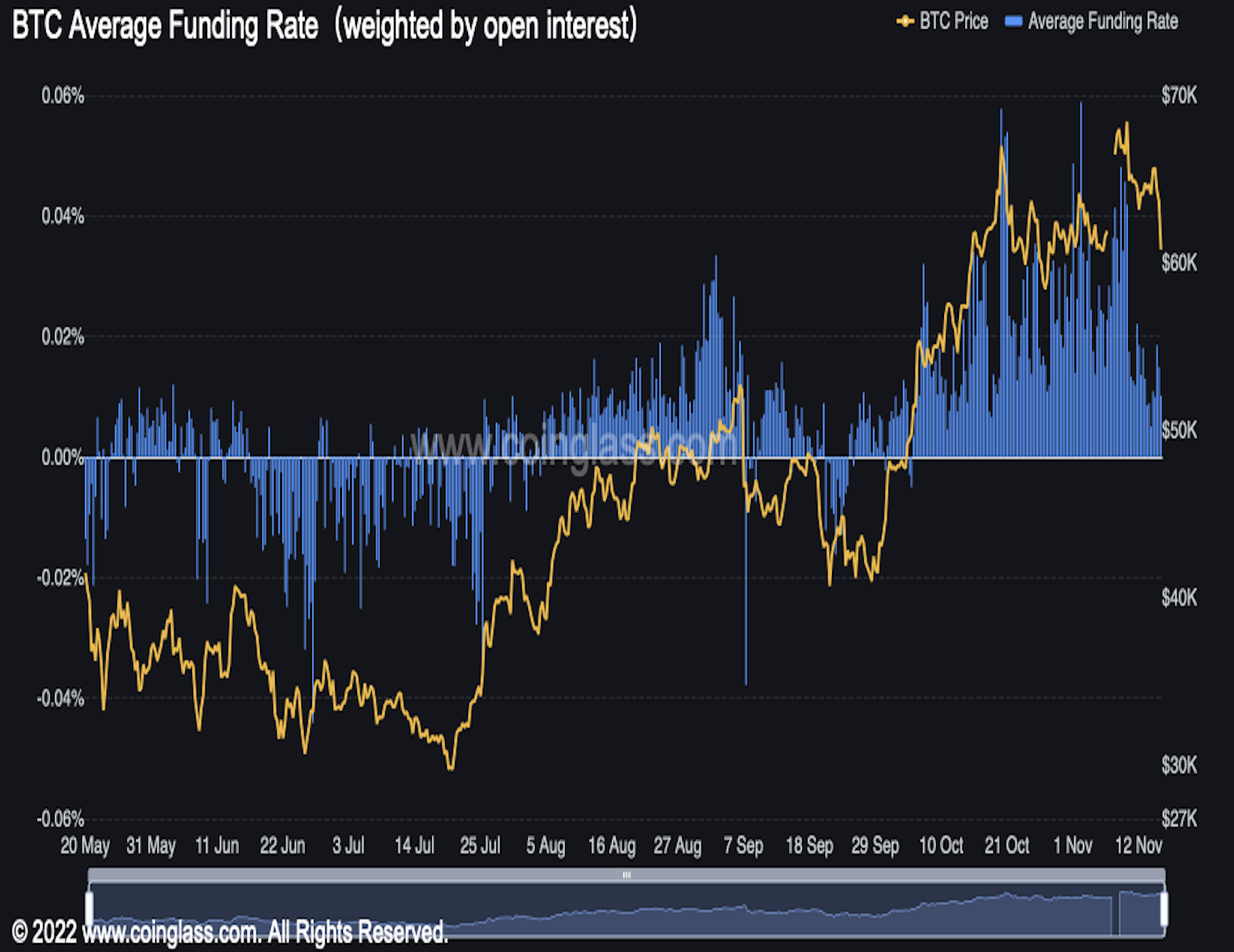

Bitcoin fell below $60,000 during mid-European hours, before press time, extending early weakness. Analysts said a pullback was expected and has normalized the elevated funding rates or costs associated with holding long positions in the perpetual futures market.

-

The cryptocurrency printed lows under $59,000, bringing the 50-day MA into the play for the first time since Oct. 1.

-

The sell-off, which began in Asia following Twitter CFO’s anti-crypto comments and continued strength in the dollar index, picked up the pace, seemingly due to forced unwinding of long positions by exchanges.

-

“We have seen substantial long positions (worth $335m) on crypto exchanges Binance and FTX,” Laurent Kssis, crypto ETF expert and director of CEC Capital, a crypto trading advisory firm, said in a Telegram chat.

-

“It’s a combination of long liquidations and market makers getting rid of their risky (bullish) exposure,” Kssis added. “Leverage and delta hedging becomes more expensive as more orders flood the market.”

-

The average funding rate across major exchanges hovered around 0.05% last week, having hit a six-month high of 0.0589% earlier this month, according to the data source bybt.

-

Funding rates are calculated and collected by exchanges every eight hours. Costs associated with leverage typically become a burden when the momentum stalls, forcing traders to liquidate.

-

Bitcoin’s move to record highs near $69,000 last Wednesday was quickly undone with a pullback to $63,000 on Friday. The cryptocurrency saw a meager bounce over the weekend before turning lower on Monday.

-

“The market was quite complacent and probably overleveraged, as evidenced from last week’s high funding rates,” Amber Funds said.

-

With the pullback, the average funding rate has reset to 0.01%.

coindesk.com

coindesk.com