Fintech’R’Us: Сan Banks Keep Up With $41.7 Bln Industry?

One of my clearest memories of moving to Ireland in 2005 was how odd it was to see people queuing up to do business at the bank. Being Swedish, I was already used to the idea of banking online. Today not only are most of us moving money around digitally, but we do so from our mobile phones.

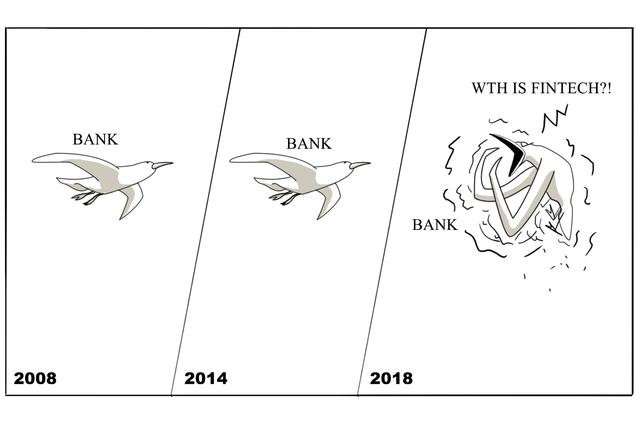

For banks, the big challenge is keeping up with this pace of technological change. But banks' adversity is FinTech's opportunity. FinTech, as the financial technology sector is known, is rapidly disrupting the way all sorts of payments are made, from cryptocurrencies like Bitcoin to 'tapping and going' at your local newsagents.

As a FinTech Adviser for the Nordic region, I hear about the topics of B2B payments, mobile payments and e-commerce on a daily basis, and it’s often from large, 'legacy' banks, concerned in the face of so much disruption. Traditionally the middleman of and clearing house for the world's cash transactions, what kind of role banks will play in the future is now up for grabs. What banks do know is that in order to sustain business and attract a new generation of customers they need a data-driven and digitalised organisation. The idea of going and queuing in a physical bank is not one that is attractive to the millions of young banking customers who do everything else on their smartphones.

But the challenge facing banks isn't just about providing a snazzy app. It's about figuring out how to manage — and capitalise on — the vast volumes of data that digital banking gives rise to. It's about providing secure payments in an increasingly cashless market, indeed, the Nordics are on track to be the first region in the world that is completely cashless within 10 years.

Cyber security is another big cause for concern, with increasing incidences of malware, phishing, fraud, identity theft and money laundering. The challenge for the banks is to implement a security system that is easy to use but still secure enough to meet the current threat levels. Many of the large banks are looking for biometric solutions like fingerprint or retinal scanning and face recognition.

Equally, many do not have a seamless solution when it comes to "on boarding" new customers. They struggle with cumbersome, inefficient and, ultimately, expensive processes. They don't yet have the systems in place to help them anticipate high-risk customers. Most bankers that I talk to are looking to find solutions wherein it is possible to sign up new customers simply but securely, with a system that automatically monitors and reviews customer data as it changes constantly.

Overarching all of this is the fact that big name banks are struggling to keep up with technological change. Most are operating on old legacy IT systems. The large traditional banks didn't fully understand the value of technology until it was too late. To be fair, the global financial crisis didn't help. But old legacy systems do not integrate well into the new world of smartphone and tablet banking, which means the traditional banking platform is simply no longer fit for purpose.

Come up with an innovative alternative and you'll find it's the banks that are queuing up to do business with you, not the customers.

About the Author: Tom Holgersson is International Business Development Advisor in Fintech, Strategy and Entrepreneurship (Nordics and Southeast Asia)