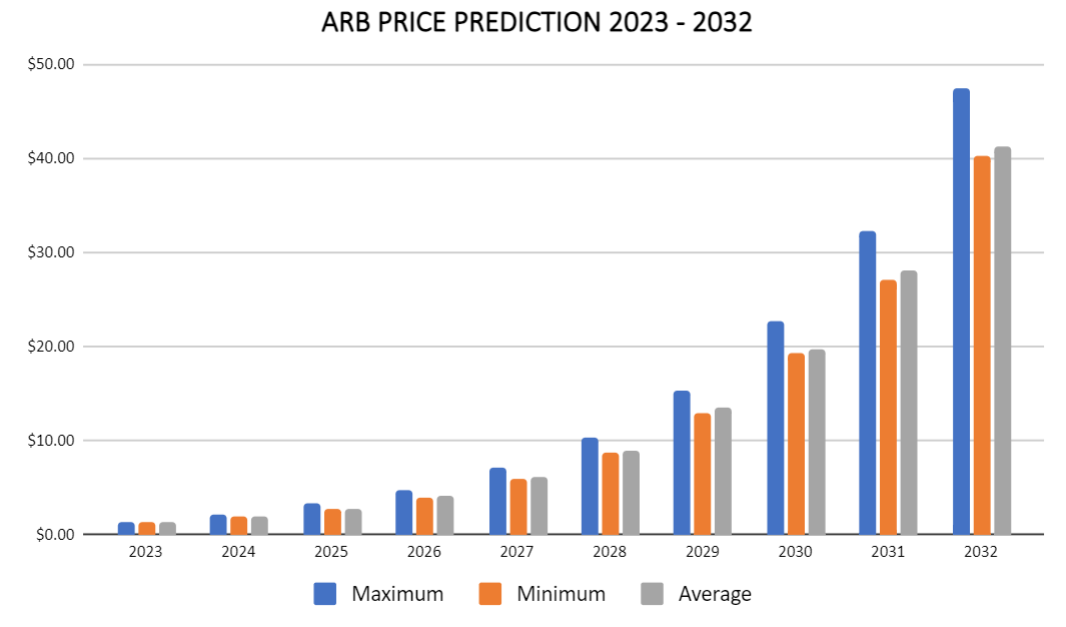

Arbitrum Price Prediction 2023 – 2032

- Arbitrum Price Prediction 2023 – up to $1.46

- Arbitrum Price Prediction 2026 – up to $4.82

- Arbitrum Price Prediction 2029 – up to $15.28

- Arbitrum Price Prediction 2032 – up to $47.50

As the blockchain world anticipates improvements, a third alternative has emerged: scaling solutions. These innovative software applications operate on top of a blockchain‘s base layer, such as Ethereum, to enhance its performance. Arbitrum is a prime example of a scaling solution recently gaining popularity among Ethereum users for executing their transactions more efficiently.

Arbitrum could add to Ethereum’s numerous advantages, boost the network’s sluggish performance, and reduce its skyrocketing fees that threaten to hinder its growth and dissuade potential users. Ethereum users must weigh their options: jump ship to faster, more cost-effective blockchains like Solana, Fantom, or Avalanche, or hold out for the much-anticipated upgrades to revitalize the network in the coming years. Or consider Arbitrum.

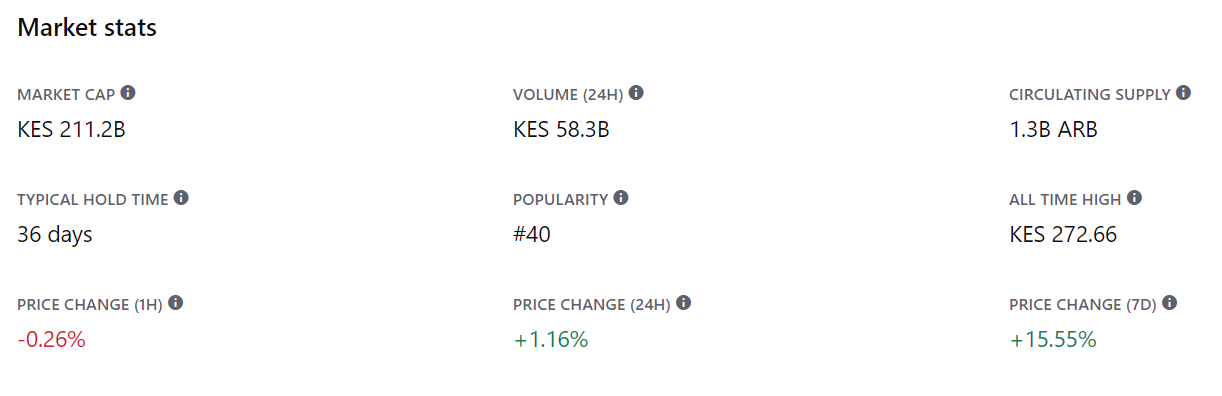

How much is Arbitrum Worth?

The current Arbitrum price is $1.11. Over the past 24 hours, it has seen a trading volume of $364.85 million. With a market cap of $1.41 billion, putting it at position #40. The $ARB price has experienced a rise of 3.23% in the last 24 hours. $ARB has a circulating supply of 1,275,000,000.

Arbitrum price analysis

TL; DR Breakdown

- $ARB is down 90.62% from its all-time high ($ATH) of $11.80, set on March 2023

- The coin registered positive growth over the last 30 days.

The crypto market was red in September, and short-sellers exploited it. From October, it offered a reprieve for the buyers despite facing resistance at $1.

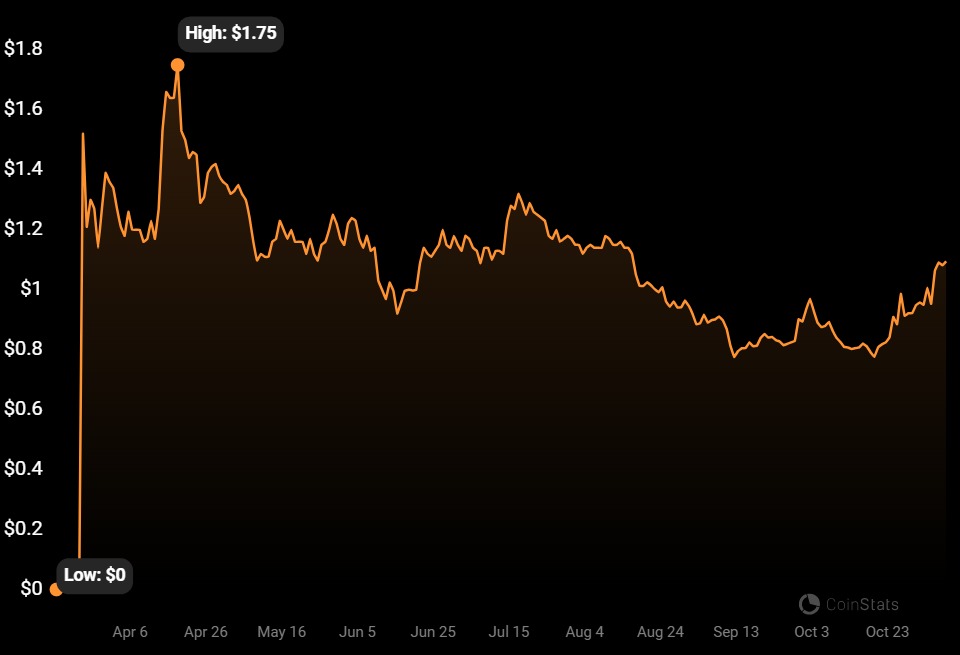

$ARB price analysis 1-day chart

$ARB is down 90.62% from its all-time high ($ATH) of $11.80, set on March 2023, and has dropped continually. It is up 33.65% in the last 30 days. The coin decline accelerated in September, falling to its lowest at $0.739, and began correcting towards the end of the month. The coin marked a high of $0.9975 in October and extended the gains into November, crossing above $1.1.

$ARB’s positive momentum slowed this week, highlighting a break from the month’s high. The Relative Strength Index is 67.32, retraced and constricted below overbought territory.

$ARB/USD 4-hour price chart

The 4-hour chart highlights the $ARB price movement in October and November. The recovery had forced it into overbought territory but later reversed with its relative strength index at 53.28. Its negative momentum slowed in the last 24 hours.

What to expect from $ARB price analysis next?

$ARB’s bear run ended in the last week of September. The market sentiment helped it rise above the $1 mark; however, it is beginning to show signs of correction on the charts.

Recent News

In a landmark development in the blockchain sphere, the Arbitrum Foundation announced the mainnet launch of its Orbit program. This pioneering initiative allows developers to establish their layer-3 networks atop Arbitrum’s established layer-2 infrastructure. This move underscores a significant evolution in blockchain technology, offering a more scalable, efficient, and customizable approach to decentralized applications, specifically within the Ethereum ecosystem. Orbit, which had previously operated on the Arbitrum test network, now enables layer-3 solutions to engage in real-world applications, a critical step forward in attracting a broader base of developers and users.

The advent of Orbit comes amidst an industry-wide push to enhance interoperability, scalability, and innovation in blockchain technology. Major players like Optimism, Polygon, and zkSync are also propelling their technologies forward, fostering an environment where their foundational frameworks can be replicated or modified, accelerating technological adoption and diversity within the space. Particularly notable is Arbitrum’s integration with Celestia. This modular solution bolsters data availability for applications developed on Orbit, underscoring the continuous efforts to enhance security and efficiency in these emerging layered blockchain structures.

This stride by Arbitrum signifies more than just technological advancement; it represents a shift in how blockchain networks might operate in the future, focusing on modular, layered solutions catering to specific community or business needs. However, it also brings to light potential challenges, emphasizing the necessity for robust security protocols within these increasingly complex multi-layered blockchain environments. As such, the mainnet readiness of programs like Orbit is not just a milestone for Arbitrum but a leap forward for the broader blockchain community, potentially heralding a new age of decentralized applications and on-chain activity.

Arbitrum Price Predictions 2023-2032

Cryptopolitan Price Prediction

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 1.31 | 1.36 | 1.46 |

| 2024 | 1.91 | 1.96 | 2.25 |

| 2025 | 2.77 | 2.85 | 3.29 |

| 2026 | 4.00 | 4.14 | 4.82 |

| 2027 | 5.87 | 6.08 | 7.06 |

| 2028 | 8.76 | 9.01 | 10.27 |

| 2029 | 13.02 | 13.47 | 15.28 |

| 2030 | 19.23 | 19.77 | 22.73 |

| 2031 | 27.18 | 28.17 | 32.27 |

| 2032 | 40.20 | 41.33 | 47.50 |

Arbitrum Price Prediction 2023

In 2023, the estimated minimum value of Arbitrum is projected to be $1.31. The price of Arbitrum could reach a peak of $1.46, with an average trading price of $1.36 throughout the year.

Arbitrum Price Prediction 2024

Our in-depth technical analysis of past Arbitrum coin price prediction data suggests that in 2024, the price of Arbitrum could be around a minimum value of $1.91. The price of Arbitrum could reach a peak of $2.25, with an average trading value of $1.96.

Arbitrum Price Prediction 2025

The price of a single Arbitrum is anticipated to reach a minimum of $2.85 in 2025. The $ARB price could peak at $3.42, with an average price of 62.93 throughout the year.

Arbitrum Price Prediction 2026

Our in-depth technical analysis of past $ARB price data suggests that in 2026, the price of Arbitrum could reach a minimum of $4.00. The $ARB price could peak at $4.82, with an average trading price of $4.14.

Arbitrum Price Prediction 2027

Based on our price forecast and technical analysis, the price of Arbitrum in 2027 could reach a minimum of $5.87. The $ARB price could peak at $7.06, with an average trading price of $6.08.

Arbitrum Price Prediction 2028

Arbitrum’s price is projected to reach a minimum of $8.76 in 2028. According to our analysis, the $ARB price could peak at $10.27, with an average forecast price of $9.01.

Arbitrum Price Prediction 2029

Based on our forecast and technical analysis, the price of Arbitrum in 2029 could reach a minimum of $13.02. The $ARB price could reach a maximum value of $15.28, with an average price of $13.47.

Arbitrum Price Prediction 2030

The price of Arbitrum is projected to reach a minimum of $19.23 in 2030. According to our analysis, the $ARB price could peak at $22.73, with an average forecast price of $19.77.

Arbitrum Price Prediction 2031

In 2031, the estimated minimum price value of Arbitrum is projected to be $27.18. The price of Arbitrum could reach a peak of $32.27, with an average price of $28.17 throughout the year.

Arbitrum Price Prediction 2032

In 2032, the estimated minimum value of Arbitrum is projected to be $40.20. The price of Arbitrum could reach a peak of $41.33, with an average trading price of $47.50 throughout the year.

Arbitrum Price Predictions by WalletInvestor

Wallet Investor uses technical analysis to forecast cryptocurrencies like $ARB. The platform indicates. $ARB’s past performance index rating of A+ adds that $ARB would make a bad one-year investment. The expected average price in 2024 will be $0.228. $ARB’s return on investment (ROI) will be -79.253% in 2024. In 2025, the ROI will be -88.4071%; in 2026, it will be -95.622%; in 2027, it will be -98.675%. According to the analysis, the $ARB price is bearish over the entire period.

.

Arbitrum Price Prediction By DigitalCoinPrice

According to DigitalCoinPrice’s $ARB price forecast, the price of $ARB is anticipated to surpass the $2.0 mark in 2024. By the end of the year, Arbitrum will attain a minimum value of $0.81. $ARB price has the potential to reach a maximum level of $1.99.

In 2027, the price of $ARB will exceed the $3.4 mark. By the end of that year, Arbitrum will reach a minimum price of $3.48 and a maximum level of $4.12. In 2032, its price will range between $16.97 and $17.58, with an average of $17.34h.

Arbitrum Price Prediction By CryptoPredictions.com

CryptoPredictions.com’s Arbitrum network price prediction states that Arbitrum will trade at an average price of $1.34 in December.

In 2024, the $ARB token may hit a minimum price of $1.035 and a maximum price of $1.662. In 2025, the $ARB token may hit a minimum price of $1.028 and a maximum price of $1.563. In 2026, the $ARB token may hit a minimum price of $1.026 and a maximum price of $1.562.

Arbitrum Price Prediction By Industry Influencers

Arbitrum token ($ARB) debuted on March 23, 2023. $ARB’s strong fundamentals cannot be ignored, especially with a team of competent experts backing it. The network’s ability to validate transactions at lightning-fast speeds makes it attractive for cost-effective and speedy transactions. An analysis by ‘Binance,’ the world’s largest crypto exchange by trading volumes indicates that it will trade at $0.948046 in 2024, $1.04522 in 2026, $1.270472 in 2030, and $2.069465 in 2040

Arbitrum Price History

The Arbitrum airdrop was one of the most-hyped crypto events in the first quarter 2023. It sparked the start of an airdrop season. A total of 1.162 Billion $ARB was allocated for the airdrop. On March 23, the Arbitrum Foundation airdropped its new token to eligible community members. According to the organization, Arbitrum tokens marked its shift into a decentralized autonomous organization (DAO).

A day after the official announcement of the airdrop, major crypto exchanges Binance, Huobi, and MEXC announced the token’s listing. On the listing day, $ARB picked momentum and reached an all-time high ($ATH) of $11.80. According to Coinmarketcap, the initial price was $1.1822 after the airdrop.

$ARB was bullish in April, reaching a peak of $1.7662. Tables turned in June as $ARB consistently traded below $1.1822. On June 15, $ARB marked its all-time low at $0.9142. From July, $ARB extended its losses below its listing price, forcing its early buyers into losses. It attempted a pup in October but faced stiff resistance at $10. It eventually broke the resistance in November.

Source: https://coinstats.app/coins/arbitrum/

Arbitrum Overview

Arbitrum technology emerges as a promising answer to the challenges of congestion and soaring fees on the Ethereum network. On March 23, 2023, Arbitrum distributed its new $ARB token through an airdrop, empowering token holders to participate in decision-making processes associated with the protocol. By doing so, Arbitrum embarks on its highly anticipated transformation into a DAO (decentralized autonomous organization).

More on Arbitrum

What’s Arbitrum?

Arbitrum, a cutting-edge layer-2 scaling solution for the Ethereum blockchain, was created by New York-based firm Off-chain Labs. In 2018, Ed Felten, a professor of computer science and public affairs at Princeton, co-founded Offchain Labs, the innovative enterprise responsible for the development of Arbitrum.

Layer-2 scaling solutions are networks operating on top layer-1 blockchains, delivering cost-effective and swift transactions by validating them independently and incorporating them into the primary chain.

Following its mainnet debut last year, Arbitrum’s scaling solution has experienced considerable success.

Consequently, numerous developers have leveraged Arbitrum’s technology to host their decentralized applications (dApps).

As the powerhouse behind a booming decentralized finance (DeFi) ecosystem, Ethereum has undeniably carved out a prominent position in blockchain and cryptocurrencies. But while the network boasts of its decentralized nature, reliability, and user-friendly smart contract support, it struggles with scalability and soaring transaction fees.

Arbitrum Bridge

Users can use the Arbitrum Token Bridge to transfer ETH and ERC-20 Ethereum tokens to a layer 2 scaling solution called Arbitrum One.

To execute an Arbitrum transaction, forward it to one of EthBridge’s Inbox contracts.

Conversely, an Outbox contract receives data from Arbitrum and incorporates it into the Ethereum blockchain for reverse interaction. As all inputs and outputs of EthBridge are publicly verifiable, Ethereum can efficiently identify and authenticate any off-chain actions.

How Does Arbitrum Work?

Individuals and smart contracts submit requests to Arbitrum’s blockchain by placing transactions into the chain’s ‘inbox.’ Subsequently, Arbitrum processes the request and generates a transaction receipt. The method by which Arbitrum processes the transaction – determining its ‘chain state’ – is dictated by the transactions present in its inbox.

Currently, Arbitrum handles Ethereum transactions using a technique known as optimistic rollup. This method settles transactions on a sidechain before reporting the results to the Ethereum network.

Conclusion

Arbitrum has emerged as a prominent contender in blockchain scalability solutions, offering a blend of security and efficiency that has resonated with developers and users alike. As we’ve analyzed the trajectory of Arbitrum from 2023 to 2032, it’s evident that many factors, from technological enhancements and adoption rates to broader market trends, will influence its price dynamics. Based on current advancements and projected ecosystem developments, it’s plausible to anticipate a positive growth trajectory for Arbitrum. However, as with all cryptocurrencies and related technologies, potential investors should exercise caution and conduct their due diligence, considering the volatile nature of the sector and the potential for unforeseen shifts in the landscape.