Proof of Stake is one of the two main consensus protocols used to verify transactions and secure blockchains. Proof of stake has recently been heralded for its energy efficiency and scalability, with the most notable example being Ethereum, which is gradually moving away from Proof of Work network to its improved version ETH 2.0, running on Proof of Stake.

What is Proof of Stake?

Briefly explained, Proof of Stake enables the parties willing in securing a network, to deposit a part of their tokens, their “stake”, to be able to produce new blocks. In return for securing the network the staking party is the rewarded. This has turned Proof of Stake into an interesting way to generate passive income on cryptocurrency assets.

Selection criteria

But each PoS blockchain will divide rewards at a different rate. We have done the research for you, to bring you the top 10 highest rewarding Proof of Stake networks that have paid out the highest rewards to their users over the last year. To get to this number we have used both the direct staking reward, as well as the 1-year price performance of the underlying asset. Both of these rewards are multiplied to give you the total gain over the last year. Therefore, projects that have been active for less than a year are excluded.

10-COTI (+570.02%)

Coin: $COTI

Staking reward: 10.00%

1-year price performance: +418.2%

COTI, short for “Currency Of The Internet, is an enterprise-grade fintech platform aimed at digitizing payments. COTI is designed to be used by retail merchants, governments, and stablecoin issuers.

With its ICO ending on June 4th 2019, COTI is a little over a year old. It can already be traded on major CEXs such as Binance and KuCoin. Although the coin has seen amazing returns in the past 12 months, it is still below its ICO price. Nevertheless, adoption of the network is growing with 5,000 merchants and 80,000 users onboarded so far.

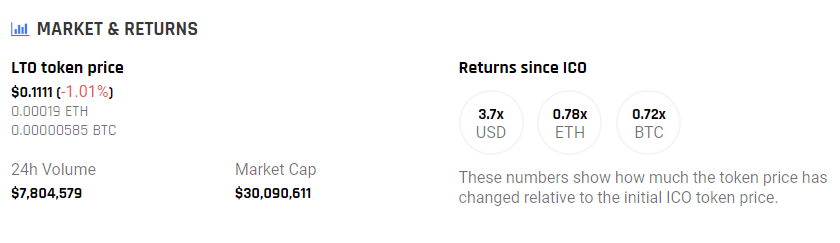

9-LTO Network (+587.77%)

Coin: $LTO

Staking reward: 9.19%

1-year price performance: +438.30%

LTO is a decentralized workflow automation blockchain that enables trustless B2B collaboration.

Similar to COTI, LTO can also be traded on Binance. LTO’s early investors already find themselves in profit, with the coin trading at 3.7x its ICO price in USD.

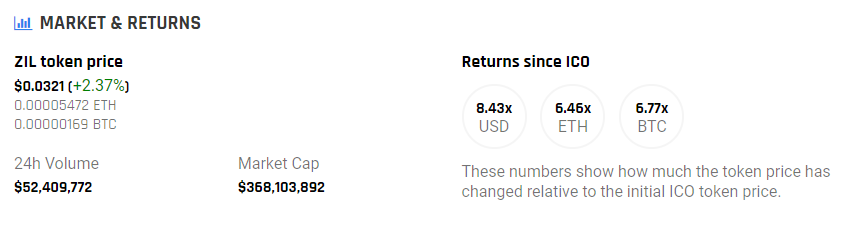

8-Zilliqa (+635.23%)

Coin: $ZIL

Staking reward: 17.57%

1-year price performance: +440.30%

Zilliqa is a blockchain designed to scale securely in a permission-less environments. Similar to ETH 2.0, Zilliqa’s pathway to scaling is sharding. This means that the blockchain is subdivided into smaller networks called “shards” that can settle transactions in parallel.

ZIL’s ICO investors are up a whopping 8.43x in USD terms! The returns are also positive in BTC and ETH. ZIL can already be traded on major exchanges such as Binance and Huobi.

7-NEM (+772.52%)

Coin: $XEM

Staking reward: 4.55%

1-year price performance: +638.90%

NEM is a smart contract supporting blockchain. The Singapore based foundation came in financial difficulties in 2019, which it was able to solve.

XEM can be traded on Binance and OKEx amongst others, and sees most of its volume on Korean exchange Upbit.

6-Kusama (+1228.03%)

Coin: $KSM

Staking reward: 14.15%

1-year price performance: +975.80%

Kusama was founded in 2019 by Gavin Wood. Wood also founded Polkadot and co-founded Ethereum, of which he was CTO. The network’s code is mostly copied from Polkadot, of which Kusama sees itself as the more risk-taking and fast-moving cousin.

Kusama’s main use is adoption by risk loving developers, or to be used as a test place for projects aiming to launch on Polkadot. KSM can be traded on Huobi, OKEx, and Binance among others.

5-Atomic Wallet Coin (+1230.37%)

Coin: $AWC

Staking reward: 23.00%

1-year price performance: +900.30%

AWC is the first token released by a decentralized wallet (Atomic Wallet). The AWC token offers benefits to its holders, such as staking, discounts on exchange services, bounty rewards, and other services.

On April 30th 2019, 50% of the ERC-20 supply was burned and migrated from Ethereum to the Binance mainnet as BEP-2 tokens. By combining staking rewards and price appreciation, you could have turned 1,000$ into 13,000$. Not bad for a one year investment. The coin is mainly traded on Binance DEX.

4-Waves (+1382.07%)

Coin: $WAVES

Staking reward: 4.52%

1-year price performance: +1222.30%

Waves is a smart contract enabling blockchain protocol. It enables development of DApps using the “Ride” languages, similar to “Solidity” on Ethereum.

Since its ICO 4 years ago, WAVES token has given an ROI of 40.21x in USD, equivalent to an increase of +3921%. It can be traded on Binance, Kraken, and Huobi amongst others.

3-Switcheo (+2828.98%)

Coin: $SWTH

Staking reward: 82.81%

1-year price performance: +1447.50%

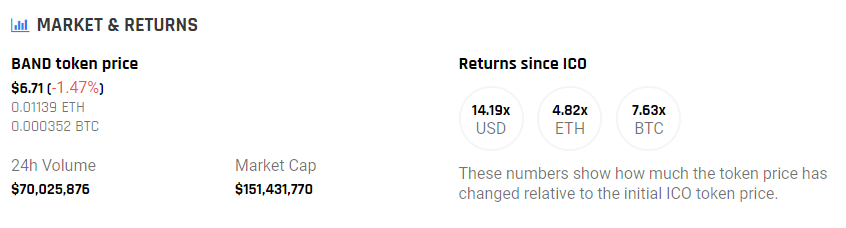

2-Band Protocol (+2905.21%)

Coin: $BAND

Staking reward: 12.64%

1-year price performance: +2479.20%

Band is a decentralized oracle, widely regarded as the #2 oracle behind market leader Chainlink. BAND was launched in 2019, with its ICO ending on the 17th of September after raising 10,850,000$.

ICO investors have seen a 14.19x return on their investment in USD. The coin can be traded on Binance and Coinbase.

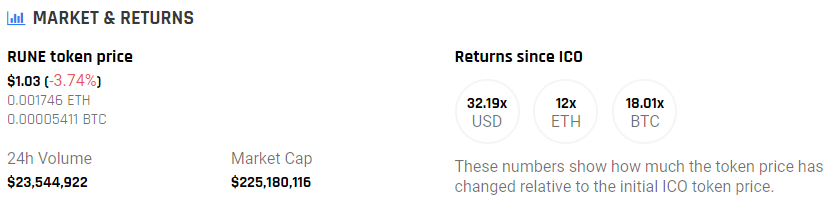

1-THORchain (+4426.40%)

Coin: $RUNE

Staking reward: +302.51%

1-year price performance: +999.70%

If you staked exactly 1000$ worth of $RUNE over a 1 year period and at the current rewards rate, you would have ended up with $45,264 by now! But what is the THORchain project behind the $RUNE coin really about?

THORchain is a multi-chain protocol. THORchain facilitates lightning fast cross-liquidity pools that work without the need for pegged or wrapped tokens. The project is currently valued at $225 million.

Since its ICO in July of 2019, the BEP-2 token has overperformed the market, returning 32.19x of its original price to the ICO investors. You can trade RUNE on Binance amongst others.

cryptoticker.io

cryptoticker.io