لدى Goldman Sachs أكثر من 400 مليون دولار في صناديق Bitcoin ETFs

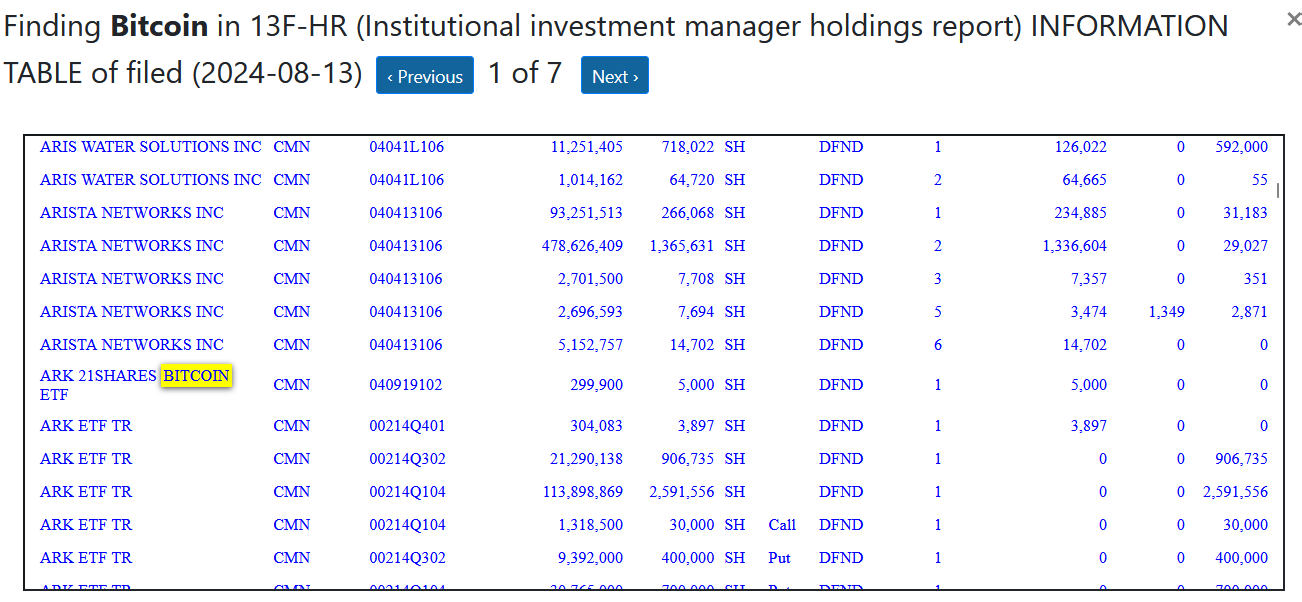

وفقًا لإيداع بنك جولدمان ساكس في نهاية يونيو، فهو يدير ما قيمته 419 مليون دولار من صناديق Bitcoin في البورصة. كشف ملف 13F أنه يمتلك 238.6 مليون دولار في iShares Bitcoin Trust مع 6,991,248 سهم. كما استثمروا أيضًا 79.5 مليون دولار في صندوق Fidelity Bitcoin ETF، بإجمالي 1,516,302 سهم، و35.1 مليون دولار في Grayscale BTC مع 660,183 سهم.

يُظهر أحدث الإيداع أنه اعتبارًا من 30 يونيو، كان لدى Goldman Sachs 6,991,248 سهمًا في iShares Bitcoin Trust (239 مليون دولار)، و1,516,302 سهمًا في Fidelity Wise Origin Bitcoin (79.55 مليون دولار)، و940,443 سهمًا في Invesco Galaxy Bitcoin ETF (56.19 مليون دولار)، و660,183 سهمًا من تدرج الرمادي…

— وو بلوكتشين (@WuBlockchain) 14 أغسطس 2024

The investment manager also had $299,900 in the ARK 21Shares Bitcoin ETF (5,000 shares), $56.1 million in the Invesco Galaxy Bitcoin ETF (940,443 shares), $8.3 million in the Bitwise Bitcoin ETF (253,961 shares), and $749,469 in the WisdomTree Bitcoin ETF (11,773 shares). The bank now has its client portfolio exposure in at least 7 of the 11 Bitcoin ETFs.

Investment managers like banks and hedge funds are required to file Form 13F with the securities regulator quarterly if they meet the $100 million investment threshold. The reporting comes weeks after Goldman Sachs CEO, David Solomon, told CNBC in an interview that Bitcoin is “speculative” but can be a “store of value” akin to gold.

Goldman Sachs has joined JP Morgan and Morgan Stanley

Just like JP Morgan’s Jamie Dimon, Goldman Sachs’ Solomon has not endorsed crypto in the past. However, the banking giants have major institutional exposure to cryptocurrencies and digital assets.

Onyx is a blockchain platform developed by a bank, designed to create advanced financial ecosystems. It facilitates the seamless exchange of value, digital assets, and information between participants. The platform aims to modernize and improve the efficiency of financial transactions and processes by leveraging blockchain technology.

According to a Fortune report, Goldman Sachs announced that it will be expanding its crypto offering by including 3 tokenization projects. Meanwhile, JP Morgan developed Onyx as a blockchain platform for the exchange of digital assets and information as it accelerated its crypto offerings. In addition, Morgan Stanley allowed its 15,000 investment advisors to offer Bitcoin ETFs to its clients, as per CNBC‘s August report.

The trend suggests that the institutional offering in the digital asset space has grown over the years. Regulated investment managers increasing their portfolio exposure to the emerging asset class is bullish for their adoption.