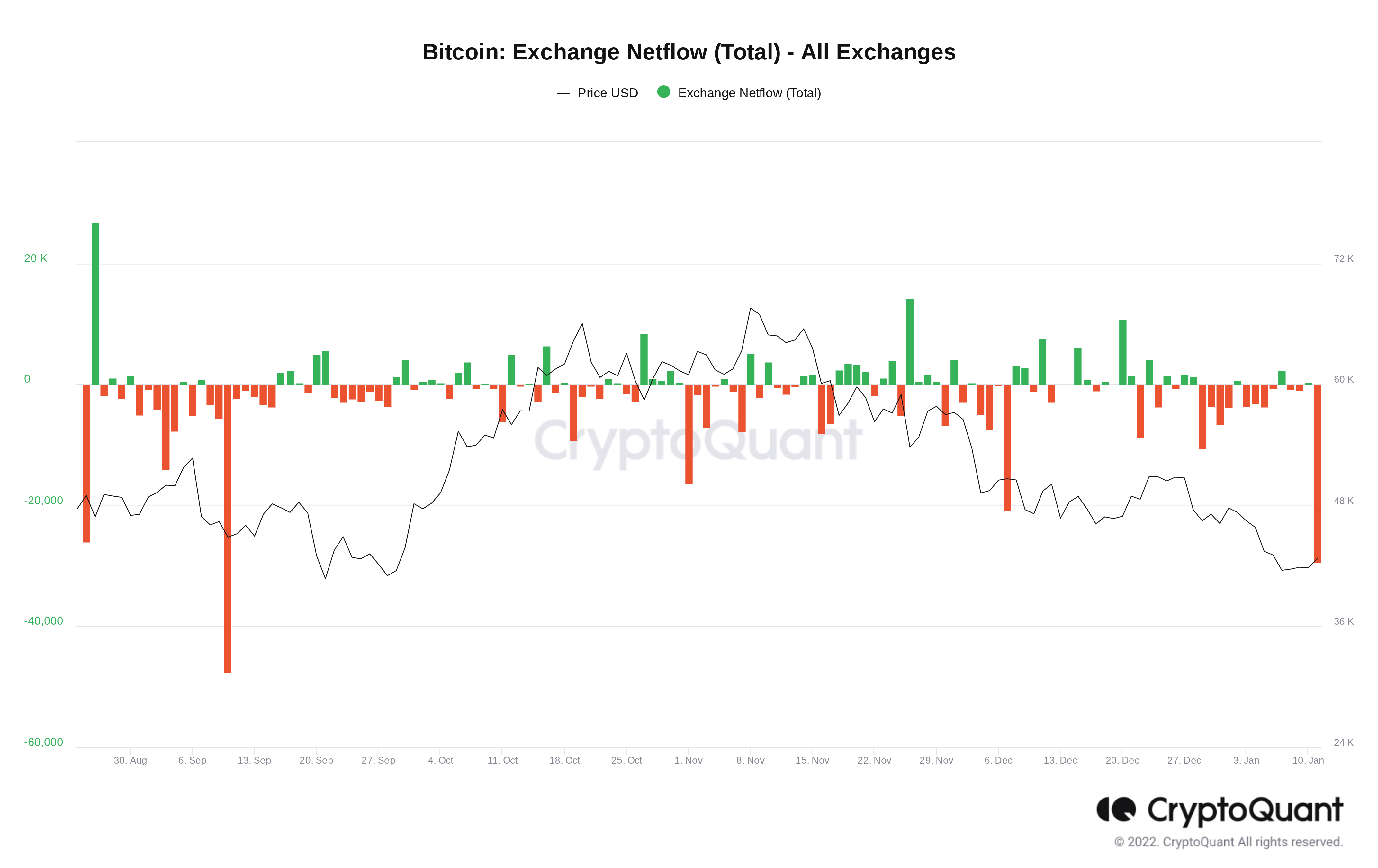

Bitcoin ($BTC) investors are voting with their wallets as one-day outflows from major exchanges near 30,000 $BTC.

Data from on-chain analytics firm CryptoQuant shows that on Jan. 11, 29,371 $BTC left exchange order books — the most since Sep. 10.

The four-month high in outflows corresponds to short-term optimism returning on Tuesday as $BTC/USD bounced and maintained levels above $42,000.

The pair subsequently went on to hit local highs of $43,150 before consolidating, this nonetheless a different turn of events to the widely-predicted cascade towards $30,000.

While such an outcome remains a topic of debate, buyers seem comfortable entering the market above $40,000.

For context, even the bounce which sparked the run to all-time highs at the end of September failed to produce as much buyer uptake as Tuesday.

"Volumes are thin. That means the market can have huge moves up or down easily," Samson Mow, CEO of Blockstream, commented on the status quo:

"Given that we had a big move down already, and everyone is buying like no tomorrow, I’d say the next move is up."

CryptoQuant tracks a total of 21 exchanges for its order book data. Last week, separate data focused on what one analyst described as a "crazy" imbalance between bids and asks, indicating that bears were finally beginning to tire of selling.

Buyers get bolder

Spot buyers were previously the main cohort missing from interest in $BTC at current price levels.

Related: Bitcoin returns to $42K as bets start favoring ‘short squeeze’ higher for $BTC

As Cointelegraph reported, miners continue to add to their reserves at an increasing pace this year, with long-term holders steadfast in their resolve not to sell.

Highlighting a bullish trend in the Bitcoin taker buy/sell ratio, CryptoQuant contributor IT Tech revealed a similar situation unfolding on derivatives markets.

The metric refers to the ratio of buy and sell volumes from takers on derivatives platforms. A value below 1 implies bearish sentiment, and while that is currently the case, the direction is up.

"If will cross 1 then we should have Bullish sentiment again and it chance to price trend reversal," IT Tech summarized in one of CryptoQuant's "Quicktake" posts Wednesday.

"Personally I am preparing to final bull run which will come sooner or later."

cointelegraph.com

cointelegraph.com