تعرضت SUI لانقطاع في الشبكة لمدة ساعتين، حيث توقف إنتاج الكتلة. لقد عادت السلسلة إلى وضعها الطبيعي، ولكنها تثير مسألة مرونتها وقابلية التوسع.

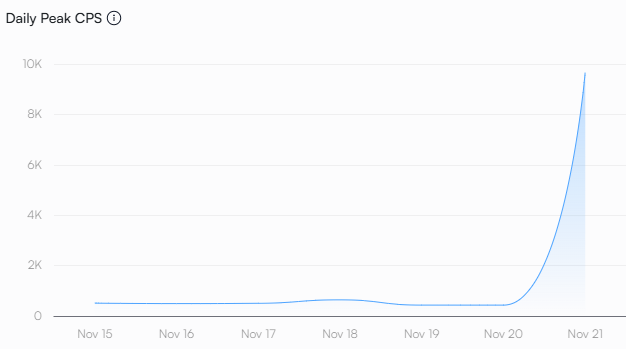

تعرضت SUI لانقطاع في الشبكة لمدة ساعتين تقريبًا في 21 نوفمبر، مما أثار تساؤلات حول إمكانية التوسع. وفي وقت لاحق، واجهت الشبكة فجوة مرة أخرى حيث لم يتم اكتشاف أي كتلة جديدة لأكثر من 29 دقيقة. حدث الانقطاع في الوقت الذي حاولت فيه شبكة SUI معالجة عدد قياسي من المعاملات في الثانية.

وفي كلتا الحالتين، تم استئناف إنتاج الكتل بسرعته العالية المعتادة مع انتهاء ثانية واحدة. ذكر فريق SUI أن سبب التأخير هو وجود خطأ تسبب في تعطل أدوات التحقق من الصحة. يمكن أن يؤدي عدم وجود توافق في الآراء بشأن SUI إلى تعطيل الإنتاج والانتشار.

عادت شبكة Sui للعمل احتياطيًا ومعالجة المعاملات مرة أخرى، وذلك بفضل العمل السريع الذي قام به المجتمع الرائع لمدققي Sui.

حدث التوقف لمدة ساعتين بسبب خطأ في منطق جدولة المعاملات أدى إلى تعطل أدوات التحقق من الصحة، والذي تم حله الآن. https://t.co/TJh2zwvQcD

— سوي (@SuiNetwork) 21 نوفمبر 2024

The bug on SUI concerned transaction scheduling, which made validators unable to handle the traffic and finality. Delegators are a crucial role on SUI, both for network finality, and for producing passive returns through staking.

SUI has a total of 108 validators, a fraction of Solana’s over 1,000 special entities. SUI aims for success similar to Solana, but has already faced some of its first stress test. The recent outages had a fast recovery, but invited comparison to previous periods of Solana inactivity due to flawed validator consensus.

SUI reaches price record on peak open interest

The outage happens at a time when SUI rallied into the top 15 of coins and tokens, trading near its all-time high of $3.70. Later, SUI slid toward $3.50 after the market rally slowed down. SUI trades on a three-year peak of open interest above $655M. The token may face a further correction in case long positions are attacked, or the entire crypto market starts a drawdown.

SUI tokens may face price pressures in the long run, as only 34.35% of the tokens are unlocked. The token has a slow unlocking schedule, but a significant share allocated to Series A, Series B and Early Contributor backers .

The SUI L1 network was one of the best-financed chains, raising $385B in a series of VC rounds and token sales. SUI used the market peak in 2022 to raise $300M in a single series B round, with backers including Binance Labs, Coinbase Ventures, and Andreessen Horowitz.

Despite the VC backing, SUI had a unique start, launching its trading from the end of May. SUI has not seen the usual drawdowns of VC-backed projects, but managed to enter the market during a bull market with favorable conditions. SUI has a long way to go until all tokens are unlocked, with the horizon stretching into 2030.

Record traffic preceded the SUI network outage

The increased traffic and interest caused a stress test for the project. SUI also reached peak trading volumes on Binance, potentially leading to increased transaction count. SUI also had a recent peak in token turnover as the L1 token reawakened along with other assets.

SUI total value locked also increased, expanding almost constantly since the August 6 market correction. The chain now carries more than $1.64B in total value locked, with the biggest contributions from Navi protocol and SUI Lend. SUI carries up to 15M daily transactions, with 826.24 daily active wallets.

The chain also carries significant stablecoin liquidity, and is connected to the Ethereum ecosystem. SUI received $864M in stablecoins and a small percentage of ERC-20 bridged tokens. The total inflows from Ethereum are $839.21M, among the top L1 chains to receive liquidity. SUI also benefits from its high-profile token with a prominent community. Despite the slowdown in the L1 token narrative, SUI remains an outlier.

On the day of the outage, the chain also had a vertical increase in the total transactions per second. The count went from under 500 TPS to 9.66K transactions per second, before validators could no longer arrange and coordinate blocks.

Previously, SUI reached an all-time high of 8.45K TPS on October 14, then falling again to its baseline. The chain has previously performed ‘Break SUI’ events to test the maximum possible transactions per second.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.