How to spend cryptocurrencies in this fiat world

Olga Rusakova from blockchain project MicroMoney explores how the crypto world interfere with a real one

Over the past couple of years, people experimented a lot trying to live for a certain period of time with no fiat money, paying for goods and services with only bitcoins. For example, the CNBC journalist Sema Modi did it for a week paying by bitcoins in New York retail stores and cafes. Kashmir Hill, the Forbes correspondent, did the same. She even managed to organize a trip, to dine at posh restaurants, and to give bitcoin tips to a girl in a strip club. All of the explorers thought that it was a bit tricky but a possible thing to realize.

Bitcoin ATMs

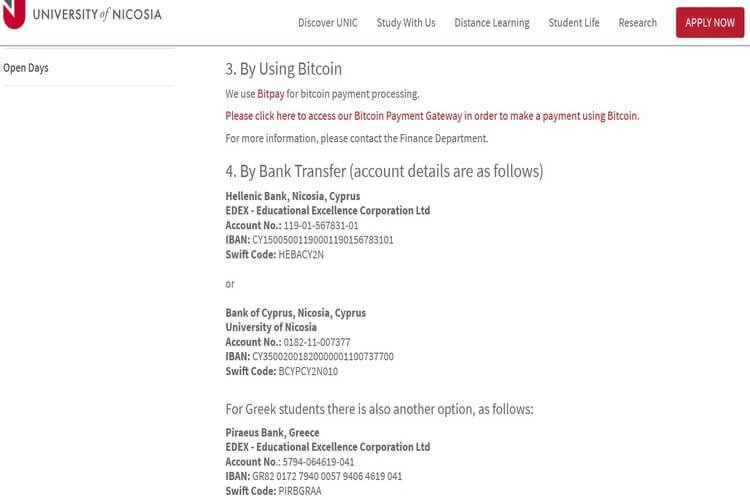

The first thing that comes to mind is the bitcoin ATM. According to Coin ATM Radar, 58 countries have Bitcoin ATMs, and there are about one and a half thousand ATMs worldwide (possibly more, because not all of the ATMs are registered within this portal). The first place by the number of ATMs take the United States, Canada, and the United Kingdom, and at the last – twenty countries with only one ATM per country – for example, Thailand, Brazil, and Kazakhstan.

ATMs look pretty up-to-date, smart and attractive, however, you cannot say the same for places where you can find them. Usually, they have a spot in small groceries or snack bars, although most of them are in busy areas close to city centers – the places easy to find. ATMs are often lost right between the bottles of alcohol and magazines.

Picture 1 and Picture 2

Bitcoin ATMs in London

Unfortunately, ATM can be used for bitcoins only, although there are now about 1070 coins in the world, according to CoinMarketCap. There's an ether and bitcoin Hybrid ATM out in the world, but there is no information where it is.

ATMs can be divided into two types – those that require ID verification and those that don’t. Type of verification depends on ATM vendor and the local legislation. A person can be verified by ID document scanning, by SMS verification (you should insert your mobile number and receive a code) or by biometry (palm scanning). There are vendors that produce ATMs combining all these methods.

Picture 3

You can be verified by biometric parameters and ID simultaneously

ID verification requirements are usual in countries where the cryptocurrency circulation is a subject to tax (e.g., the US, Singapore, South Korea, Japan, etc.). But even there the ATM with no requirements is easy to find.

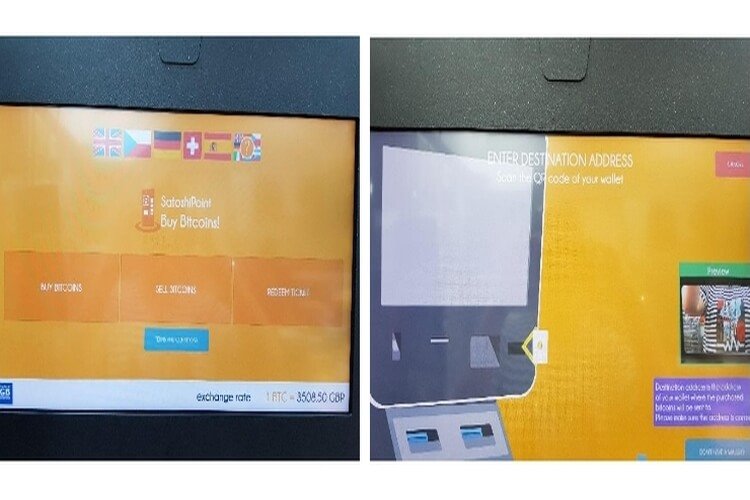

The process is following. Usually, ATM allows three or four types of operations: buy bitcoins, sell bitcoins and redeem sold, and transfer bitcoins to someone. For all these operations, a person needs an e-wallet as an application on mobile phone. Therefore, a user should choose any available option, display an e-wallet’s QR-code on a phone’s screen and scan it for ATM to receive the destination address.

If a user does not have any crypto e-wallet it can be immediately downloaded from the ATM’s screen (just scan the QR-code to start downloading).

Picture 4 and Picture 5

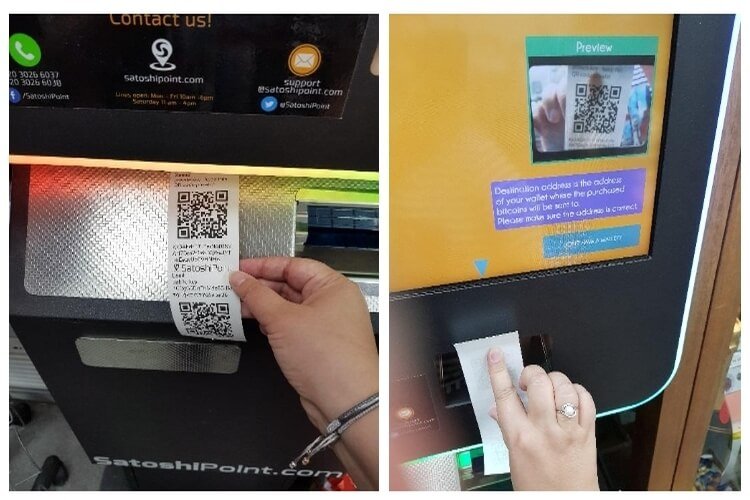

Alternatively, the system will offer to register a temporary paper wallet in the form of receipt or ticket with a private key and QR-code (looks like the crypto market is the only industry that uses QR-codes successfully).

Picture 6 and Picture 7

Paper e-wallets

When bitcoins are sold a person can redeem the ticket and withdraw cash (fiat finally). Don’t forget about the time to approve the transaction (it’s about 7-10 minutes average).

The issue is not only in waiting period but also in fees the ATM vendor and exchange take with the taxes in some countries. User sell or buy coins within the exchange, which means a customer sell bitcoins according to the rate is offering right now, so sometimes it is not the best and below market probably. In addition, there is a limit of $800-$1000 per operation depends on ATM vendor. The average sum to sell or buy is $200-300 so the more amount acquired means more identification requirements. So the large amounts seem to be not enough profitable to withdraw as a cash.

Online shopping

The most obvious way to spend virtual money in the real world is to go to online stores accepting bitcoins. In fact, there are hundreds of them from giants like Aliexpress or Overstock to tiny specialized shops with clothes, food, jewelry and much more. For example, cosmetics for mustaches, leather accessories or some meat snacks.

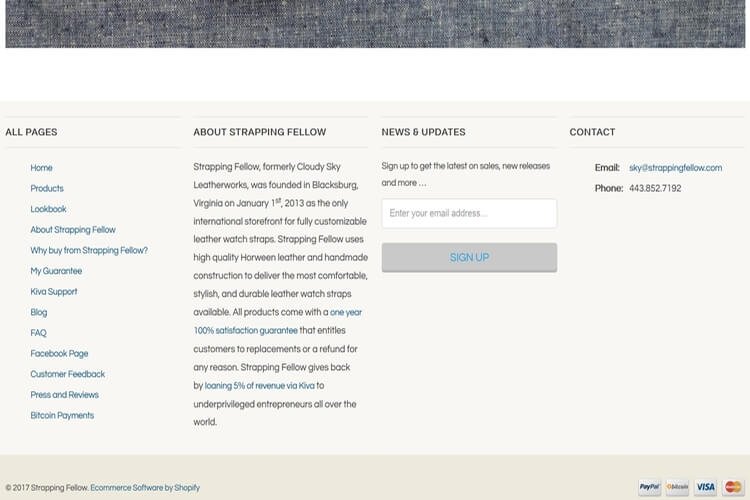

If a store accepts bitcoins, it will show it displaying the orange and white Bitcoin logo, usually in the bottom of the Home page in a row with other payment methods. Alternatively, with some other notifications, "Bitcoin accepted here" phrase, for example. Experts recommend checking for this option every time: some services announced it but deleted due to technical, local legislation reasons or because of low popularity.

The payment process is rather easy: after shopping, a system generates the Bitcoin address to send the payment or a QR code to scan with e-wallet on the mobile device. This is the most sensitive part of the process: in case user makes a mistake while copying and pasting before clicking "Send" button he or she has no goods and no money back: bitcoin operations are irreversible.

Some sites use a payment processor (for example, Bitpay or Coinbase) for incoming payments, so a customer is redirected to another page to receive a total amount in bitcoins and destination address.

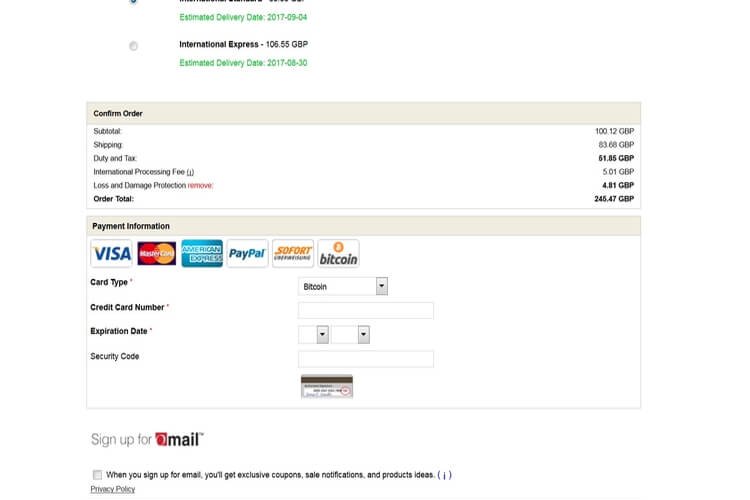

Picture 8

The proof that this service takes bitcoins as payment can be found here

Picture 9

Payment by bitcoin

Services

With bitcoin, you can rent a car, pay for domains and hosting, book a flight or hotel, eat in cafes and restaurants, make donations, buy gift cards, play games and much more. Here is the list of web sites to search for such services in a certain region:

CoinMap

Spendabit

UseBitcoins

Flight search engine Bitcoin.travel

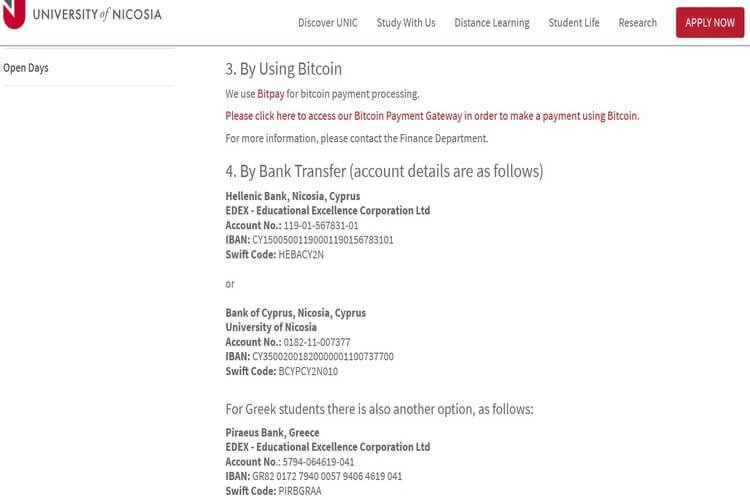

Even worldwide corporations use payments in bitcoin or tried them some day: Expedia, Dell, Microsoft, Overstock, etc. There are crafty services that allow using bitcoins for services that have never accepted bitcoins! Just buy a gift card by bitcoins with eGifter and Gyft, and pay with it for Uber or Starbucks, for example. Even Richard Branson’s private space company Virgin Galactic offered its customers to pay with bitcoins for the future space flights. The University of Nicosia in Cyprus did the same for the higher education and the University of Cumbria in the United Kingdom followed the practice.

Even Richard Branson’s private space company Virgin Galactic offered its customers to pay with bitcoins for the future space flights. The University of Nicosia in Cyprus did the same for the higher education and the University of Cumbria in the United Kingdom followed the practice.

Picture 10

Payment for education with bitcoins

There are districts and even entire cities, in which everything is comfortable and available for bitcoins payment. For example, in Zug, the Swiss city, everyone can pay with bitcoins for utilities and other public services.

Pros and cons

The cryptocurrency is popular and even legal in many countries, so the number of places you can spend your coins increases every year. Moreover, you don’t need to exchange your currency into the local one, by the way – it’s always just bitcoin. The other cryptocurrency advantage is the easiness you can get your e-wallet and open an account in a few clicks, even if you are a teenager with no ID yet. However, there are some weak points.

First, a penetration of bitcoins even in large cities is still low and you have to get to a place accepting bitcoins (and to find it there, of course). Sometimes you may be a first person ever to pay in such an eccentric way so you have to explain a cashier your intentions and all the process in details.

The second unpleasant thing is the hidden fees taken for transactions, payment processing, ATM’s using and other operations. All the researchers explored the bitcoin in everyday life we mentioned above complained they had the additional expenses up to 40% more in comparison with cash. And yes, the taxes sometimes go as VAT for cryptocurrency in some countries.

Thirdly, as a Bitcoin buyer, you are especially vulnerable to fraud because bitcoin transactions are irreversible, and if you get ripped off, there’s probably no way to get your money back. In fact, the process is similar to sending someone cash by post mail: you can send the money nameless but you cannot call off the transaction.

As a fourth thing, payment in other cryptocurrencies is hard to find. Probably, just on sites where people exchange something by something, including ethers and others.

The last but not the least thing to know: each crypto operation should be approved, and it takes time, so you can discover yourself waiting for an hour to just pay for your launch.

If you are not afraid of it – welcome to a new decentralized crypto world.