PrimeXBT Lead Analyst Kim Chua: The Return of $100 Oil?

The price of Oil has been on a tear lately, with US Crude surging above $66 per barrel for the first time since the pandemic. This comes on the back of rising demand as economies reopen after locking down for the most part of 2020.

With vaccination for the Covid19 virus advancing well in the USA and Europe, and beginning to take foothold in Asia, the chances for a renewed lockdown has been reduced significantly, leading to positive expectations that the worst is over and the world economy is en route to a sustained recovery.

After being locked up for most of 2020, economies are showing signs of strong rebound, with employment picking up significantly and demand for goods and services expected to increase substantially. Hence, demand for oil is expected to revert back to pre-covid levels or even higher in the months ahead as the world opens up.

This has brought the price of oil steadily rising since the start of 2021, with more good news about vaccines sending the price inching up. This week though, the price of oil surged even more dramatically as it rose 25% despite a very strong USD.

A strong USD typically makes buying oil cheaper in relation since oil is quoted in USD. However, last week’s 25% increase in price came amid a stronger USD, with the price of all other commodities trounced.

So, what caused the surge in oil price other than the post-pandemic demand?

A significant event last week shocked the markets and sent traders scrambling to buy oil.

Oil price rallied to the highest level in nearly two years in New York after OPEC+ shocked markets with a decision to keep supply limited as the global economy starts to recover from a pandemic-driven slump.

OPEC+ on Thursday decided to keep production levels largely steady into April, with Saudi Arabia also announcing that it would extend its voluntary one million barrels per day production cut. This comes on the back of an increase in the demand for oil, which will inadvertently drive the price of oil surging.

The group first implemented unprecedented supply cuts in 2020 in an effort to provide a floor as oil prices tumbled to historic lows. Hence, the lack of action with impending demand increase is seen as an effort to increase the price of oil to improve OPEC+’s profitability after a terrible year last year.

Furthermore, many US oil counterparts are not looking to increase oil production either as they plan to transition towards zero carbon emission oil products. Hence, more effort will be put into research and development on new products, rather than increasing capacity of existing oil production.

Occidental Petroleum CEO, Vicki Hollub, said during an interview that she doesn’t envision US oil production returning to pre-pandemic levels. She believes companies will focus on optimizing current operations and facilities, rather than seeking growth at all costs. She however, acknowledged that oil demand is recovering faster than expected, driven primarily by China, India and the United States.

Hollub reiterated on Thursday that the company is working toward net zero carbon oil production through its heavy investments into carbon capture and will not be increasing production. Hence, with US producers mostly out of the picture, and with Saudi Arabia’s production cut, the price of oil is expected to rise more with each positive news out of the pandemic.

Top banks are raising their price targets for oil this year into next year. Goldman Sachs raised its Brent forecasts by $5 a barrel and now sees the Brent at $80 by 3Q2021. JPMorgan increased its Brent projection by $3 a barrel and ANZ Banking boosted its three-month target to $70. Citigroup said Crude could top $70 before the end of this month.

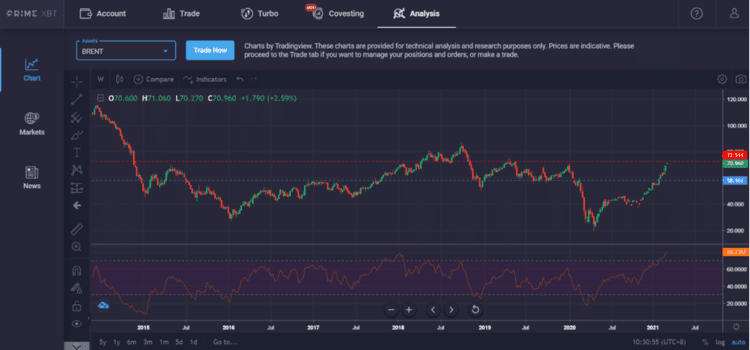

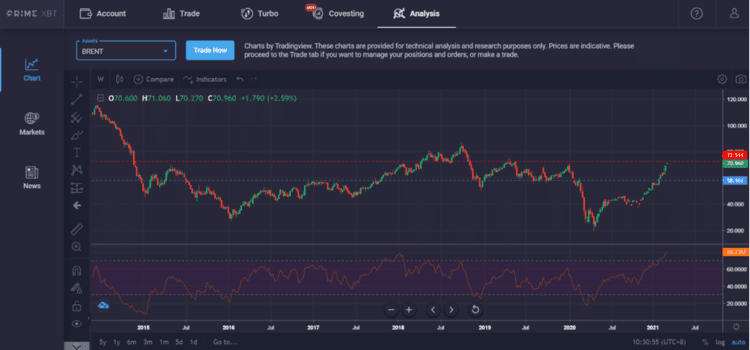

As at the start of this week, Crude trades above $67, while Brent is above $72. While oil is expected to continue gaining for the rest of the year, its current overbought conditions and short-term resistances may cause prices to consolidate for both Crude and Brent before attempting higher, especially when prices have already reacted to the supply shock announcement last week. In the event that prices retrace, good areas for entry for Crude is around $53 and that for Brent is around $58.

My personal forecast is for Crude to be around $90 and Brent at around $99 at the end of this year.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.