3 Token Unlocks That Could Sink the Market – Crypto’s Quiet Crash Triggers

The market feels calm — maybe too calm. Bitcoin is steady, volatility indexes are flat, and sentiment on X looks optimistic. But under the surface, three major token unlocks are quietly approaching, each with the potential to trigger a chain reaction of sell-offs across the market.

According to some online sources, these events will release over $312 million worth of new tokens. For traders, it’s the equivalent of sitting at a poker table where three big players are about to cash out at once — the odds for everyone else shift instantly.

In times like this, understanding your house edge matters. The crypto world has its own version of odds and strategy, much like gambling — the smart players don’t just bet on hype; they study the table. Platforms like LuckyHat.com and its reviews of crypto casinos show the same principle: play smarter by reading the rules before the game begins.

What Are Token Unlocks — and Why They Matter

In crypto, a token unlock is when previously locked tokens — usually held by founders, early investors, or developers — are released for trading. These events often follow vesting schedules to prevent founders from dumping their supply too early.

But when big unlocks arrive in a weak or thinly traded market, they can unleash massive sell pressure.

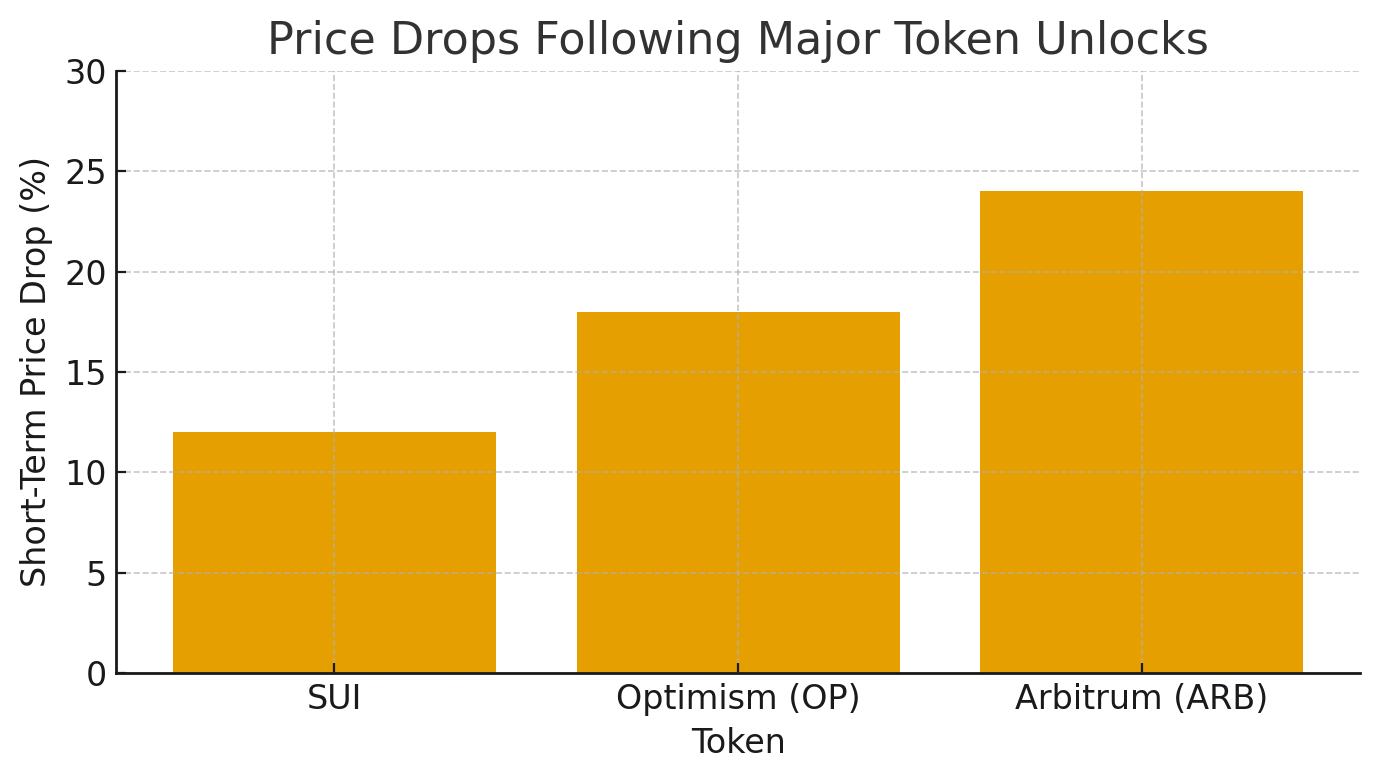

Historical data shows that major unlocks like those from SUI, Optimism (OP), and Arbitrum (ARB) were followed by short-term price drops of 10-25% and steep declines in social sentiment.

The reason is simple: new supply meets limited demand. Liquidity thins during downturns, amplifying volatility and turning small waves into market tsunamis.

The Three to Watch

1. Ethena (ENA) — DeFi’s Risk-Reward Paradox

Ethena, the synthetic stablecoin protocol behind USDe, is set to unlock roughly $135 million in tokens. ENA’s model allows yield generation from staked Ethereum derivatives, a double-edged sword that thrives on stability but collapses under volatility.

When Ethena’s early investors finally get liquid, analysts expect some will take profits. As The Block noted in its October preview, even modest selling can trigger a confidence dip in DeFi yields.

For everyday traders, it’s like a poker game where one player suddenly pushes all their chips in — everyone at the table gets nervous, even if the hand isn’t over yet.

2. Memecoin (MEME) — The Hype Machine Meets Reality

MEME’s upcoming $90 million unlock is the market’s wild card. Memecoins often run on sentiment alone, but this one carries the weight of big venture investors and influencers.

When those tokens hit the open market, liquidity will test just how much of the community’s conviction is genuine. Similar meme-token unlocks earlier this year saw price dips exceeding 40% within 72 hours.

As Cointelegraph observed, “meme assets are uniquely vulnerable to liquidity shocks — once the fun stops, so does the bid.”

3. Movement (MOVE) — Infrastructure With Institutional Weight

The MOVE ecosystem, focused on decentralized data storage and computation, is unlocking $87 million worth of tokens. While less meme-driven, its institutional backers mean bigger holders have deeper liquidity and faster exit options.

For investors holding smaller positions, MOVE’s unlock could feel like a rigged game: insiders control the pace of exits, while retail traders react to the aftershock.

This is where perspective matters. Just as Bitcoin casinos operate with visible odds and provably fair mechanics, smart traders must treat unlocks as visible probability shifts — not surprises.

Reading the Table: The Psychology of Unlocks

Token unlocks are predictable — dates, amounts, and addresses are public, yet markets still react with panic every time. The issue isn’t surprise; it’s psychology.

When early investors cash out, social media sentiment shifts instantly. Retail traders read that as a sell signal, which cascades into self-fulfilling dips. Analysts from IntoTheBlock note that even a 1% unlock-to-supply ratio can cause a 3-5% drawdown in total market cap during low liquidity phases.

It’s not unlike a casino streak, once the table turns, players start chasing losses instead of walking away.

Lessons from the Floor

- Watch the calendar, not the crowd. Token unlocks are scheduled months in advance. FOMO buys or panic sells rarely work.

- Track wallet behavior. Large pre-unlock transfers can signal insider positioning.

- Diversify your risk. Avoid over-exposure to tokens with major unlocks in the same week.

- Treat volatility as the “house edge.” The more emotional the market, the more advantage institutions have.

The Big Picture

What these unlocks reveal is not just investor impatience, but the maturing logic of the market itself. Crypto isn’t random — it’s behavioral math, gamified.

Just as players on LuckyHat’s crypto casino reviews learn to manage odds, traders must calculate probabilities before the cards hit the table.

When the next wave of unlocks arrives, the calm before the storm won’t be serenity — it’ll be the sound of chips stacking.