أصبح جاستن صن أحد أكبر المستثمرين في World Liberty Financial ($WLFI)، وهو صندوق DeFi المرتبط بعائلة دونالد ترامب. يهدف الصندوق، الذي تم إطلاقه برموز مقفلة، إلى الاستفادة من المشاعر الصديقة للعملات المشفرة لإدارة دونالد ترامب.

انضم جاستن صن، مؤسس TRON وأحد أكبر الداعمين لمشاريع العملات المشفرة والتمويل DeFi ، إلى World Liberty Financial كأكبر مستثمر فيها. تمتلك Sun حصة بقيمة 30 مليون دولار في مشروع DeFi ، لتصبح أكبر مستثمر منفرد فيها.

يسعدنا أن نستثمر 30 مليون دولار في World Liberty Financial @worldlibertyfi كأكبر مستثمر فيها. أصبحت الولايات المتحدة مركزًا للبلوكتشين، Bitcoin تدين بذلك لـ realDonaldTrump ! تلتزم TRON بجعل أمريكا عظيمة مرة أخرى وريادة الابتكار. دعنا نذهب! pic.twitter.com/cISTsVYP1f

– سعادة جاستن صن 🍌 (@ justinsun tron ) 25 نوفمبر 2024

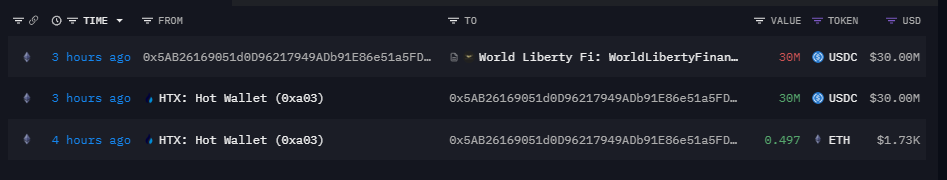

The purchase by Justin Sun was noted earlier, before the X announcement. The tokens were acquired for a direct purchase with $USDC on the Ethereum network. Sun acquired the tokens to a wallet tagged as belonging to the HTX exchange, with the funds flowing into the HTX hot wallet.

After the purchase of 2B tokens, Sun and HTX became the ninth biggest wallet holding $WLFI, not counting several top reserve wallets and other unknown whales. The holding distribution of $WLFI is skewed toward whales, raising questions on the real potential for governance. Whales with more tokens can sway votes and steer the project’s payouts or rules.

World Liberty Financial showed special appreciation for Sun’s share, stating its goal to drive crypto innovation. The buy-in from Sun arrives after World Liberty Financial only realized 10% of its fundraising goal.

The $WLFI token sale initially aimed to raise $300M, a sum too high even for large-scale crypto projects. The goal was revised down to $30M in a recent filing. However, the sale is going at a leisurely pace and is still far from the $30M cutoff.

Donald Trump’s company is also preparing to take profits on the $WLFI token sale, instead of reverting the proceeds back into crypto.

$WLFI token sale slows down

The $WLFI presale is open to persons in the US, as well as in outside countries. The current price of the $WLFI token is $0.015, with the goal of placing 20B tokens. As of November 25, the DeFi, lending and yield hub had sold only 3.39B tokens.

After the initial inflow of buyers and a crashed site, $WLFI is still open for purchase at the same presale price, for ETH, USDT, $USDC, and WETH tokens. The $WLFI presale aimed for mainstream adoption, but the most recent buyers seem to be crypto natives, some with ENS addresses. The stakes are relatively small, with purchases of under $100 in $WLFI. The community has raised issues such as putting a deadline on the presale, or making a decision of burning or distributing unsold tokens.

Trump’s crypto project offers an older version of crypto and DeFi, with limited meme-like potential. Practically, $WLFI will offer a personalized instance of Aave’s vaults, focusing on lending and accruing passive income for liquidity providers.

The World Liberty Financial token has spread to a total of 20,396 holders, similar to the ownership of a mid-range meme token. However, with more funding and promotion, $WLFI can continue to spread its adoption. The problem for $WLFI is that it arrived at a time when traders were allocating their funds either to BTC or meme tokens, with no time to wait long-term for a new project to prove profitable.

Additionally, $WLFI is still not directly tradable or transferable, instead relying on its DeFi liquidity to start producing gains. Waiting for the token to begin trading or prove its viability is making many investors pass on the offer. Even Trump’s fame and crypto-friendly message was not enough to achieve immediate success. On the positive side, $WLFI is a fully vetted, transparent and compliant project.

The $WLFI tokens themselves will be used as governance tokens, while the protocol has not yet established liquidity and yield. The inclusion of Justin Sun may be the foundation of liquidity and a wider adoption in the crypto space. The tokens, already controlled by the HTX exchange, are not intended for the open market, though the future will tell if they would have additional utility.

If World Liberty Financial uses the known DeFi models, its vaults would require additional deposits of stablecoins or collateral to achieve passive earnings.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan