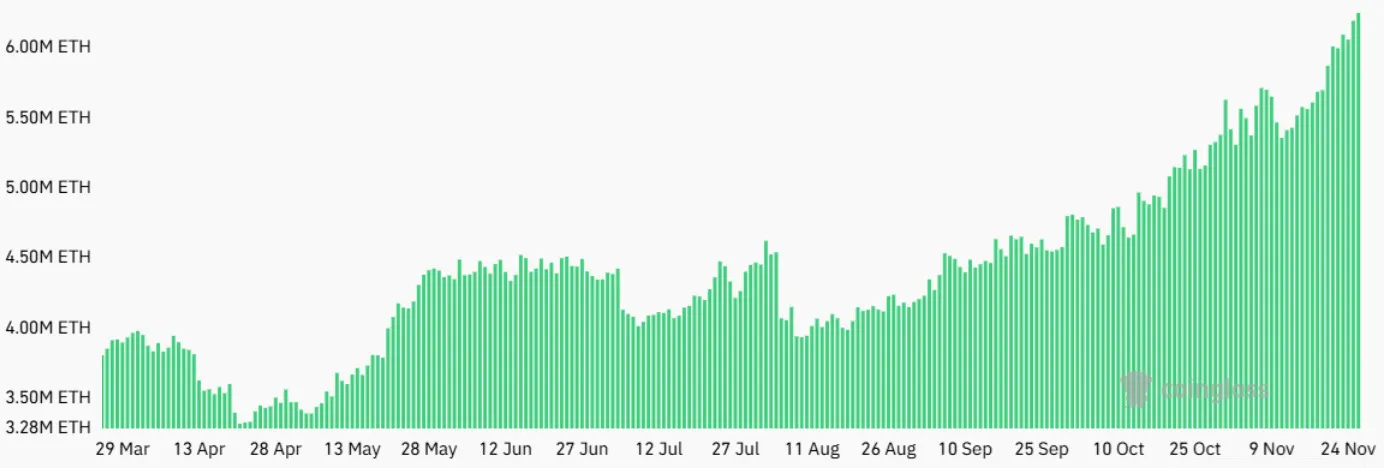

وصلت الفائدة المفتوحة للعقود الآجلة للإيثريوم إلى مستوى قياسي قدره 22 مليار دولار، مما يمثل نموًا بنسبة 23٪ في الفترة من 27 أكتوبر إلى 27 نوفمبر. ويشير الارتفاع إلى اتجاه صعودي جديد في إيثريوم. وتزامن هذا النمو مع ارتفاع سعر ETH بنسبة 15٪ ليصل إلى 3500 دولار في الفترة ما بين 20 و27 نوفمبر، مما يسلط الضوء على أنشطة السوق المكثفة.

محلل العملات المشفرة، مايكل فان دي بوب ، متفائل بأن هذه مجرد البداية. وفقًا لتقرير X الخاص به، ستصل ETH قريبًا إلى 4000 دولار لأنه يشعر أن العملة المشفرة تتعزز بينما بدأت العملات البديلة في الارتفاع.

#البيتكوين لم تصل إلى مجال الاهتمام بعد.

— مايكل فان دي بوب (@CryptoMichNL) 27 نوفمبر 2024

إنها مجرد فترة من الدمج، يمكنك من خلالها رؤية أن #Altcoins بدأت في الانطلاق.

شيء جميل، أعتقد أننا سنظل نرى 100 ألف دولار هذا العام، لكنني أعتقد أننا سنرى أيضًا سعر ETH بقيمة 4000 دولار. pic.twitter.com/yvtfR2y86o

Ethereum lovers are excited with the surge in Ether futures open interest

Ethereum lovers are enjoying the unprecedented growth of its futures open interest. Most crypto merchants are enticed by price growth, hoping the trend will continue. Binance, Bybit, and OKX dominate the Ether futures market, jointly accounting for 60% of overall demand.

Still, there are risks if price volatility triggers liquidation. Such a scenario always leaves the market at a crossroads since it’s challenging to predict which way the market will swing.

The ETH price surge to $3,500 is the most robust recovery since mid-2023. Around May, when the coin traded at $4,000, futures open interest was at $14 billion, $8 billion less than today’s value. The severe growth shows the market’s enthusiasm, although ETH still lags behind its historic peak.

Ethereum’s recent rally is due to several factors. First, there has been growing institutional interest in the crypto-based financial products. The Ethereum blockchain is also among the most secure and reliable blockchains. Additionally, the increasing adoption of DeFi is a reasonable catalyst, as are improving macroeconomic sentiments.

Should investors worry about the market leverage, or is it beneficial to them?

Rising futures open interest is usually a promising market sign. However, excessive leverage can be cut both ways. In a highly leveraged market, sharp price corrections can lead to liquidation. Given this risk, it is essential to monitor funding rates, which may show whether the leverage is leaning toward bullish or bearish positions.

To this moment, market analysts are unsure what the surge in open interest means for ETH’s short-term trajectory. Investors have gained confidence in the cryptp’s ecosystem, while others think that people should trade cautiously or the market will experience volatility.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.