وفقًا لمحلل السوق والمساهم في CryptoQuant Maartuun، يجب على المستثمرين توخي الحذر من الضغوط الهبوطية المحتملة. "إنها لعبة الكراسي الموسيقية: enj بالرحلة، ولكن كن مستعدًا عندما تتوقف الموسيقى"، قال في منشور على X.

🚨باع حاملو الأسهم على المدى الطويل 827,783 بيتكوين في 30 يومًا.

— مارتن (@JA_Maartun) 8 ديسمبر 2024

هذه إحدى الإشارات الهبوطية على السلسلة وراء بيان BOLT هذا.

موضوع حول المزيد من الإشارات الرئيسية وراء هذا الادعاء https://t.co/C2M9CHM83c pic.twitter.com/NgIBf8i3Vm

Maartuun also talked about the 149,800 BTC that are linked to purchases by MicroStrategy and the 84,193 BTC inflows to spot Bitcoin exchange-traded funds (ETFs). He noted that these transactions represent only one-third of the total sell-offs, which signals there’s broader market dynamics at play.

Analyst: Retail investors have boosted Bitcoin demand

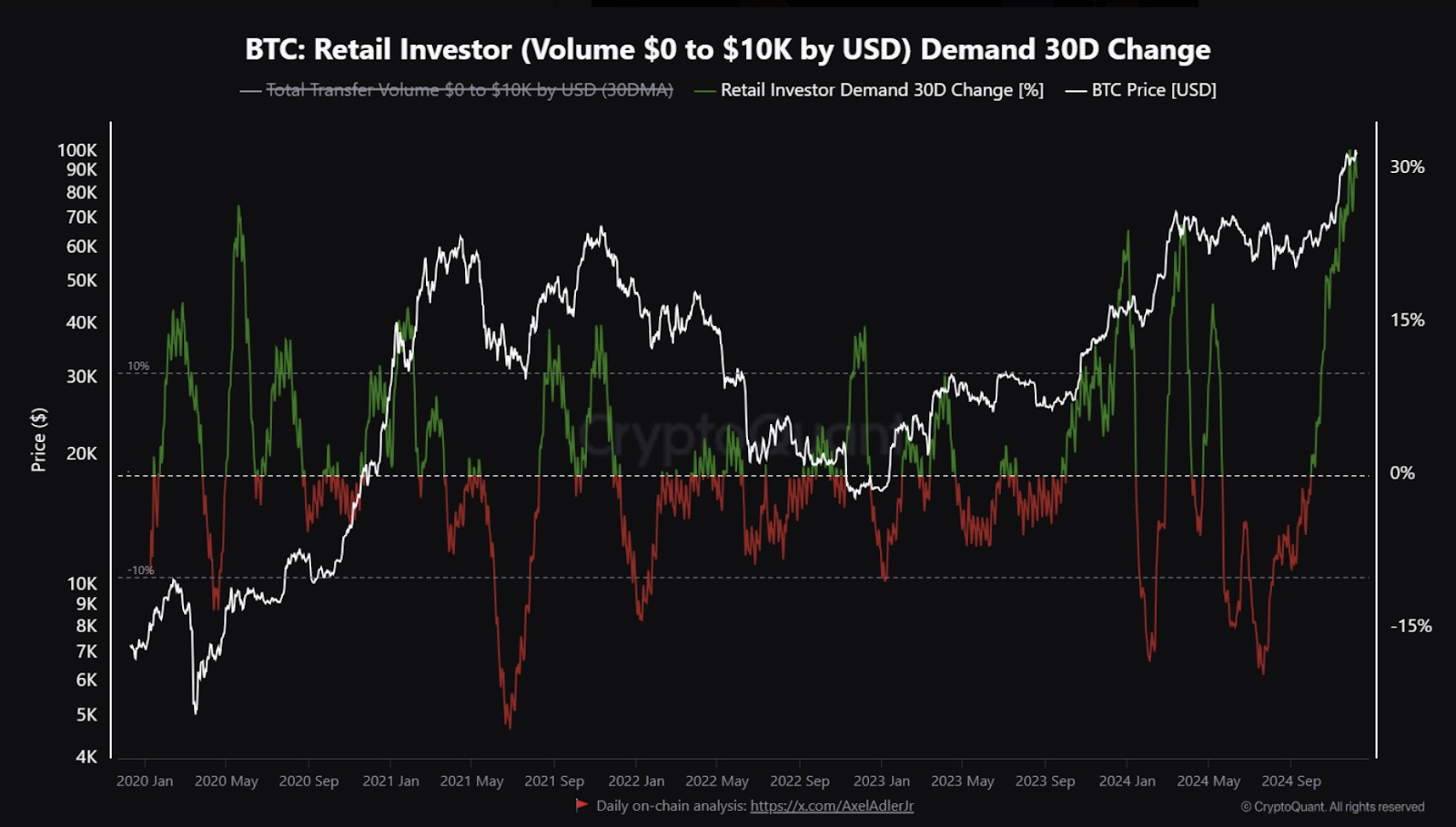

The crypto analyst believes that despite sell-offs by seasoned investors, Bitcoin’s price resilience remains strong because of retail trader’s interest. Per CryptoQuant’s retail demand metrics, retail participation in Bitcoin has hit yearly highs.

Per Maartuun, the surge in retail BTC trades extends to Bitcoin futures trading, with data from CoinGlass showing an Open Interest (OI) value of $61.18 billion.

“Retail is also involved in futures trading,” the crypto analyst said.

Maartuun also noted that the average purchase price for long-term holders stands at $24,481, reflecting unrealized gains of nearly 400% at Bitcoin’s current trading price of $99,203, as reported by CoinMarketCap.

Technical indicators show positive trends

Bitcoin is trading within a rising trend channel, signaling continued investor confidence. In the short term, the cryptocurrency is testing support at $98,000, with analysts projecting potential upward movements if this level holds.

Over the long term, Bitcoin remains technically bullish. The price has climbed strongly since breaking past the $67,241 resistance level, meeting the $84,547 target and indicating further gains. Analysts see no major resistance ahead, although support around $80,000 could stabilize any pullbacks.

However, amid the overall bullish market sentiment, traders’ concerns over deteriorating liquidity remains persistent. Through a thread posted on X, Real Vision’s chief crypto analyst Jamie Coutts warned on December 6 that waning liquidity could challenge BTC’s rally.

Using his BTC MSI macro model, Coutts expressed caution about the rally’s sustainability if liquidity conditions worsen. “While Bitcoin has reached new all-time highs against a backdrop of declining liquidity, the sustainability of this rally is uncertain if conditions worsen further,” Coutts stated.

Amazon shareholders advocate for Bitcoin investments

In other news, the National Center for Public Policy Research (NCPPR) has proposed that Amazon allocate at least 5% of its $585 billion in assets to BTC.

The proposal, filed with the US Securities and Exchange Commission (SEC) last week, argues that Bitcoin’s performance outpaces traditional assets like corporate bonds, which are also deemed attractive hedges against inflation.

The National Center for Public Policy Research has submitted the attached shareholder proposal to https://t.co/Lve7Kg1nVI, Inc. for consideration at the 2025 annual shareholder meeting.

— Tim Kotzman (@TimKotzman) December 8, 2024

Shareholders request that the Board assess adding #Bitcoin to the Company’s Treasury pic.twitter.com/lsgHC0aGrt

BTC’s price has surged 131% in 2024 alone, with a five-year gain exceeding 1,200%. The NCPPR letter highlights the success of companies like MicroStrategy, Tesla, and Block, which have integrated Bitcoin into their balance sheets and seen substantial returns.

MicroStrategy, in particular, has experienced a 537% stock price increase in the past year, largely attributed to its Bitcoin holdings. NCPPR suggests Amazon could follow suit to safeguard long-term value and diversify its portfolio.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap