6 Things You Should Know Before Using Xlence – Xlence Review 2024

Xlence is gaining recognition in the world of forex and CFD trading, offering a broad range of features that cater to both beginner and professional traders. In this Xlence review, we’ll walk you through seven key things you should know before choosing Xlence as your broker. This guide will help you weigh the benefits and understand some areas for potential improvement.

1. Flexible Leverage Options

Leverage is one of the standout features in Xlence’s offering, providing traders with leverage options as high as 1:1000. This gives traders the opportunity to open larger positions in the market, making Xlence suitable for both conservative traders and those looking for higher risks and rewards.

High leverage is a double-edged sword, offering the chance for significant returns but also the risk of larger losses. Xlence’s flexible leverage options allow traders to find the balance that suits their strategy.

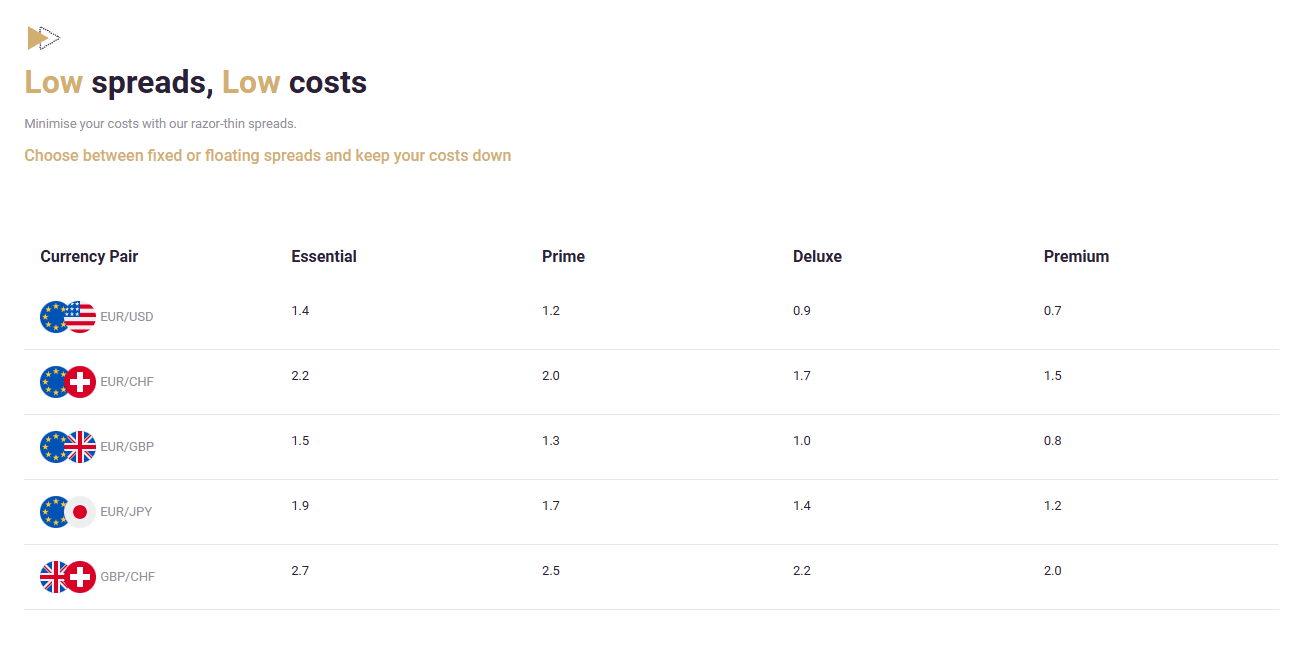

2. Xlence Review: Competitive Spreads & Trading Accounts

When it comes to spreads, Xlence shines with its low-cost trading. Traders can enjoy spreads as low as 0.7 pips on popular currency pairs like EUR/USD, meaning your trading costs are kept minimal. This is especially beneficial for high-volume or day traders looking to reduce transaction costs over time.

In this Xlence review, we dive into the broker’s competitive spreads, which vary based on the account type you choose. Xlence offers four distinct account options, each with tailored spreads to match different trading styles. Here’s a breakdown:

-

Essential Account: Spreads start from 1.1 pips on EUR/USD, designed for beginners looking for a straightforward, cost-effective trading experience without commission charges.

-

Prime Account: More competitive spreads starting from 0.9 pips on EUR/USD, catering to traders who want a balance between lower costs and flexible leverage.

-

Deluxe Account: Spreads as low as 0.6 pips on EUR/USD, ideal for more active traders seeking reduced trading costs and higher liquidity.

-

The tightest spreads available, starting from 0.4 pips on EUR/USD, offering professional traders the most competitive conditions for high-volume trading.

Xlence’s tiered account structure means traders can access increasingly tighter spreads as they progress to more advanced accounts. This flexibility ensures that both beginner and experienced traders can minimise costs based on their trading frequency and preferences. Whether you’re focused on forex, commodities, or indices, Xlence delivers attractive spreads across all markets.

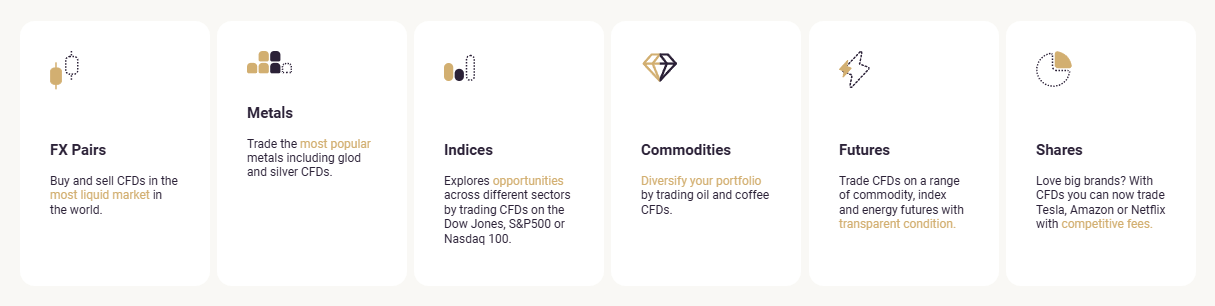

3. Wide Range of Tradable Instruments

This Xlence review wouldn’t be complete without highlighting the broker’s extensive range of tradable instruments. Xlence provides access to over 300 instruments across six major asset classes, enabling traders to diversify their portfolios. Here’s what you can trade with Xlence:

-

Forex: Over 80 currency pairs, including major, minor, and exotic pairs.

-

Metals: Xlence offers CFDs on precious metals such as gold, silver, and palladium. These instruments are popular for traders seeking safe-haven assets or those looking to diversify into commodities.

-

Commodities: In addition to metals, Xlence offers energy commodities like oil and natural gas, as well as agricultural products like coffee, crude oil, and sugar.

-

Indices: Major global indices such as UK 100, Nasdaq 100, and Germany 30 are available for trading, offering exposure to broader market movements.

-

Shares: Trade CFDs on globally recognized companies like Tesla, Apple, and Google, as well as other major corporations.

-

Futures: A variety of futures contracts in commodities, indices, and energy sectors for long-term trading opportunities.

This diverse selection of instruments makes Xlence a great platform for traders looking to explore various markets or hedge their portfolios.

4. User-Friendly Platforms

A key part of any trading experience is the platform, and in this Xlence review, we highlight the broker’s reliance on the ever-popular MetaTrader 4 (MT4) platform. Available on desktop, mobile, and web, MT4 is known for its powerful charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs).

In addition to MT4, Xlence also provides access to WebTrader, which is ideal for traders who prefer browser-based trading without the need to download any software. Both platforms are secure, reliable, and intuitive, ensuring a smooth trading experience.

5. Exceptional Educational Resources

If you’re new to trading or want to improve your strategies, Xlence offers a wealth of educational resources. This broker places a strong emphasis on education, which is crucial for beginners and intermediate traders alike.

-

Xlence Academy: Packed with courses on trading strategies, technical analysis, and market fundamentals, helping traders improve their skills.

-

Economic Calendar: Stay informed about key market-moving events, including earnings releases, economic reports, and geopolitical developments.

-

Trading Courses: A library of educational materials, including guides and articles, is available to help traders enhance their knowledge of different financial instruments and trading techniques.

These educational tools have made Xlence a go-to broker for traders looking to expand their knowledge base while trading.

6. Excellent Customer Support and Withdrawal Process

Finally, this Xlence review wouldn’t be complete without discussing their customer service and withdrawal options. Xlence offers 24/5 customer support that is responsive and available through multiple channels including live chat, email, and phone. Many traders have praised the professionalism and helpfulness of the support team in various online reviews.

In terms of withdrawals, Xlence offers a hassle-free process with multiple payment methods such as bank transfers, credit cards, and e-wallets. The broker ensures quick processing times, with most withdrawals being handled within a day or two. This is crucial for traders who need access to their funds without unnecessary delays.

Xlence Review Conclusion: Is Xlence the Right Broker for You?

As you can see in this Xlence review, the broker provides a strong offering for traders at all levels. With flexible leverage options, low spreads, and a wide range of instruments, Xlence has the tools to cater to both beginners and experienced traders. Additionally, the educational resources and top-notch customer support make it a well-rounded broker for those looking to grow their skills and confidence in the market.

While there’s room for improvement in areas like platform diversity beyond MT4, Xlence is a solid choice, especially for those seeking high leverage and a diverse portfolio.

If you’re looking for a broker that offers competitive trading conditions and robust educational support, Xlence is definitely worth considering.

All trading involves risk. It is possible to lose all your capital.