Summer.fi: A DeFi Platform Comprehensive Analysis

Introduction

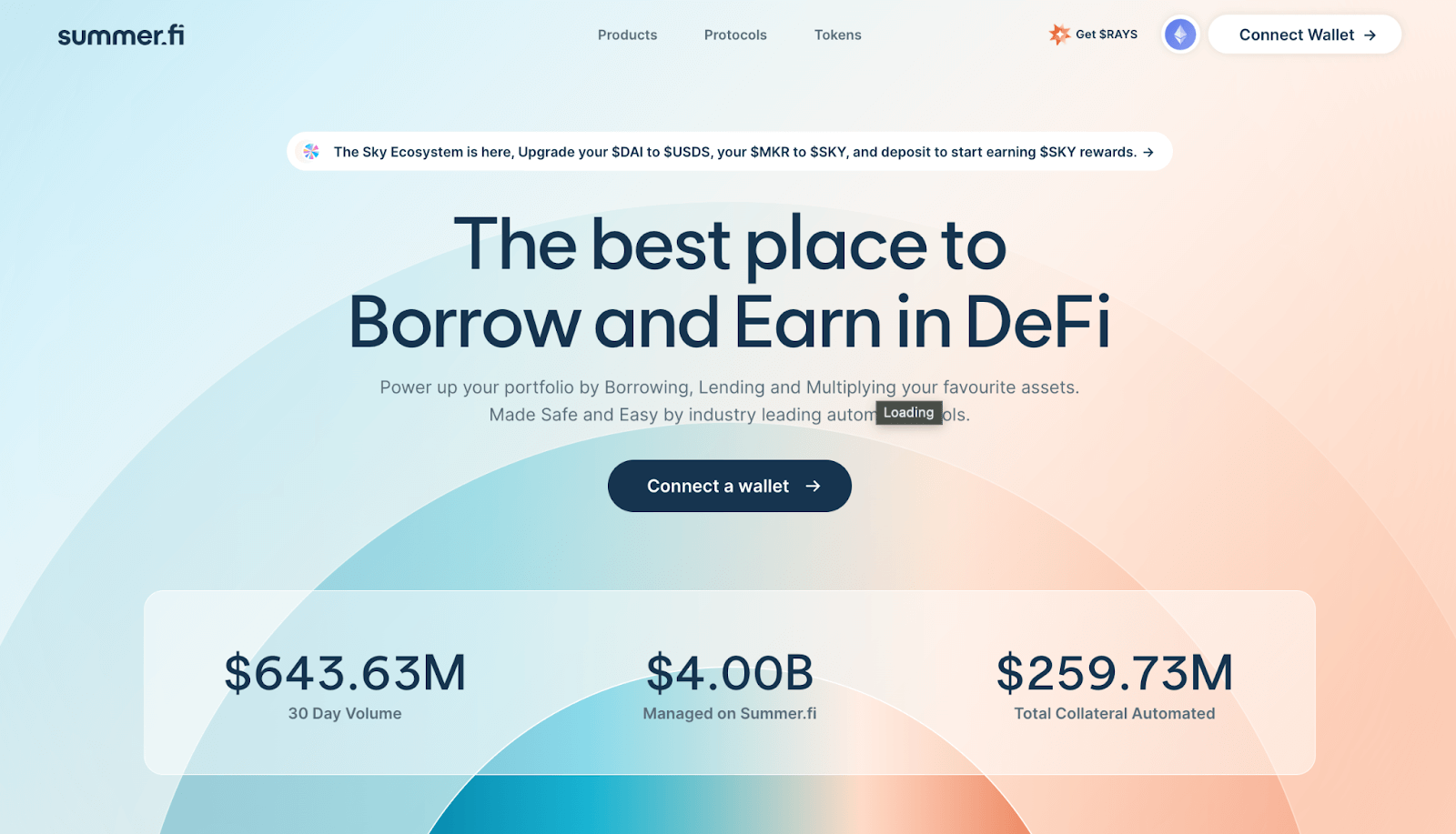

In the fast-evolving world of Decentralized Finance (DeFi), efficient position management is crucial for users navigating complex lending, borrowing, and investment strategies. Summer.fi has emerged as an influential platform designed to enhance DeFi position management with advanced automation, sophisticated tracking, and customizable strategies. The platform aims to make DeFi tools more accessible without compromising the depth and functionality expected by experienced users.

Core Proposition

Summer.fi is tailored for advanced DeFi users, with a core proposition built around sophisticated position management, risk mitigation, and operational efficiency. It emphasizes:

-

Advanced Position Management: The platform allows real-time monitoring and adjustment of leverage ratios, strategy automation, and gas-optimized transactions, all accessible through a single interface.

-

Risk Mitigation: Automated liquidation protection, intelligent collateral management, and health monitoring systems provide robust defenses against market volatility.

-

Efficiency and Automation: Streamlined smart contract interactions and bundled transactions allow complex operations to be executed with minimal manual intervention.

Product Offering

The Summer.fi platform offers a comprehensive suite of tools:

-

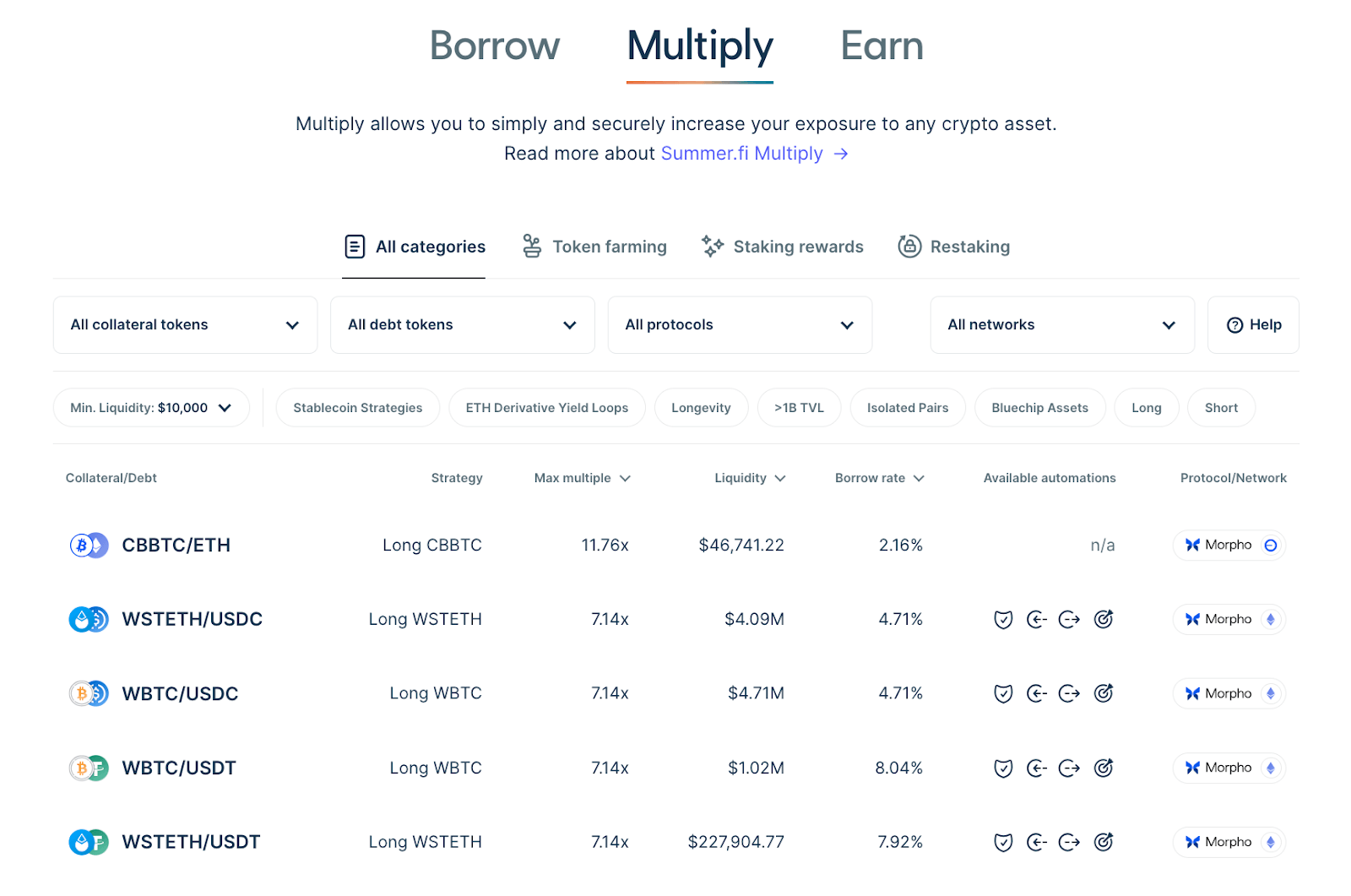

Smart Position Management: Multi-collateral management with cross-protocol support and advanced leverage tools.

-

Automation Features: Includes customizable triggers for automated adjustments and yield optimization strategies that reduce user involvement while maximizing returns.

-

Smart Wallet Integration: A non-custodial smart contract wallet enables efficient gas-optimized transactions across protocols.

-

Vaults: Users can create and manage Vaults for their assets, benefiting from automation capabilities and insights into other users’ strategies.

Strategic Vision

Summer.fi’s strategic vision centers on becoming the premier platform for sophisticated DeFi users by balancing accessibility with advanced functionality. The platform focuses on three core elements: seamless protocol integration, robust security, and professional-grade tools.

The platform targets experienced DeFi users while remaining approachable for newcomers, emphasizing interoperability and risk management. This positioning reflects Summer.fi’s understanding that the future of DeFi belongs to platforms that effectively bridge sophisticated functionality with user accessibility while maintaining security standards.

Impact on the DeFi Landscape

Summer.fi has made notable advancements in DeFi, primarily through automation and optimized transaction processing, raising user expectations across the DeFi landscape.

Key Innovations

- Automated Position Management: Summer.fi pioneered tools like Auto-Sell and Auto-Buy, allowing users to manage leverage and collateral ratios automatically, reducing liquidation risk and enhancing capital efficiency.

- Transaction Efficiency: The platform has reduced gas fees through transaction bundling, flash loan integration, and gas-efficient routing algorithms across networks like Aave and 1Inch, as well as using Layer-2 solutions like Arbitrum.

- User Experience Standards: Summer.fi has set benchmarks in DeFi by simplifying complex strategies within a user-friendly interface, adding features like real-time monitoring, transparent fees, and security measures.

These contributions help lower barriers to sophisticated DeFi strategies, establishing new standards in transaction efficiency, risk management, and accessibility for both novice and advanced users.

Competitors and Market Position

Summer.fi operates in a competitive DeFi ecosystem where various platforms serve distinct user needs.

-

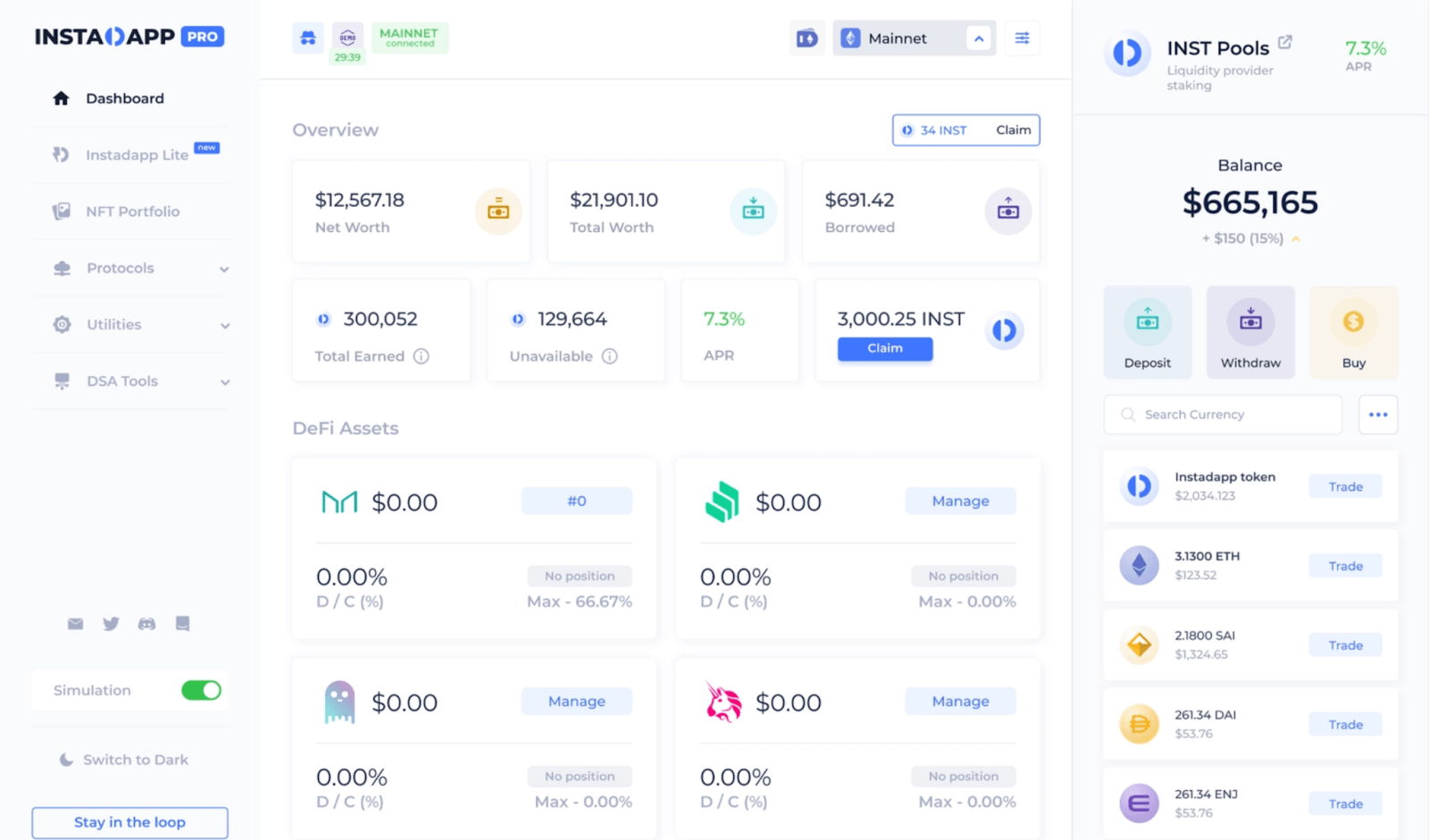

InstaDApp: Offers sophisticated protocol aggregation and powerful “Smart Accounts” for cross-protocol automation. Its extensive developer ecosystem and deep integrations appeal to users seeking maximum flexibility and customization. Although its interface may deter new users, experienced users often appreciate its comprehensive features.

-

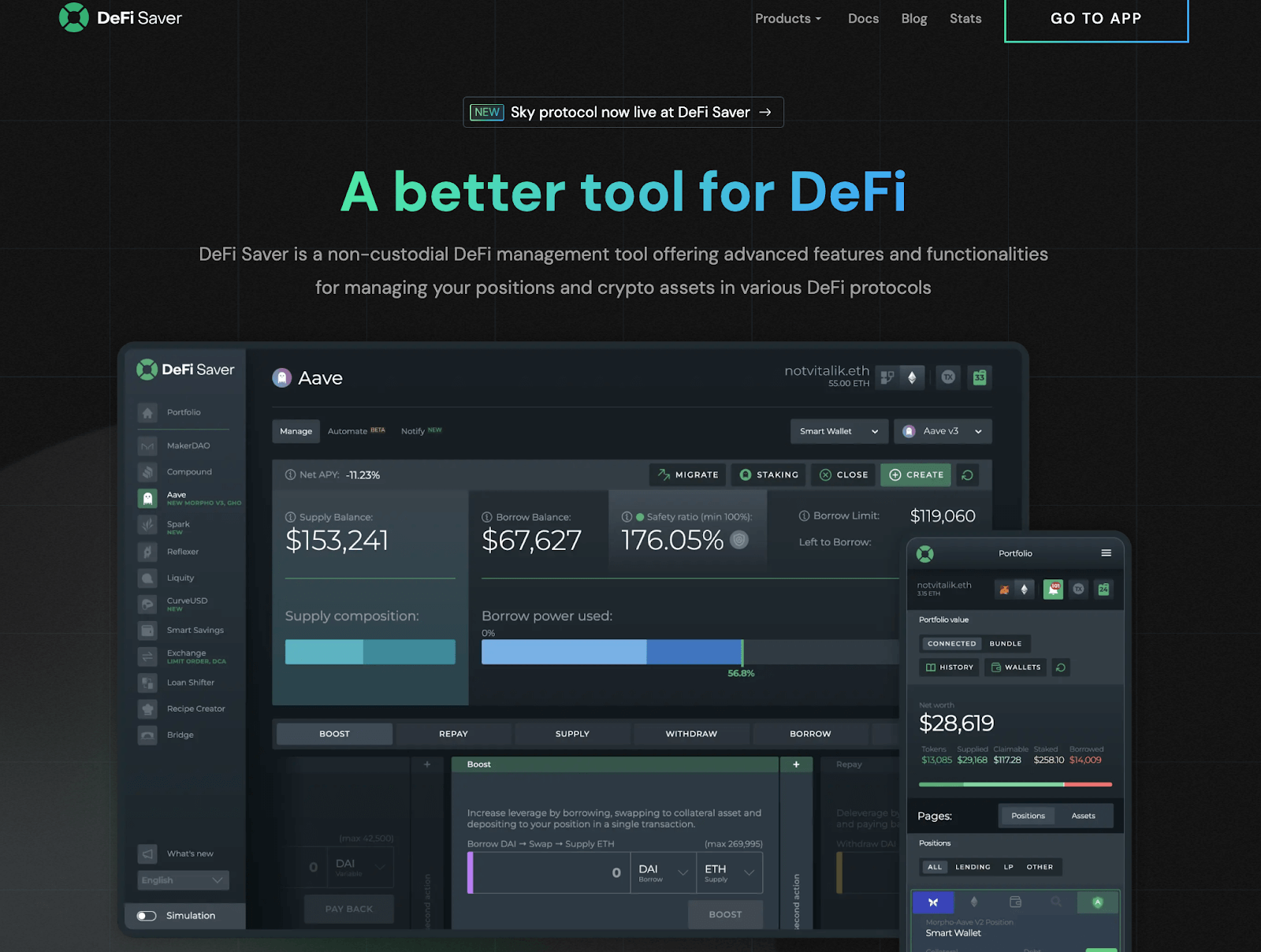

DeFi Saver: Specializes in advanced position and asset management, excelling for users of MakerDAO, Aave, Compound, and Liquity protocols. It offers automated position management, debt refinancing, and leverage management tools that are relevant to DeFi users seeking sophisticated control over their assets and risk.

-

Emerging players like Argent and Yearn are making strides in mobile Layer 2 solutions and yield automation strategies, respectively, each appealing to specific user segments.

Summer.fi has established itself as a leader in advanced position management and automation, particularly excelling in Maker Vault management. Its combination of sophisticated features with gas-efficient operations has attracted a growing institutional user base. The platform’s focus on professional-grade tools and robust automation capabilities serves advanced DeFi users well.

To maintain its competitive advantage, Summer.fi continues to innovate in automation and user accessibility while addressing emerging needs in cross-chain functionality and protocol integrations.

Related Projects and Ecosystem Integration

Summer.fi leverages strategic partnerships and integrations to optimize its capabilities across lending, automation, analytics, and trading. Below is an overview of key protocols and tools enhancing the platform:

Position Management Platforms

-

Spark Protocol: MakerDAO’s native lending protocol built on Aave V3 architecture with deep integration into Summer.fi, providing users efficient, non-custodial liquidity pools optimized for DAI-centric strategies.

-

Layer 2 Solutions: Summer.fi has expanded its presence on Layer 2 networks, particularly Arbitrum, offering users cost-effective position management while maintaining security and functionality.

Automation Infrastructure

-

Gelato Network: Provides core automation infrastructure for Summer.fi, enabling reliable transaction execution.

-

Keep3r Network: Enhances automation capabilities through its decentralized keeper network, managing recurring tasks.

Analytics and Security

-

DeFiLlama and Dune Analytics: Offer comprehensive protocol analytics, providing transparent, real-time metrics.

-

Security Partners: Summer.fi maintains high security standards through regular audits, real-time monitoring systems, and transparent security reporting.

Trading and Yield Integration

-

DEX Aggregators: Integration with leading aggregators like 1inch Network, ParaSwap, and CowSwap for optimized trading routes and pricing.

-

Reference Protocol: Summer.fi integrates with established protocols such as Aave, Compound, and Yearn Finance to enhance its yield strategies and improve capital efficiency.

Strengths and Areas for Improvement

Strengths

-

Advanced Position Management: Robust tools for managing leveraged positions and capital control, particularly appealing for secure capital management.

-

Automation Capabilities: Features backed by Gelato and Keep3r networks enable reliable transaction handling, essential for high-frequency activities.

-

User Experience: The platform’s intuitive interface and in-depth documentation support seamless navigation for all users.

-

Security: Audited smart contracts and a conservative approach to onboarding new protocols enhance user trust.

Areas for Improvement

-

Learning Curve: Integration with complex protocols may challenge new users. Enhanced onboarding resources could lower this barrier.

-

Protocol Coverage: Expanding support for Ajna’s unique features could increase utility for advanced users.

-

Mobile Experience: Developing a dedicated mobile app could enhance accessibility for users on the go.

Strategic Partners

Summer.fi leverages a network of strategic partners to optimize data, infrastructure, cross-chain operability, and advanced lending options:

-

MakerDAO: Facilitates efficient management of Maker Vaults and provides access to DAI.

-

1inch Network: Offers optimal trading routes and competitive token swap pricing.Aave: Enhances lending capabilities, providing access to diverse liquidity pools.

-

Ajna Protocol: Enables users to create lending pools for any token pair without oracles.

-

Spark Protocol: Enhances capital efficiency within the Maker ecosystem.

-

Morpho Blue: Introduces permissionless market creation with customizable risk parameters.

Future Outlook

As Summer.fi progresses, its roadmap focuses on several initiatives designed to enhance functionality and user experience:

-

Cross-Chain Integration: Expanding cross-chain capabilities will allow for lower transaction costs and broader accessibility.

-

Expanded Protocol Coverage: Actively working to broaden offerings and explore innovative protocols.

-

User Experience Improvements: Enhancing onboarding processes and developing educational materials. Plans for a dedicated mobile app are also in progress.

-

Innovation and Automation Initiatives: Committed to advancing automation strategies to optimize user engagement.

Conclusion

Summer.fi has established itself as a versatile platform within the DeFi ecosystem, especially valuable for users seeking position management tools. While its sophistication may present a learning curve for beginners, its commitment to security makes it indispensable for serious DeFi users.

The platform’s ability to balance complex functionality with intuitive design underscores its impact on the DeFi landscape. As Summer.fi continues to expand integrations and refine its user experience, it is well-positioned to remain at the forefront of DeFi innovation, empowering users to engage confidently in decentralized finance.