look at the below graph, we can see that the overall market cap of all cryptocurrencies has been hovering around the $230 B, while in January 2018 it has hit the $800 B of all time high.

The fall of crypto prices has disappointed many investors, especially those who joined towards the end last year. Those people got trapped by the fast fall of crypto prices, where they did not have the time to sell before it is too late. At the time, many analysts expected that the market will go through a minor correction and then rally again to new all time high. However, they were actually mistaken and those who believed them either had to sell for loss, or had to hold on up to 90% loses of their portfolios.

Most of the newly created blockchain startups has raised funds through ICOs, which means that they have minted some tokens and associated their value to an existing cryptocurrency, whether that is Ethereum (which has been the most dominant since 2017 and is still so) or any other crypto. Such startups has lost much of their value during 2018 due to the major crypto price correction too.

Let’s have a look at the M&A as the bright side

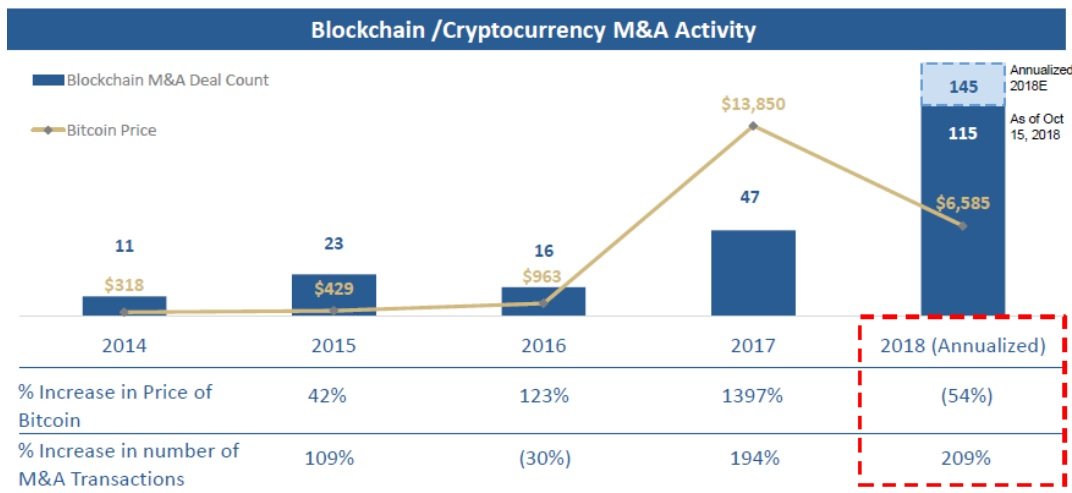

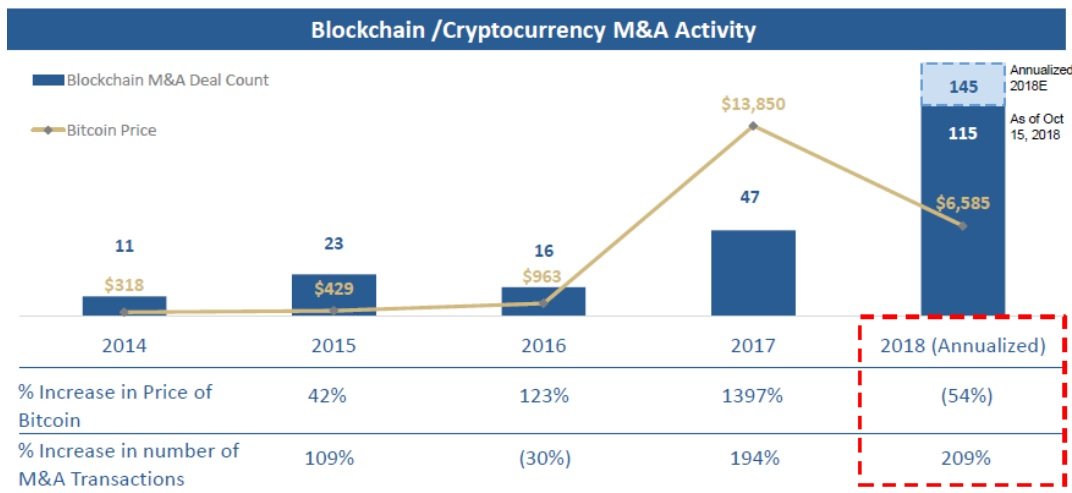

If we examine the blockchain industry outside of daily crypto prices fluctuations, we can see that there is a positive side to the crypto price collapse. Current situation is much needed to help the new technology survive for the long term. According to JMP Securities and data from PitchBook, Merger and Acquisition activities for blockchain technology companies has more than doubled during 2018 in comparison to 2017, with an expected number of closed deals by the end of 2018 to be 145 M&As.

This is absolutely no surprise, as such activities happen when the prices get lower and companies with enough capital use such opportunities to strengthen their strategic market position through the acquisition of competitors or companies which complement their current services. M&A leads to stronger and healthier market conditions for the long run, as it creates higher density among the currently fragmented market, as well as it helps businesses run more efficiently with reduced costs. If we have a look at traditional businesses, we can see a few large M&A which are worth almost as much as the entire crypto market cap. Take an example of Vodafone and Mannesmann or America Online and Time Warner which was worth over 180$ billion and 164$ billion accordingly.

In the below graph we can see the correlation of Merger & Acquisition activities in relation to the price of Bitcoin. This data reflect actual numbers taken at the end of each year in comparison to the previous year. We can see the M&A activities has increased by 194% during 2017 compared to 2016, thanks to the lower prices for the first half year of 2017 which gave a good opportunity for visionary leaders to spot an emerging market and make strategic acquisitions right before the market skyrocketing. Despite the almost 200% increase of M&A during 2017, the momentum did not lose steam. To the contrary, it has actually increased even more to reach 209% of all M&As done during 2017, this is mainly due to the market consolidation during 2018 and to the price depreciation of both crypto and tokens.

Conclusion

To summarize, 2018 has been a tough year for investors who has joined the market towards the end of last year. In contrary, it has been the most successful year for blockchain companies with enough cash to acquire other companies within the same sphere. Now, such companies enjoy an easy access to a very scarce human resource like blockchain software engineers, or even executives who has actual experience in blockchain startups.

Since this sphere is relatively new, without M&A it could have been an extreme challenge for companies who have the cash to hire experienced candidates. Other benefits of M&As include market expansion beyond the current geographic location. Imagine a US company which wants to expand its operations in the Far East — it would have been quite a challenge to start from scratch, while through M&A the process can be made much faster and easier. Lastly but not least, M&As decrease the fragmentation of a scattered industry and increase efficiency by joining efforts of several companies towards a shared goal.